From Liberation To Levitation – But Gravity Is Patient

The US stock market rally since “Liberation Day” in April has been spectacular – and was thoroughly underestimated by many, including us. Back in June, in Thoughts 83, we already hinted that the party could continue for a while, but that the ice was getting thinner and thinner. And the longer the party, the worse the hangover. Regardless, the S&P 500 has gained another 6% since then. It's high time to take a closer look again.

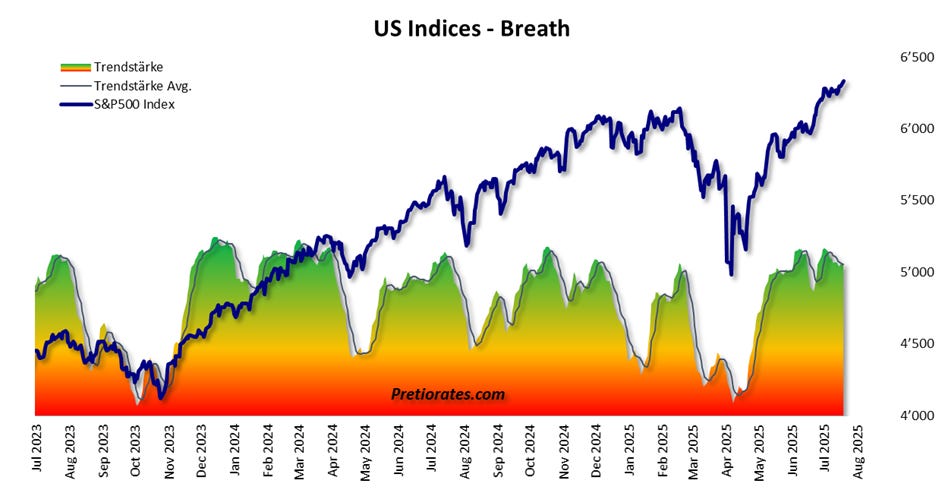

The trend strength of the US indices remains in the green – for now. However, momentum has been crumbling in recent trading days. There is no clear sell signal yet, but a warning light is flashing...

(Click on image to enlarge)

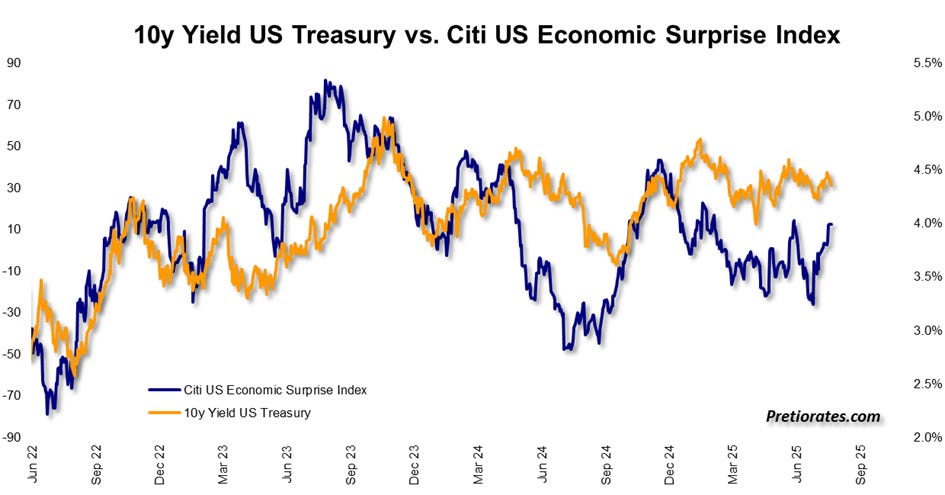

At the same time, the debate about a possible recession in the US is raging – and with it the hope of interest rate cuts in the near future. The Citi Economic Surprise Index measures whether the latest economic figures have come in above or below expectations. And it shows the opposite: the economic data has recently surprised on the upside. This means that fantasies of lower interest rates remain unfounded for the time being. The US economy would have to weaken more significantly for US Fed Chairman Jay Powell to cut interest rates...

