A Big Beautiful Bill For The Bond Market

Image Source: Pixabay

,It was April 7, 2025 – known as Liberation Day – when the US announced import tariffs. And what happened? The US bond market, which had seemed unshakable until then, suddenly got goose bumps. Not long ago, any reasonably sober economist would have expected the legendary «Day X» – when the US would finally have to face its avalanche of debt – to come in a decade at the earliest. But that changed abruptly.

The tariff announcement caused volatility in the US bond market to rise noticeably. Hedge funds were forced to reduce their basis trades, which in turn drove up market yields. And how! A jump in yields of a magnitude rarely seen before – the much-vaunted stability of the bond market was shaken to its core. Since then, «Day X» is no longer a distant prospect – the rotten foundations of the overloaded US debt house could collapse sooner than expected.

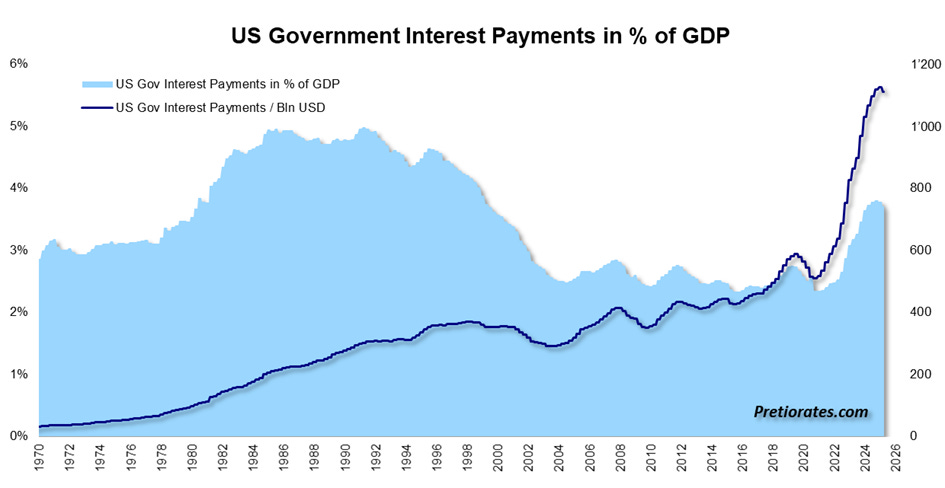

Admittedly, US government debt is not a new issue. The deficit was already a perennial problem under previous US presidents. However, things really started to get uncomfortable with the rise in interest rates two years ago. Interest costs shot past the trillion-Dollar mark – even though they remain well below the 1980s level as a percentage of GDP. Historical consolation? Perhaps. All clear? Hardly.

(Click on image to enlarge)

