Investors Look Abroad On Tariff Eve

Image Source: Unsplash

On the eve of the scheduled implementation of Trump tariffs on Canada, China and Mexico, equity investors are selling US shares in favor of European stocks. Risk assets across the Atlantic have outperformed their American counterparts year-to-date, as market participants worry that trade tensions could slow growth and drive cost pressures in the world’s largest economy. In light of the stagflationary winds, this morning’s stateside economic calendar offered evidence of weaker activity amidst heightening inflation, with both ISM-manufacturing and construction spending missing expectations while losing momentum from the previous month. Moreover, the pivotal prices-paid segment of the ISM-manufacturing print jumped to a 31-month high, while the new orders component retreated sharply into contraction territory. The development is particularly worrisome because this economy can’t afford goods reinflation, considering that services charges have been incredibly sticky, bolstered by elevated rents and mortgages alongside a tight labor market that has supported rising wages. Emblematic of the vulnerability is this morning’s update to the Atlanta Fed’s GDPNow being lowered to negative 2.8% for this quarter following the intraday publications, which signals an acute deterioration to start 2025.

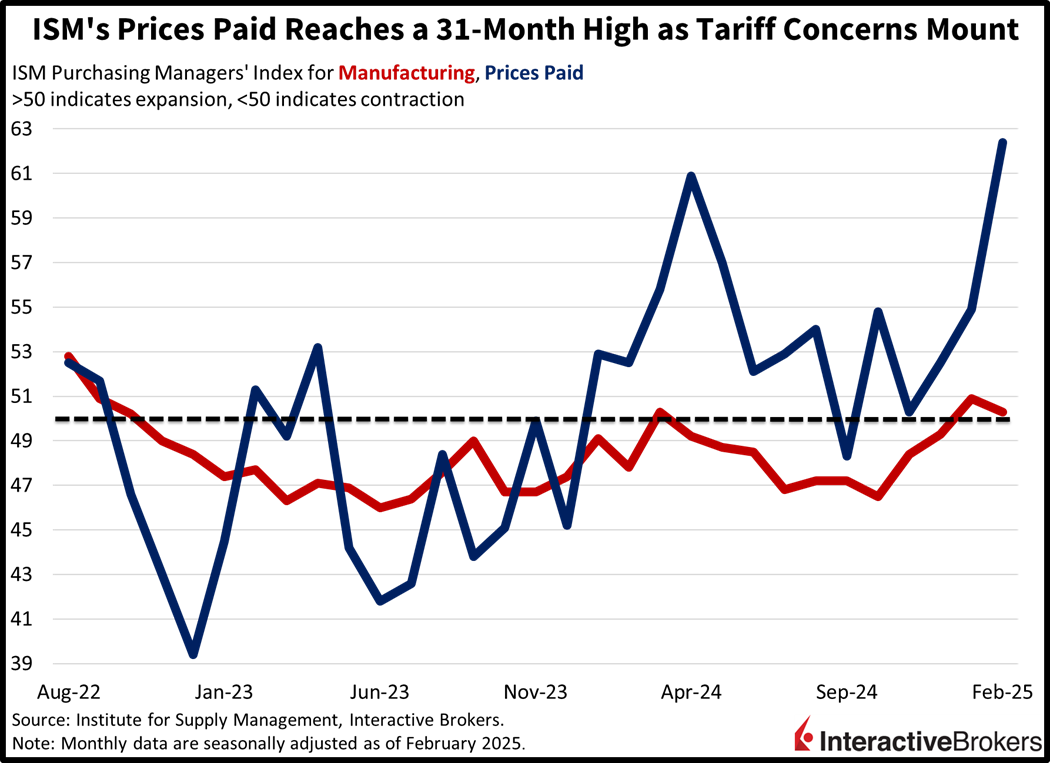

US Goods Reinflate

Trade policy uncertainty drove a slowdown in domestic manufacturing last month, with the Institute for Supply Management’s (ISM) Purchasing Managers’ Index for the sector decelerating to 50.3 in February, beneath the median estimate of 50.5 and January’s 50.9. New orders and employment saw sizeable declines that knocked the two pivotal categories back into contraction territory, sporting scores of 48.6 and 47.6 and weighing on the headline. But exports and production stayed marginally above 50, at 51.4 and 50.7, which helped support the sector’s meager growth last month. Prices, meanwhile, accelerated to 62.4, the tallest rate since July of 2022, a 31-month high. Contracting demand amidst expanding costs is adding to evidence of a weaker stateside economy.

