Is The Current Rally In S&P 500 A Dead Cat Bounce Or Sign Of Strength?

After the presence of demand in a combination of shortening of the thrust to the downside in the S&P 500, a Wyckoff change of character bar finally showed up on 3 Oct 2022. Here is how to differentiate if the current rally in S&P 500 is a dead cat bounce or a Wyckoff sign of strength rally as one of the bullish components on identifying the market bottom.

Watch the video below and pay attention to the key level and the most important bar S&P 500 needs to test.

Video Length: 00:12:02

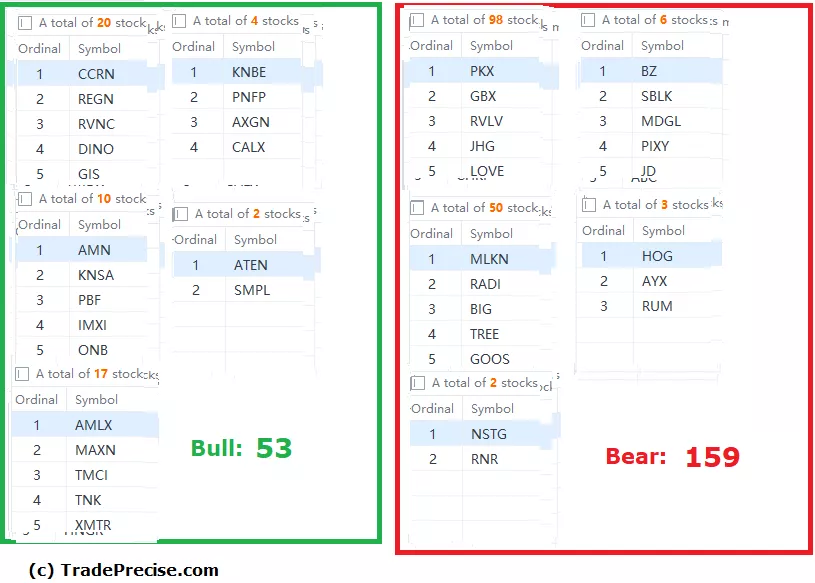

The bullish setup vs. the bearish setup is 53 to 159 from the screenshot of my stock screener below.

Despite the strong rally in the indices, the bullish trade entry setups are still less than 100. This is still a difficult trading environment hence the key is to be very selective and to find out how to pick winning stocks in the leading sector in order to ride a sustainable rally.

More By This Author:

Here Is How To Anticipate If A Relief Rally Or A Capitulation Will Show Up In The S&P 500

How To Spot The Hidden Demand In S&P 500 & What To Expect From Here On

Here Is How To Use Relative Strength To Predict The Next Big Move In Tesla

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.