FOMO > Facts?

Image Source: Unsplash

There were several good reasons for stocks to rally this morning. Since yesterday’s close, we learned that we are likely avoid a government shutdown tonight and we’ve so far had a dearth of new tariff threats.Plus, we seemed due for a bounce amidst the oversold conditions that allowed us to “achieve” the widely reported 10% correction in the S&P 500 (SPX). Thus, I was not at all surprised to see pre-market futures rise.But I am surprised to see indices doubling those gains in mid-morning even after a truly atrocious reading on consumer sentiment.

There is no way to sugarcoat today’s University of Michigan data.Frankly, it stinks.

- Sentiment sank to 57.9 from 64.7, below the 63.0 consensus estimate

- Current Conditions dipped to 63.5 from 65.7, below the 64.4 consensus

- Expectations plunged to 54.2 from 64.0, way below the 63.0 estimate

- 1-Year Inflation Expectations zoomed to 4.9% from the prior 4.3%, which was also the consensus

- 5-10 Year Inflation Expectations rose to 3.9% from 3.5%.A slight dip to 3.4% was anticipated

While the Sentiment reading is the lowest in over two years, the prior low was registered on November 30, 2022.That was also the prior high reading for the 1-Year Inflation reading.By the way, that was a rather opportune time to buy stocks.Expectations, however, haven’t been this low since July 31, 2022, which was in the teeth of that year’s bear market.And 5-10 Year Inflation number has not been this high since 1991!

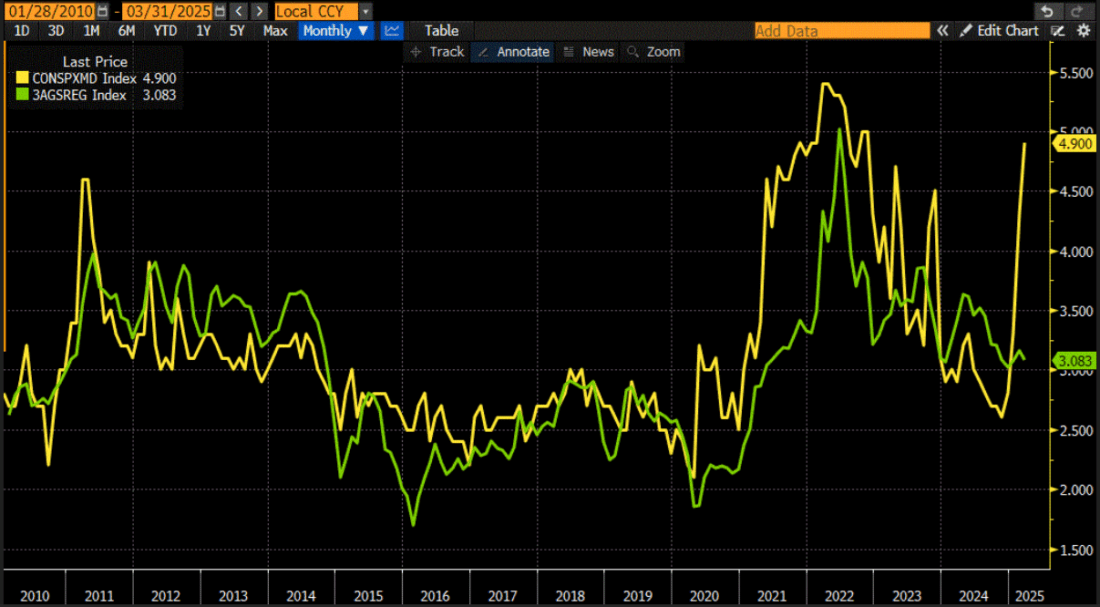

For several weeks, we’ve been discussing how a range of consumer sentiment readings have been deteriorating. On February 7th we noted an unexpected decline in the UMich Sentiment reading, from 71.1 to 67.8, and a head-scratching rise in 1-Year Inflation Expectations to 4.3% from 3.3%. That reading typically follows pump prices for gasoline.But we noted that there was no corresponding increase in gas prices, and the current reading continues to far outpace relatively quiescent pump prices:

UMich 1-Year Inflation Expectations (yellow), AAA Retail Gasoline Prices (green), since January 2010

(Click on image to enlarge)

Source: Bloomberg

The last time we saw a spike of this magnitude was in 2021, a good year for stocks. But while the prior spike was driven by Covid-era supply shocks and stimulus, which also led to rising gas prices, none of those conditions exist now.Perhaps this spike is being driven by tariff fears, perhaps it is being driven simply by bad vibes.It will be hard for the Federal Reserve to simply shrug off a jump off this magnitude at next week’s meeting.