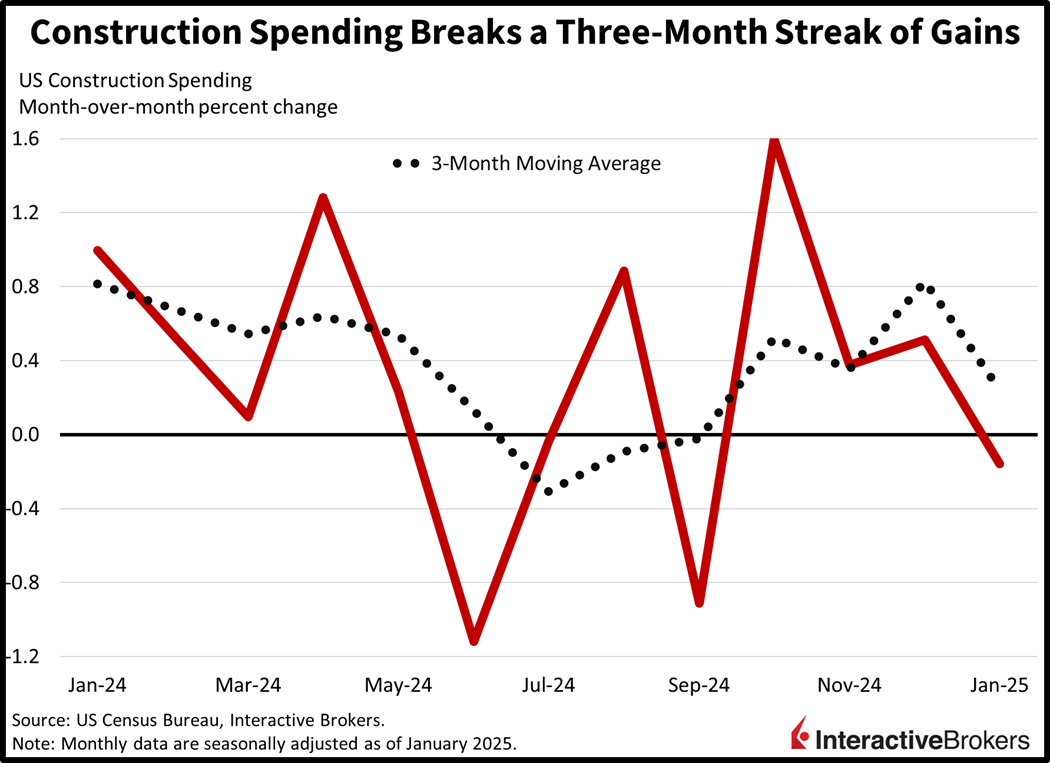

Construction Investments Decline

A decline in residential investment due to heavy financing charges and elevated prices drove a contraction in January construction spending. The headline figure declined 0.2% month over month (m/m), missing the median projection for no change and dropping below December’s 0.5% result. The housing component hampered progress as total investments declined 0.5% m/m, but a 0.1% growth rate in the nonresidential segments helped cushion the blow. Driving nonresidential activity were the religion, lodging, health care, highway/street and conservation and development areas, which posted m/m increases of 1.6%, 0.7%, 0.6%, 0.6% and 0.6%.

