Here Is How To Anticipate If A Relief Rally Or A Capitulation Will Show Up In The S&P 500

The S&P 500 is testing the critical support with extreme oversold condition. Find out how to anticipate if there will be a relief rally or a breakdown with market capitulation to the downside.

Watch the video below and pay attention to the stats as reflected in the breadth thrust and also the one exceptional case as illustrated.

Video Length: 00:16:24

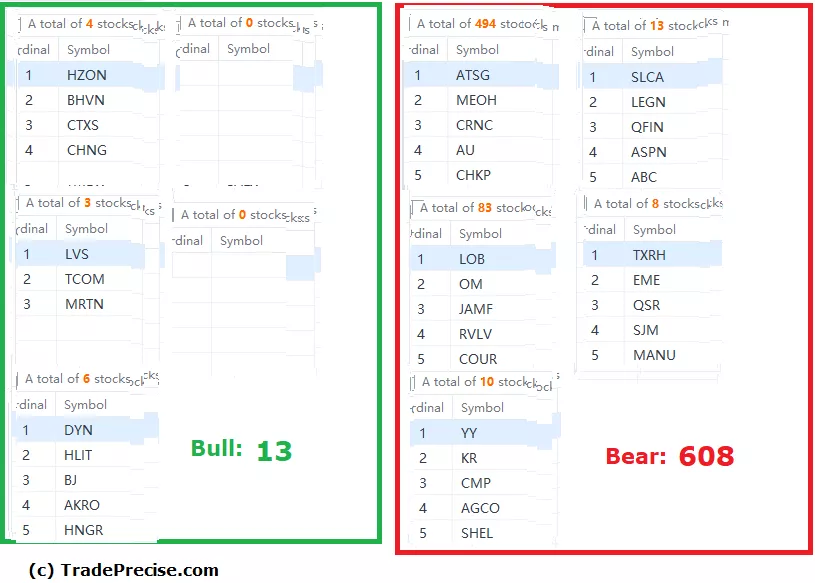

The bullish setup vs. the bearish setup is 13 to 608 from the screenshot of my stock screener below.

Most importantly, majority of the outperforming stocks in the leading industry groups broke the key levels and violate the bullish structure as derived from the Wyckoff logic. Without the leading groups with outperforming stocks, the market bottom scenario will be violated.

More By This Author:

How To Spot The Hidden Demand In S&P 500 & What To Expect From Here On

Here Is How To Use Relative Strength To Predict The Next Big Move In Tesla

Here Is How To Pick Winning Stocks To Outperform In A Bear Market Or Market Correction

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.