Homebuilder Sentiment Plunges Despite Lighter Mortgage Rates

Stocks are achieving modest gains to start the week as investors breathe a sigh of relief considering the US government averted a shutdown. But today’s economic data was nothing to write home about, as retail activity recovered only modestly from January’s decline, which marked the steepest fall in 42 months. Meanwhile, the recent drop in financing costs hasn’t produced a smile for homebuilders, with this morning’s sentiment print posting its worst result in seven months. Both publications missed estimates by sizeable amounts and when taken together, point to rising uncertainty that is subduing confidence about consumption and construction alike.

Stores Report Better Results

US shopping trends improved during February but not in broad-based fashion, as most categories registered subtractions in transaction volumes. Retail sales, which are not adjusted for inflation, rose 0.2% month over month (m/m), missing the 0.6% median estimate but recovering slightly from January’s 1.2% drop, the sharpest since July 2021. Spending was better when excluding gasoline and autos, however, driving the control group, a significant input to the consumption aspect of gross domestic product, north by 1% m/m. Ecommerce, health/personal care retailers, food markets, building materials suppliers and general merchandise sellers represented the gainers, posting increases of 2.4%, 1.7%, 0.4%, 0.2% and 0.2%. But restaurants and drinking parlors, gasoline stations, clothing shops, sporting goods destinations, automobile dealerships and repair spots, miscellaneous establishments and electronics and appliance stores contracted 1.5%, 1%, 0.6%, 0.4%, 0.4%, 0.3% and 0.3%. Furniture showrooms were unchanged.

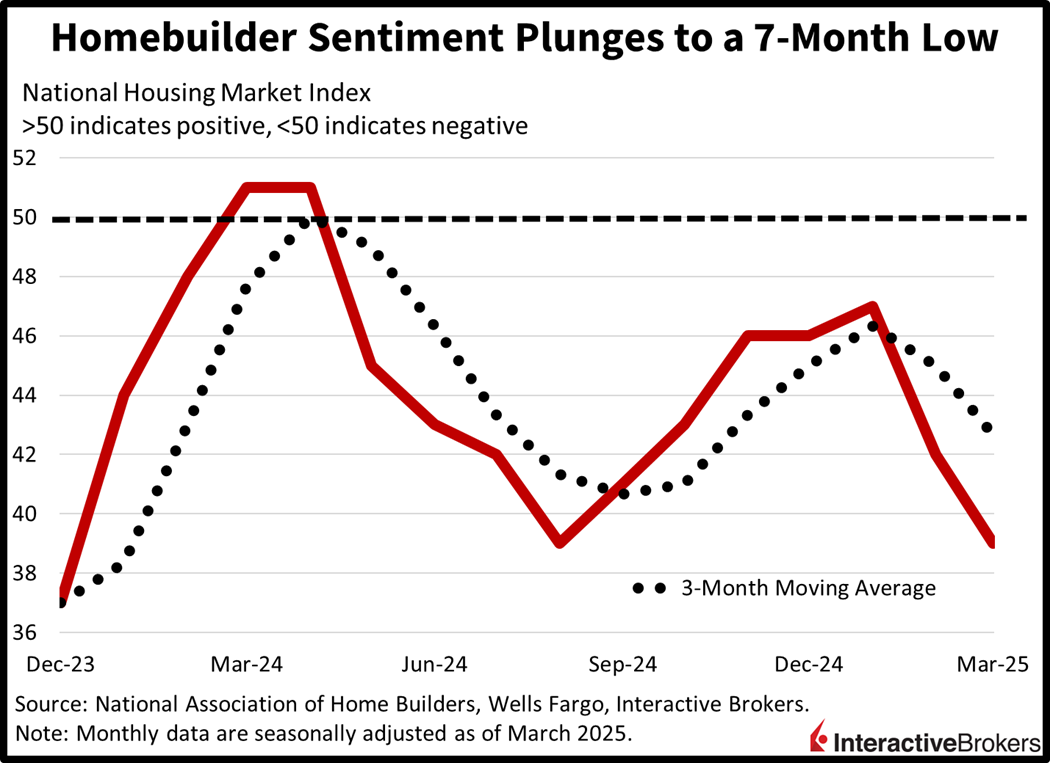

Housing Industry Mood Sours

Easing financing costs failed to propel volumes of prospective home buyers and the near-term outlook for single-family closings, as rising economic unclarity offset the affordability benefits of cheaper borrowing rates. The National Association of Home Builders/Well Fargo Homebuilder Sentiment Index tanked to 39 this month, its lowest level since August. The result missed the expectation for an unchanged 42. Survey respondents reported deteriorating conditions regarding single-family transactions in present and prospect traffic, with those metrics slipping from 46 and 29 to 43 and 24. At the same time, prospects for individual home deals in the next six months stayed at 47. Additionally, all regions saw worsening assessments, as the Northeast, Midwest, South and West fell from 50, 43, 41 and 35 to 47, 38, 39 and 34.

Markets and Economy Face Considerable Hurdles

The buying activity in risk assets was an encouraging start to the week, but economic data, broadly speaking, has frequently surprised to the downside in the past few weeks. Moreover, the headwinds of trade policy, immigration restriction and government spending reductions are clouding the outlook and debilitating transaction momentum. Individuals are concerned about their job security in light of the significant changes the administration is enacting quickly, while even wealthy investors are feeling the pinch of the stock market correction and are worried that more selling may ensue. Businesses, meanwhile, are hesitant at this juncture—they are unsure about capital expenditure plans and hiring considering the wide range of possible outcomes. Finally, tomorrow we’ll get a read on the manufacturing sector via industrial production, which is a major focus of the White House in terms of boosting investment and employment.

International Roundup

Chinese Stores Experience More Demand

China’s February retail sales strengthened during a month in which the number of out-of-work individuals increased, housing prices fell and production decelerated. Shoppers increased their outlays 4% year over year (y/y) compared to 3.7% in January and the analyst consensus forecast of 3.8%. The country is seeking to trigger more shopping by providing incentives for purchasing electric vehicles and large appliances, but a box office hit and the timing of the Lunar New Year are believed to be the primary drivers of more frequent visits to cash registers. The growth occurred even as unemployment moved from 5.2% in January to 5.4%. Analysts anticipated 5.1%. In the industrial sector, y/y production growth fell from 6.2% to 5.9% but surpassed the analyst outlook for 5.3%. In another sign of weakness, the country’s troubled real estate market continued to languish with home prices falling 4.8% y/y, which was a slight moderation from January’s 5% dip.

Canada Housing Starts Weaken

Canadian contractors broke ground on 229,000 habitats last month, according to the Canada Mortgage and Housing Corp. The volume missed the analyst forecast of 246,000 and declined from 239,300 in January.

More By This Author:

FOMO > Facts?

Beware The Ides Of March

“Dump And Chase” Works In Hockey, Not In Markets

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more