Jay, Stay Strong – Even When Thunder Rumbles Above

Image source: Wikipedia

Fed Chairman Jerome ‘Jay’ Powell will need to keep his cool again this week. US President Donald Trump reiterated his call for lower interest rates during a meeting with British Prime Minister Keir Starmer.

After Trump pushed through another deal with the EU, all eyes are now on the impact of tariffs on the US economy. The fact is that the majority of companies will pass on the new import tariffs to consumers. More expensive products mean potentially weaker consumption – and thus less growth momentum for the US economy. The impact on inflation? Probably limited – if consumer sentiment and demand decline at the same time.

In addition, the US dollar has weakened noticeably in recent months. A weak greenback makes imports more expensive and thus pushes up inflation from outside – this is called imported inflation. On the positive side, US exports are becoming more competitive. A dream for Trump – but possibly a nightmare for the US government bond market. This is because a weaker dollar could scare off foreign investors, which has historically always been reflected in higher yields and weaker bond prices.

The strength or weakness of the US dollar is not only home-grown. It is also driven by trends in all other major global currencies. We measure these with this chart. It currently shows that all other currencies have recently outperformed the greenback, which is why the internal strength of the US dollar has recently fallen back to zero. However, whenever this strength falls to zero, we have seen an important interim low in the US currency in the past.

(Click on image to enlarge)

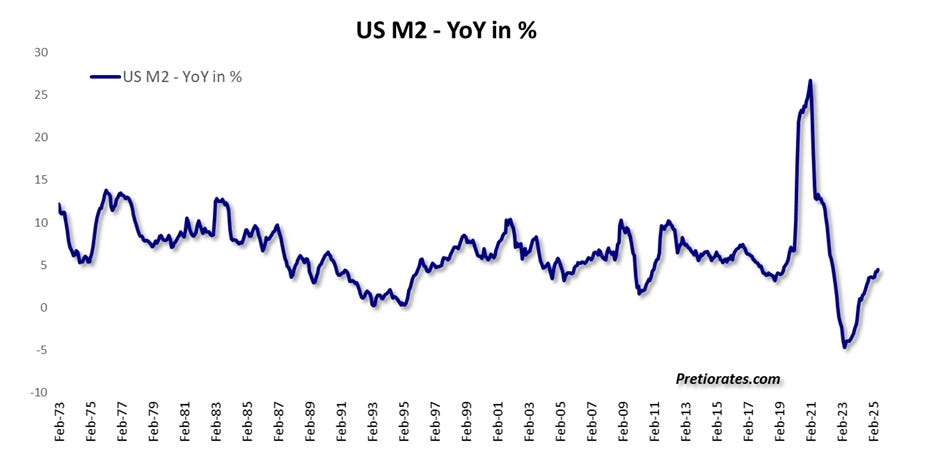

The M2 money supply – a measure of the amount of liquid money in circulation – initially exploded after the pandemic, but then declined significantly until the beginning of 2023. Since then, it has been rising again. More money in circulation means no real monetary tightening, even if the key interest rate is high. So anyone who says the Fed is restrictive is overlooking this development.

(Click on image to enlarge)

With more money in circulation, the chances of more money being available for investment also increase. And indeed, this chart shows that there is a high correlation between the percentage change in the money supply and the S&P 500 Index.

(Click on image to enlarge)