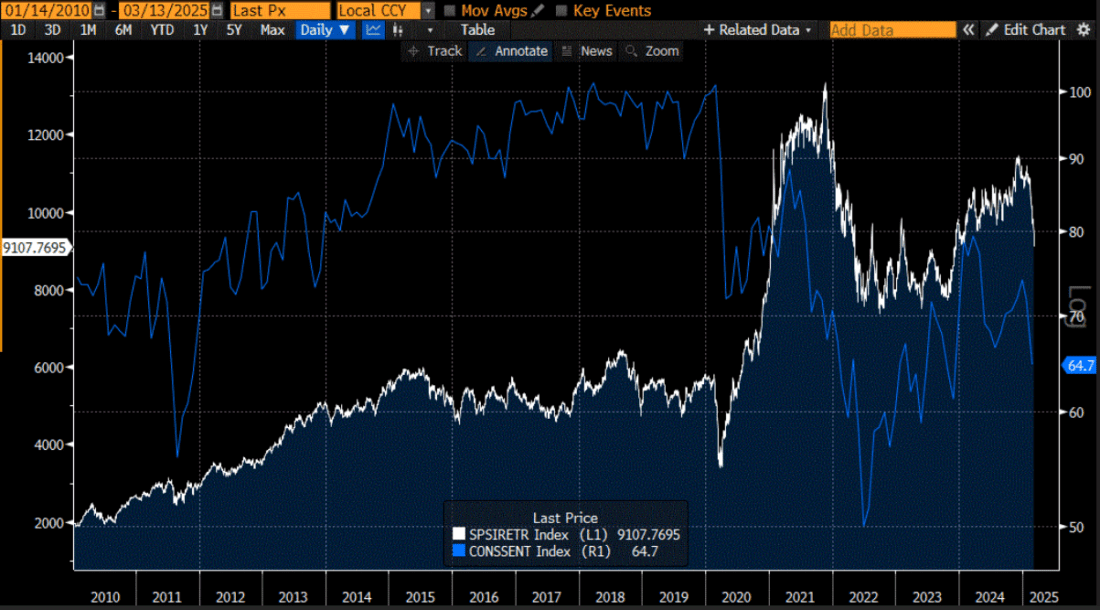

The plummeting sentiment certainly is affecting retail stocks. There is an understandably close relationship between consumer sentiment and the S&P Retail Select Industry Index, the one that underlies the popular XRT ETF.The relationship held through most of the 2010s, then switched to a new plateau when stocks took a leap after Covid:

S&P Retail Select Industry Index (white), UMich Consumer Sentiment (blue), since January 2010

(Click on image to enlarge)

Source: Bloomberg

The relationship has been especially close over the past four years:

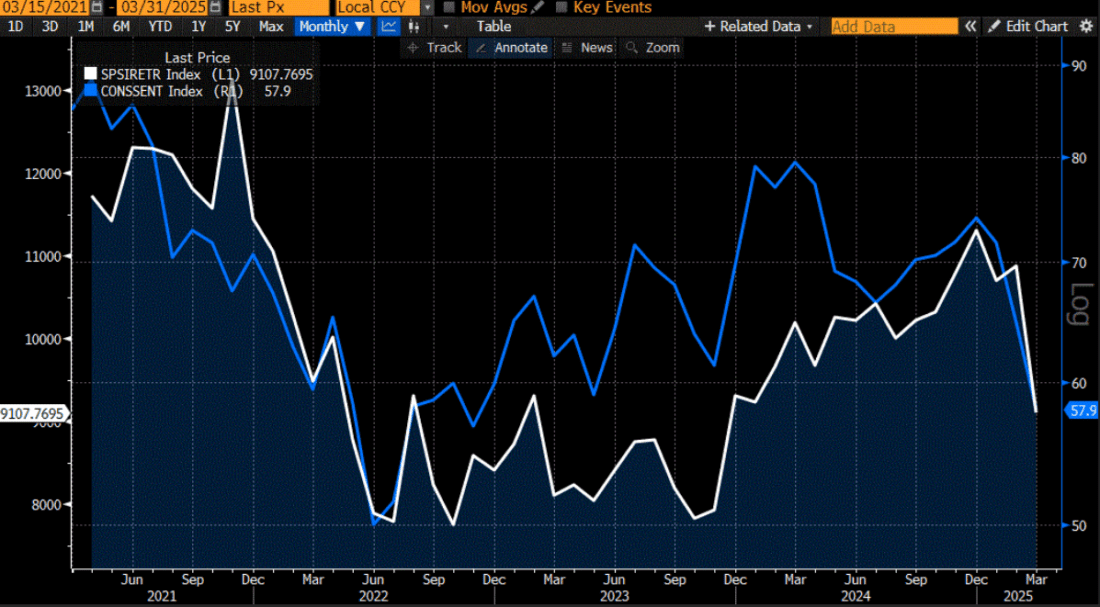

S&P Retail Select Industry Index (white), UMich Consumer Sentiment (blue), since March 2021

(Click on image to enlarge)

Source: Bloomberg

So, why are stock traders so sanguine today. It could be that they too recognize that some of the parlous UMich numbers last touched these levels just as the market bottomed in 2022, but I’ve frankly heard no commentary to that effect.Instead, I think it’s human nature.Many traders despise missing a rally, regardless of rationale. FOMO can outpace actual fear, which is one reason why bear market rallies can be among the most powerful of all. This is not to suggest that the recent decline is anything more than a basic correction so far, but the rationale behind the latter part of today’s bounce seems to have that character. (As noted, there were solid reasons for the initial move higher.) That it is occurring on a Friday, when we have over 600 expiring options classes that can be pushed through strikes, probably adds to the rally’s ferocity. The final test will be to see how many of these sanguine traders feel like taking long positions home with them over the weekend.

More By This Author:

Beware The Ides Of March

“Dump And Chase” Works In Hockey, Not In Markets

Investors Look Abroad On Tariff Eve

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment ...

more