Party Too Long, Face The Hangover

Image Source: Pexels

In Thoughts 82, we discussed the carry trade in the Japanese market. Rising interest rates in Japan are making this popular financing strategy – borrowing cheap Yen and investing in expensive US Dollars – increasingly unattractive. What was considered virtually risk-free for years is now becoming obsolete. What does this mean for the US Treasury market in the medium term? The script is currently being written… - and explained in Thoughts 82.

At the same time, the risk window is opening further – significantly so. The war in Ukraine, which has recently been more of a background noise from the perspective of the financial markets, could once again become the loud main topic. The latest drone attack on Russian military airfields on its own soil may have military symbolic significance for Ukraine, but it puts Vladimir Putin under pressure domestically. No counterstrike? Then he risks losing power. A counterstrike? Then the situation escalates. The statement by the new German Chancellor Friedrich Merz that weapons for Ukraine are no longer subject to range restrictions is also causing heated debate in Moscow.

The financial markets have so far reacted only sporadically to these developments. Gold and silver have responded to the increased geopolitical risk with sharp jumps – a classic signal. But the stock markets continue to celebrate. The big resurrection party has been going on since April – only the cautious investors have already quietly taken their leave. The rest are still dancing. But those who stay too long risk a hangover.

Why the gloomy tone?

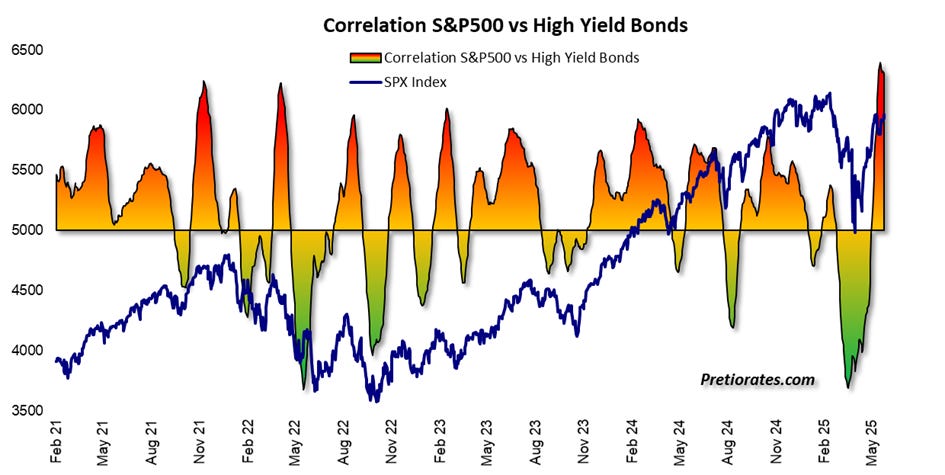

Because the correlation between equities and high-yield bonds is at its highest level in over five years – a sign of massive risk appetite. Investors are as deeply exposed to risk as they have been since the outbreak of the pandemic.

(Click on image to enlarge)

In April, demand for hedging – for example via put options – was still high. Now? Tempi passati. The 21-day average of the put/call ratio has returned to a level that has often been observed in the past shortly before corrections.

(Click on image to enlarge)

The General Sentiment Indicator – with short-term inputs – is also sounding the alarm: the markets have not been this euphoric in five years!

(Click on image to enlarge)

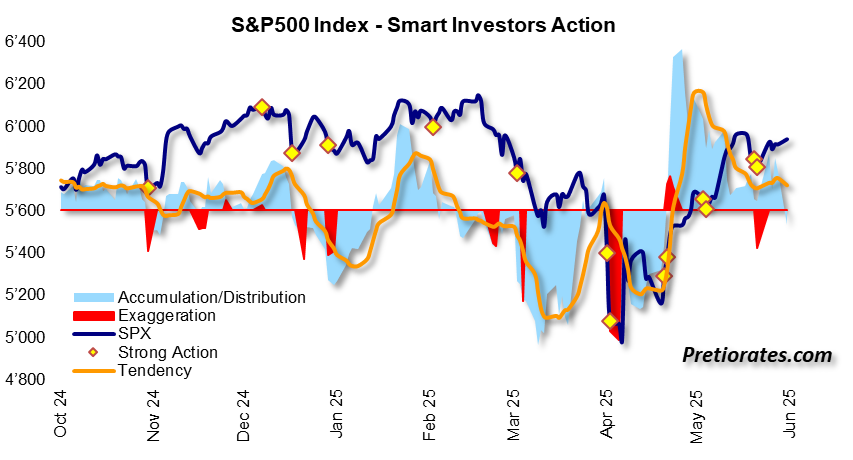

Smart investors are still showing accumulation behavior, but to a much lesser extent than last month. We would not be surprised if this indicator shows in the coming days that investors are beginning to distribute their holdings behind the scenes...

(Click on image to enlarge)

The next sentiment indicator also shows that optimism has declined sharply recently, but the bulls still have the upper hand...

(Click on image to enlarge)

And the consolidation of the US stock markets during the last few trading days has already caused the balance of power to shift back toward the bulls...

(Click on image to enlarge)

Bottom line: The rally since the April sell-off is lasting much longer than previously expected. And according to the indicators presented today, the party could indeed continue for a little while longer. However, the risk of a severe hangover one of these mornings is continuing to rise sharply.

More By This Author:

A Big Beautiful Bill For The Bond MarketThe Rise Of The Alternative Metals

From Fear At Warp Speed To Euphoria

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more