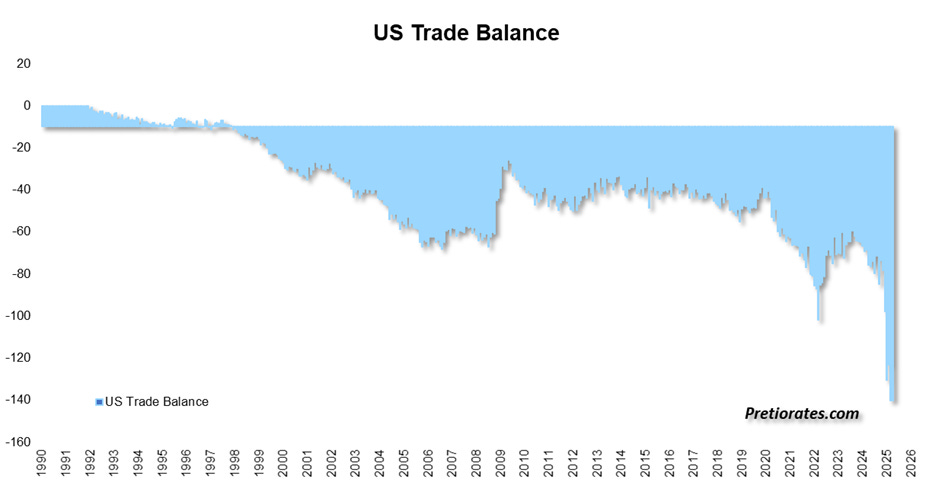

Another culprit for the growth in debt is the trade deficit. To get this under control, the Trump administration has brought out the tariffs. And with the new budget draft – grandly titled the «Big Beautiful Bill» – the aim is to «beautify» and thoroughly clean up the problem in the long term.

(Click on image to enlarge)

Surprisingly, the House of Representatives passed the bill by a narrow margin of just one vote (215 to 214). The ball is now in the Senate's court, which ideally should pass the bill before the summer recess.

However, the bill is not quite as «beautiful» as it seems. Massive tax cuts will initially lead to even more debt, while there is no guarantee that economic growth will be stimulated and the economy strengthened. No wonder, then, that the bond market is trembling and some market participants already see the «BBB» as an indication of the US's upcoming credit rating.

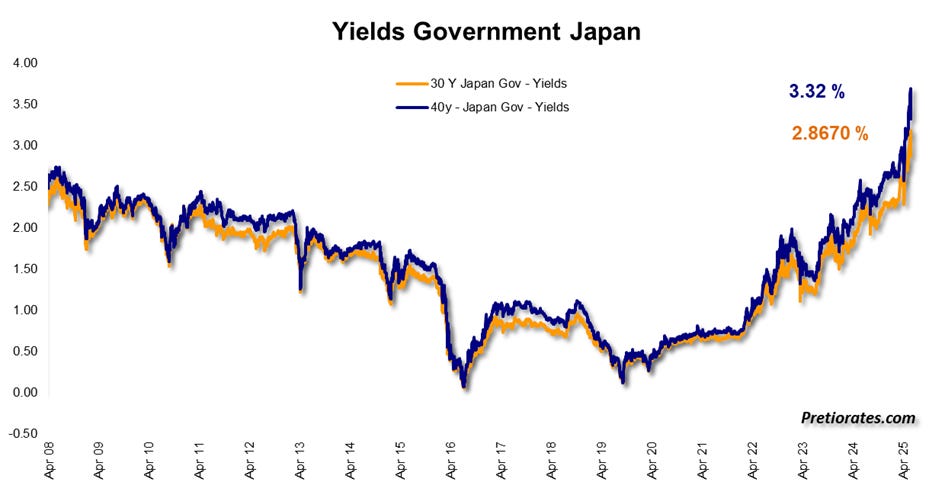

But we cannot really agree with that. The main reason for the renewed volatility on the US bond market lies far away... not in terms of time, but in the Far East, in a country called Japan. There has been a real earthquake on the bond market there – especially for long-term bonds with maturities of 30 or even 40 years. Since hitting a low of almost zero percent five years ago, yields have now climbed to almost – or even above – three percent.

(Click on image to enlarge)

This hurts – especially Japan's life insurers. Names such as Meiji Yasuda, Sumitomo Life, Dai-Ichi Life, and Nippon Life now have to digest book losses running into the billions. And these book losses have consequences: they are forced to rebalance their bond and equity holdings, which is leading to sell orders in equities.