Tariff Eve Sparks US Stock Selling

US markets are bearish today as stocks, Treasurys and the greenback take losses while investors look at European equities for an alternative. Traders are not just scooping up European shares, they’re also adding to long commodity positions as well as US equity volatility protection in case turbulence increases. All major domestic benchmarks are modestly lower with the Russell 2000, S&P 500, Dow Jones Industrial and Nasdaq 100 indices losing 0.4%, 0.2%, 0.1% and 0.1%. Sectoral breadth is positive, however, as real estate, healthcare and consumer staples lead the gainers; they’re up 0.9%, 0.6% and 0.5%. Just 2 of the 11 major segments are trimming on the session; technology and energy are down 0.6% and 0.5% so far. Treasurys are near their flatlines and taking modest losses with the 2- and 10-year maturities changing hands at 4.01% and 4.21%, 1 basis point (bps) heavier on both fronts. The greenback is selling off, meanwhile, because slowing economic data prints and rising evidence of incoming fiscal stimulus from the European Union are weighing on US GDP growth projections and relative performance. The Dollar Index is down 93 bps as Washington tender depreciates versus all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie currency. Commodities are strongly bullish with silver, lumber, gold and copper gaining 2%, 1.9%, 1.1% and 1% but crude oil is bucking the trend; its down 0.6% so far today.

Could See a Last-Minute Surprise

Tariffs are expected to be implemented tomorrow but a significant consideration I’ve been discussing lately concerns negotiations coming down to the wire. An event similar to what happened in previous weeks regarding the postponement of 25% levies on Canada and Mexico, could certainly occur this time around as well. President Trump’s messaging and posturing have driven elevated uncertainty, which is already weighing heavily on US economic prospects and market sentiment. On the heels of a weekend in which the White House lifted enthusiasm in the crypto markets, illustrated by bitcoin trading at around $78,000 on Friday to $95,000 on Sunday, does the economy and stock market need that kind of reassurance? Equities are near the flatline year to date while the Atlanta Fed’s widely followed GDPNow forecast has drifted to negative 2.8% for this quarter. These conditions are ripe for a last-minute deal as the US Economy and markets crave sympathy from the Executive Branch, not apprehension.

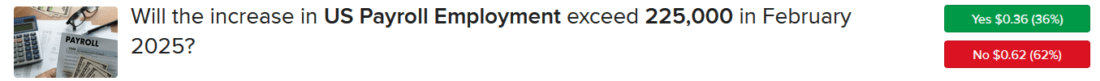

ForecastEx Pick of the Week

Chief Strategist Steve Sosnick and Senior Economist Jose Torres like the “No” Forecast Contract for a figure above 225,000 in this Friday’s Jobs Report. The “No,” currently priced at $0.62, pays out a dollar if correct.

Source: ForecastEx

International Roundup

Euro Price Pressures Ease

Inflation in the euro area eased on a 12-month basis in February but accelerated m/m, according to estimates from Eurostat. The headline and core CPI indices climbed 2.4% and 2.6% year over year (y/y), respectively, compared to 2.5% and 2.7% in January. Despite moderating, the results exceeded the consensus estimates of 2.3% and 2.4%. On a m/m basis, headline and core inflation climbed 0.5% and 0.6% after January’s results of -0.3% and 0.5%. The broader benchmark result was hotter than the 0.4% anticipated by economists.

Services led price pressures m/m, increasing 0.7% followed by costs for the food, alcohol and tobacco category and the non-energy industrial goods climbing 0.4% each. The only broad category to weaken was energy, which fell 0.3%. The easing inflation comes after the ECB has made five cuts to its key interest rate.

Hong Kong Sales Drop Again

Hong Kong retail sales dropped 5.2% y/y during the initial month of 2025 compared to the 11.3% contraction in December, pointing to an easing of the country’s 11-month streak of declining sales.

China’s Manufacturing Picks Up Slightly

China’s manufacturing activity picked up slightly last month, according to both the Caixin/S&P Global Purchasing Managers’ Index (PMI) and the government version of the gauge. Caixin/S&P reported today that the index hit 50.8, exceeding January’s score of 50.1 and the consensus estimate of 50.3. The government PMI, released on Saturday, hit 50.2 and the non-manufacturing version climbed from 50.2 to 50.4. The overall index, furthermore, rose from 50.1 to 51.1, which is above the contraction/expansion threshold of 50. The manufacturing gain is likely to have resulted from US companies stocking up on items prior to the start of potential tariffs tomorrow as domestic demand within China has weakened.

More By This Author:

Sixty Percent Of The Time, It Works Every Time

Bulls Bounce Back On Lowe’s Optimism, AI Enthusiasm

Another Day, Another Stinker (Plus, NVDA)

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more