Here’s What Could Happen To S&P 500 According To Wyckoff’s Efforts Vs. Results

The presence of hidden demand as reflected in Wyckoff’s efforts vs results with the Wyckoff trading method together with the shortening of the thrust to the downside have given the bull a chance to prove itself.

Watch the video below and pay attention to the failure case at the critical level with stock market capitulation to the downside. The failure will violate the bullish scenario as demonstrated by the market breadth thrust in determining the market bottom.

Video Length: 00:10:20

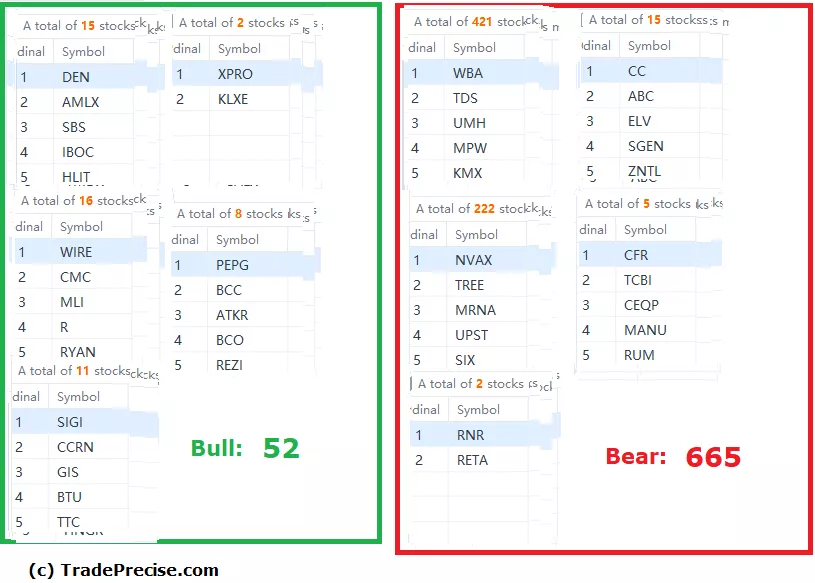

The bullish setup vs. the bearish setup is 52 to 665 from the screenshot of my stock screener below.

S&P 500 stalled at the key level at 3800 followed by a failure as it reacted to the non-farm payroll last Friday. The weakness in the S&P 500 continued to spook the prior market leaderships. So far, there is no leading industry group, which makes it hard for the market bottom scenario to materialize. The key to survive in this volatile market is to be nimble while picking the winning stocks to ride the momentum.

More By This Author:

Is The Current Rally In S&P 500 A Dead Cat Bounce Or Sign Of Strength?

Here Is How To Anticipate If A Relief Rally Or A Capitulation Will Show Up In The S&P 500

How To Spot The Hidden Demand In S&P 500 & What To Expect From Here On

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.