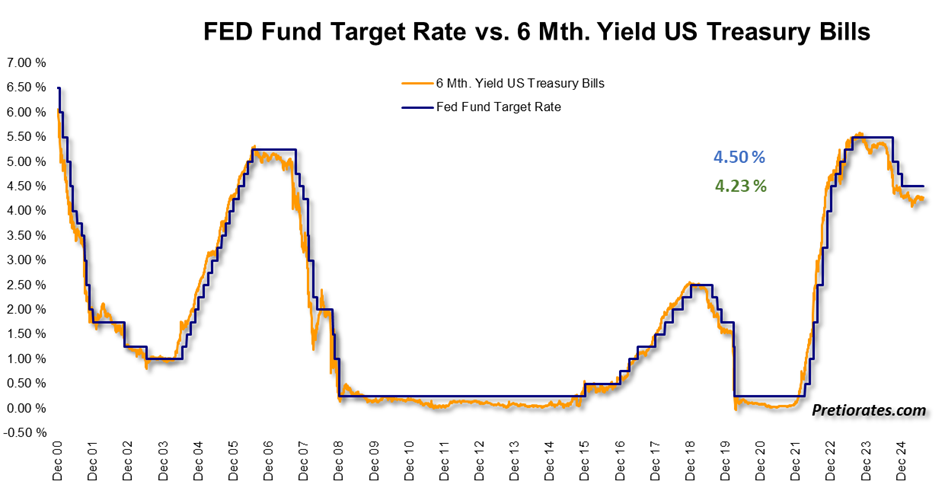

An early indicator of the interest rate path is the spread between the Fed Funds Rate (currently 4.5%) and market yields on 2-year US Treasuries (currently 3.93%). The markets are therefore pricing in an interest rate cut of around 50 basis points.

(Click on image to enlarge)

It is even more accurate to compare the spread with 6-month yields rather than over two years. Financial professionals often prefer this in order to better assess the upcoming decision. And they currently point to an interest rate cut of only 25 basis points over the next six months, possibly at the Fed meeting in September 2025.

(Click on image to enlarge)

Incidentally, we can track sentiment over a longer period of time in the futures market. The spread between September 2025 and July 2026 currently still signals a potential cut of around 75 basis points.

(Click on image to enlarge)

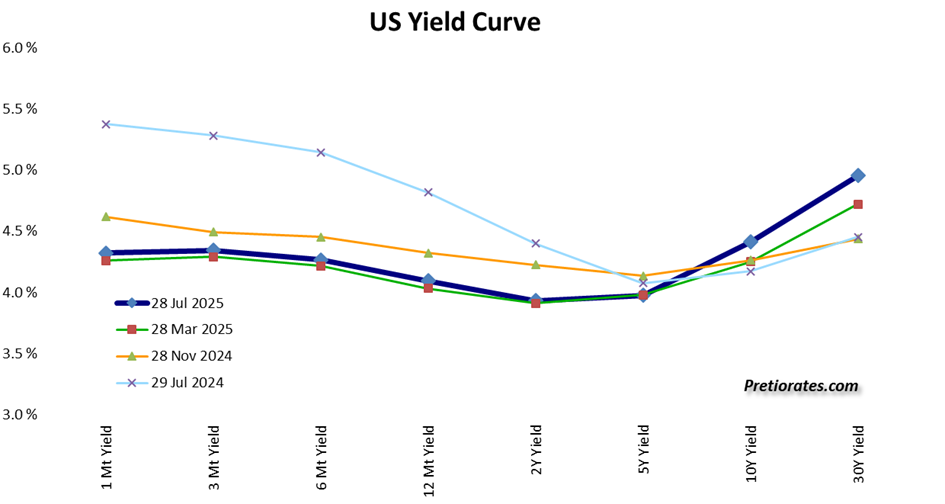

However, we will get a definitive answer from the yield curve. This shows the different yields for different maturities. Short maturities are on the left and long maturities are on the right. During periods of economic prosperity, the curve rises from left to right because a strong economy means that the central bank is more likely to raise interest rates in the future. If, on the other hand, a recession is expected, the curve falls from left to right, i.e. it is inverted. The development over the last twelve months, with four key dates, shows us that it has changed from falling to rising over the last twelve months. At the long end, it even rose slightly recently. The curve tells us that the market only expects slightly lower interest rates to be temporary and anticipates a more robust economy in the long term.

(Click on image to enlarge)

So is President Trump right to make his demand? At first glance, perhaps: US yields are currently well above the consumer price index (CPI) of around 2.9%, which could indeed suggest that the Fed is being too restrictive. However, the M2 money supply has been rising again for some time. The spread on high-risk bonds, or high-yield bonds, is extremely low compared to top-rated debt. In addition, the stock markets are back in la-la land, celebrating a comeback of speculation: speculative trends such as meme stocks and margin debt are experiencing a revival. None of this fits with a supposedly restrictive monetary policy. In addition, there are issues such as inflation and geopolitical developments, and the latter in particular could have a stronger impact again in the near future. Therefore, another interest rate cut might be popular, but it would not necessarily be wise. Jay, hold your ground!

More By This Author:

From Liberation To Levitation – But Gravity Is PatientFed Up? What If Jay Powell Walks...

White Metals: When Pessimism Gets Bullish

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more