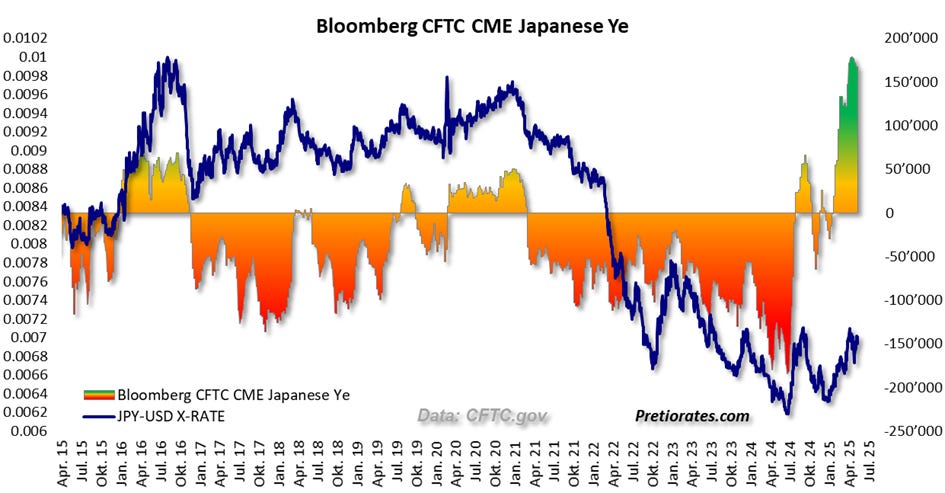

But that's not all: rising interest rates in Japan are destroying one of the most lucrative sources of financing in recent years – carry trades. Borrowing money with the cheap Yen and investing it in higher-yielding US assets, especially Treasuries, has been a winning strategy for a long time. The only risk – a strong Yen – was practically non-existent. Until now.

Now Japanese interest rates are rising. Carry trades can no longer be rolled over so easily. As a result, US Dollars are being sold and Yen must be bought back. And lo and behold: the net long positions of large investors (non-commercials) in the forex futures market are literally exploding.

(Click on image to enlarge)

Carry trades were already a source of nervousness for the stock markets in August 2024. This time? Not yet. Because the selling pressure is not acute. But with the disappearance of cheap Yen financing, demand for US government bonds is also falling. Fewer buyers = higher yields. Logical. And, unsurprisingly, long maturities in the US bond market are particularly affected.

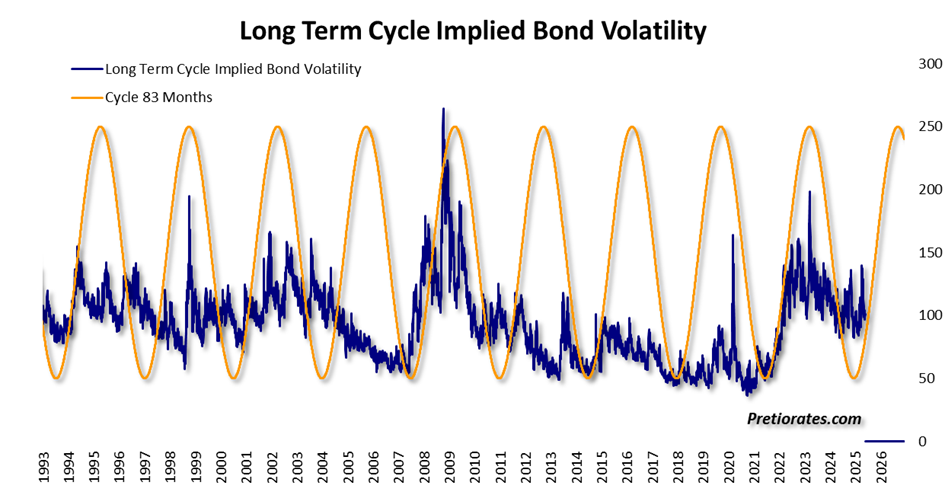

Incidentally, according to the 83-month cycle, volatility on the US bond market would be expected to rise again anyway...

(Click on image to enlarge)

Bottom line: In many of our «Thoughts», we have always taken a critical view of market hopes that interest rates will fall again soon – and so far we have not been proven wrong. And if our thinking is correct, this is unlikely to be the case in the near future either.

More By This Author:

The Rise Of The Alternative MetalsFrom Fear At Warp Speed To Euphoria

When Correlations Crackle

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more