(Click on image to enlarge)

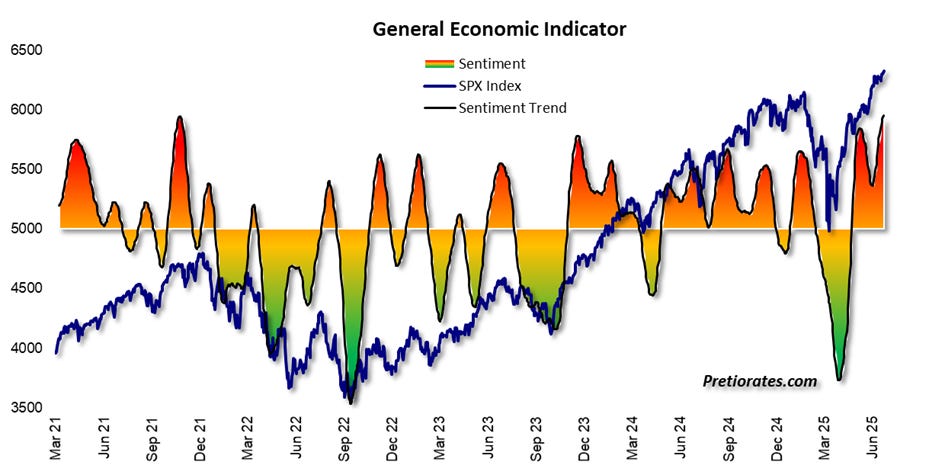

Our General Economic Indicator, which focuses less on hard data and more on economic sentiment, is also sending clear signals: the sentiment barometer of business leaders is at its highest level since 2021!

(Click on image to enlarge)

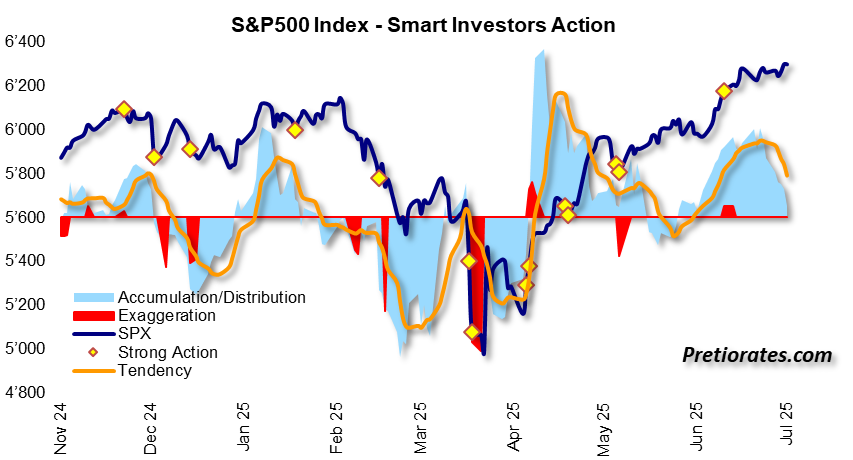

The Smart Investors Action Index shows that “smart” investors have been eagerly accumulating assets recently – but with decreasing intensity. Are the first signs of fatigue emerging?

(Click on image to enlarge)

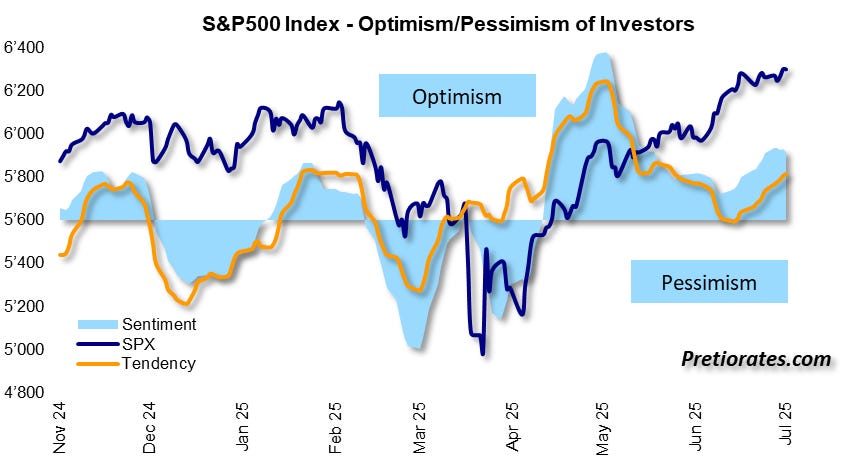

Sentiment remains positive – a good sign. However, this indicator is volatile and can change quickly. As long as pessimism does not set in, a sharp correction is unlikely without a surprising negative event – but caution is advised: the wind can change quickly...

