Gas Projections Keep Going Up

Photo by American Public Power Association on Unsplash

On Thursday morning, Williams Companies released their earnings without the rumored announcement of a Behind The Meter (BTM) deal. The stock briefly dipped as algos reacted to the news release, but it then rallied because the broad outlook for natural gas demand has remained strong.

It’s turning into a global high tech arms race. The proliferation of data centers is driven by two factors. First, every country wants to control the physical location of the AI that’s increasingly viewed as crucial to growth. Second, they want to keep the physical distance between data centers and users short enough to eliminate any noticeable latency.

Last week, French President Macron announced that 1 Gigawatt of nuclear power would be dedicated to support billions of dollars in investments in AI projects. Along with other initiatives from Brookfield Asset Management and Middle Eastern investors, these will be part of $113 billion in commitments that Macron will unveil next week.

The reliance on nuclear power, which provides over 60% of France’s electricity, is the European way of building data centers while maintaining fealty to their green ambitions. Macron even offered his own version of drill baby, drill: “Plug baby, plug.”

Vice President JD Vance was at a French AI summit warning against Europe’s desire to impose regulations that would affect US technology companies.

The proliferation of new data centers is making it hard to estimate the growth in global power demand. The Energy Transfer deal with Cloudburst, which was announced on Monday, promised 450 billion BTUs of natural gas every day to run a gas turbine. That is almost 0.5% of daily US gas production, a huge amount.

However, there was some confusion because reports estimated this would produce 1.2 Gigawatts (GW) of power daily, whereas most observers would expect the amount of natural gas contemplated to produce three times as much power.

Energy Transfer's earnings call includes the term “data center” 27 times, reflective of the mix of questions the management team fielded from analysts. They’ve received requests from 70 prospective data centers across 12 states. If each one was the same size as the Cloudburst BTM agreement (i.e., 0.45 Billion Cubic Feet per Day, BCF/D), that would add up to 31 BCF/D of gas demand.

It shows the uncertainty around forecasts related to data centers. Wells Fargo revised their 10-year growth forecast for US natural gas consumption from 12 BCF/D to 11 BCF/D in the wake of the DeepSeek news a couple of weeks ago.

The 1 BCF/D reduction by Wells Fargo suggests a precision that doesn’t exist for 2035 gas consumption. They’re simply registering their view that DeepSeek is a net negative to earlier projections.

Data centers need 24X7 power, which is why they’re not planning to rely on solar and wind. Even combined-cycle natural gas plants have downtime for maintenance – typically around 5%. Diesel generators and batteries are typically planned for back-up. Using batteries 5% of the time seems much more sensible than the 60-70% that they’re needed for weather-dependent solar and wind.

Energy Transfer's CEO Marshall “Mackie” McCrea couldn’t resist commenting: “How wonderful is life after this election when we have a President and an administration that loves this country that fully recognizes how blessed we are with…fossil fuel resources.”

The International Energy Agency (IEA) published a report forecasting global electricity demand will grow at 4% per annum by 2027. 85% of this growth is expected to be in emerging economies. The additional 3,500 Terrawatt Hours of power needed is equivalent to adding a new Japan every year.

The US is expected to continue the 2% growth of last year following a couple of decades of flat consumption. GDP and the population grow, but energy efficiencies offset the increase in power demand that would otherwise resume.

In 2023, EU power demand slumped to the levels of two decades ago and only managed 1.4% growth last year. The European industry still pays around 2X the US price for electricity and 50% more than China.

The IEA is forecasting 1% annual growth in global natural gas power generation through 2027. This is probably too low. Last year was +2.6%.

Meanwhile, we’ve been bulls on natural gas demand for years. We think even we underestimated the potential. Two funds that could profit from this environment include the following:

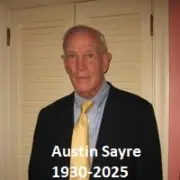

Finally, we were very saddened to lose long-time friend Austin Sayre, who died peacefully at the age of 94. Austin asked me to manage his portfolio back in 2009, when I wasn’t giving any thought to managing other people’s money. He was our first client.

Austin was witness to my early efforts at golf, having generously offered to sponsor me at our local club in New Jersey. When I once took seven strokes on a par 3, he memorably commented, “You sure got your money's worth on that hole!” Austin was an unfailingly charming and upbeat man. I feel privileged to have known him. Austin will be sorely missed by many people. A life well lived.

More By This Author:

Bond Buyers And TariffsNothing Ventured, Nothing Gained

More Gas Demand Is Coming

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their ...

more