(Click on image to enlarge)

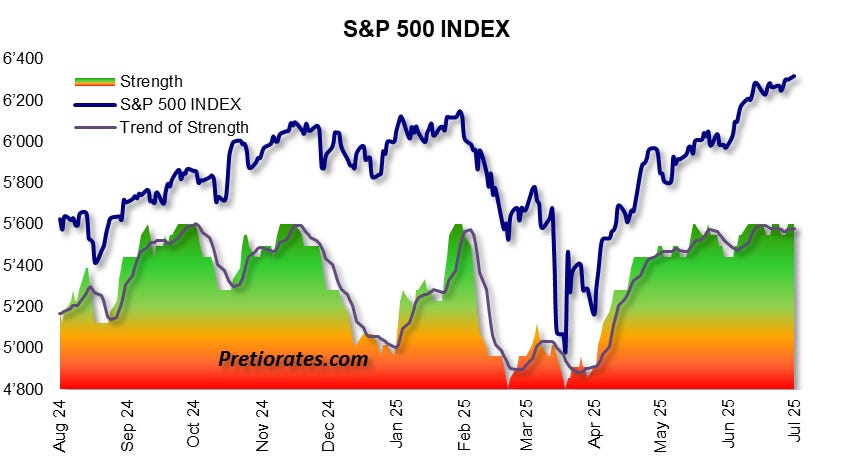

The inner strength of the S&P 500 remains impressive. It shows where we are, not where we are going – and is therefore a very important input. And it tells us that we are currently in dark green territory...

(Click on image to enlarge)

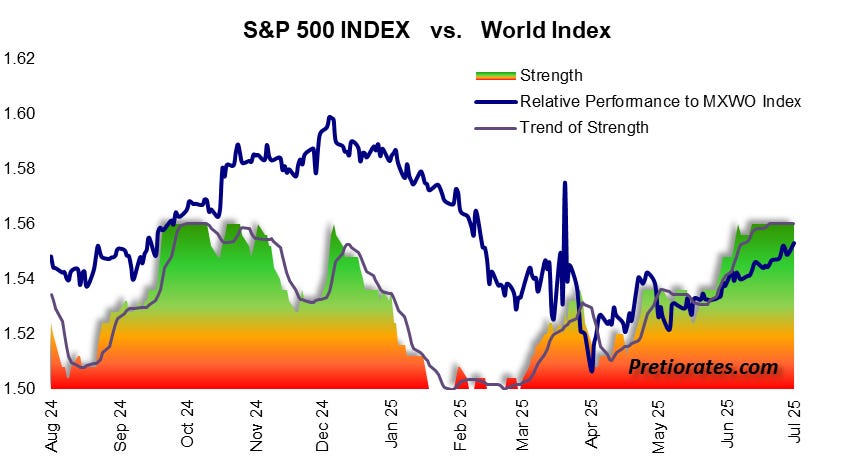

It is also interesting to note that the inner strength continues to score the maximum number of points compared to the world index. In other words, the US market is currently unrivalled in global comparison...

(Click on image to enlarge)

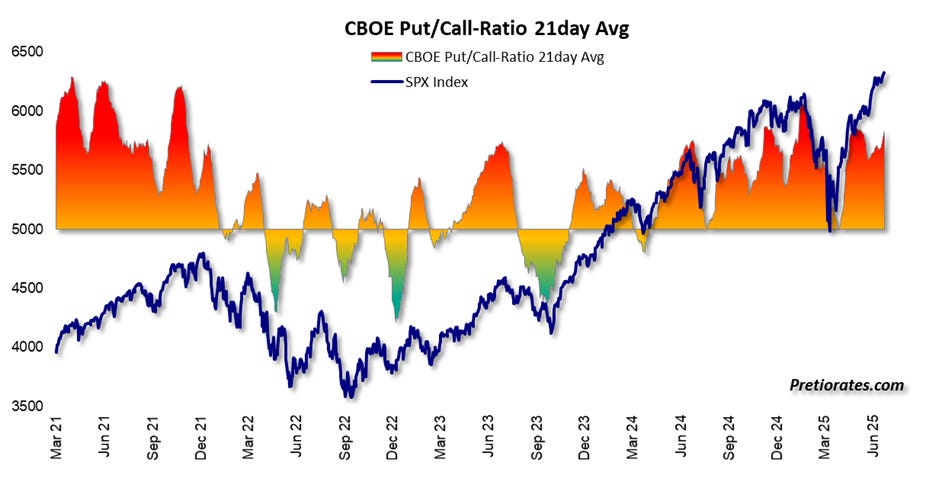

With strength comes overconfidence: the put/call ratio is at extremely high levels – investors are almost exclusively betting on rising prices and neglecting hedging. The stock market likes to punish such recklessness – usually when no one expects it.

(Click on image to enlarge)

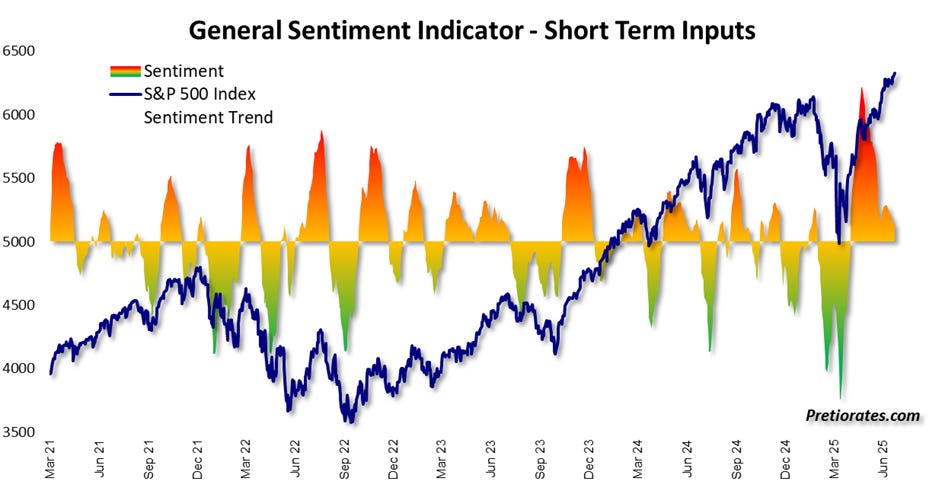

The General Sentiment Indicator provides another warning signal with its short-term inputs: after reaching its highest level in over five years in May, it has fallen significantly since then. This argues against the upward trend continuing.

(Click on image to enlarge)

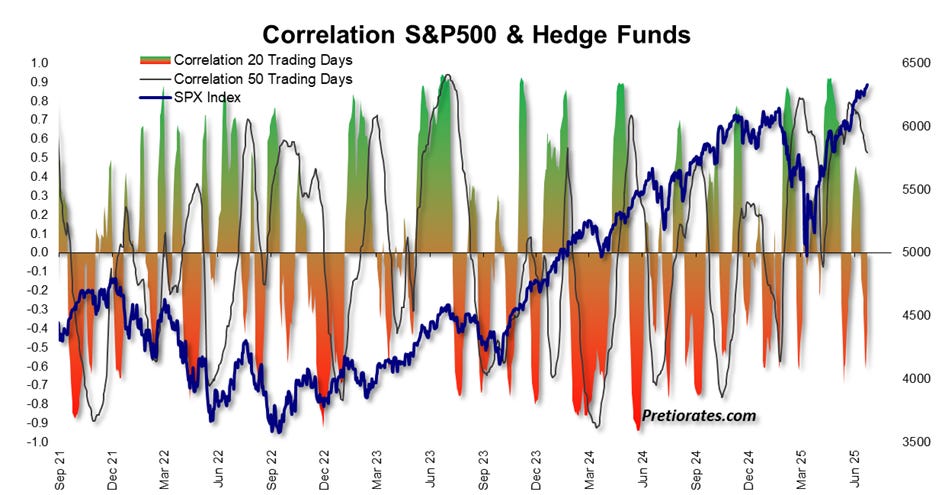

Particularly interesting: hedge funds with index exposure have recently reduced their long positions and switched to short positions. In other words, they are betting on a correction.

(Click on image to enlarge)

Bottom line: Everything still looks stable. But that's exactly how it always looks before a turnaround. The number of scratches in the paintwork is increasing – and the more cracks there are, the higher the risk of a price slide. The time for overconfidence should now be over and discipline should be the order of the day. As they always say on the trading floor: taking profits is not forbidden.

More By This Author:

Fed Up? What If Jay Powell Walks...White Metals: When Pessimism Gets Bullish

Gold And Silver With Tailwinds From Another Direction

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more