Image Source: Unsplash

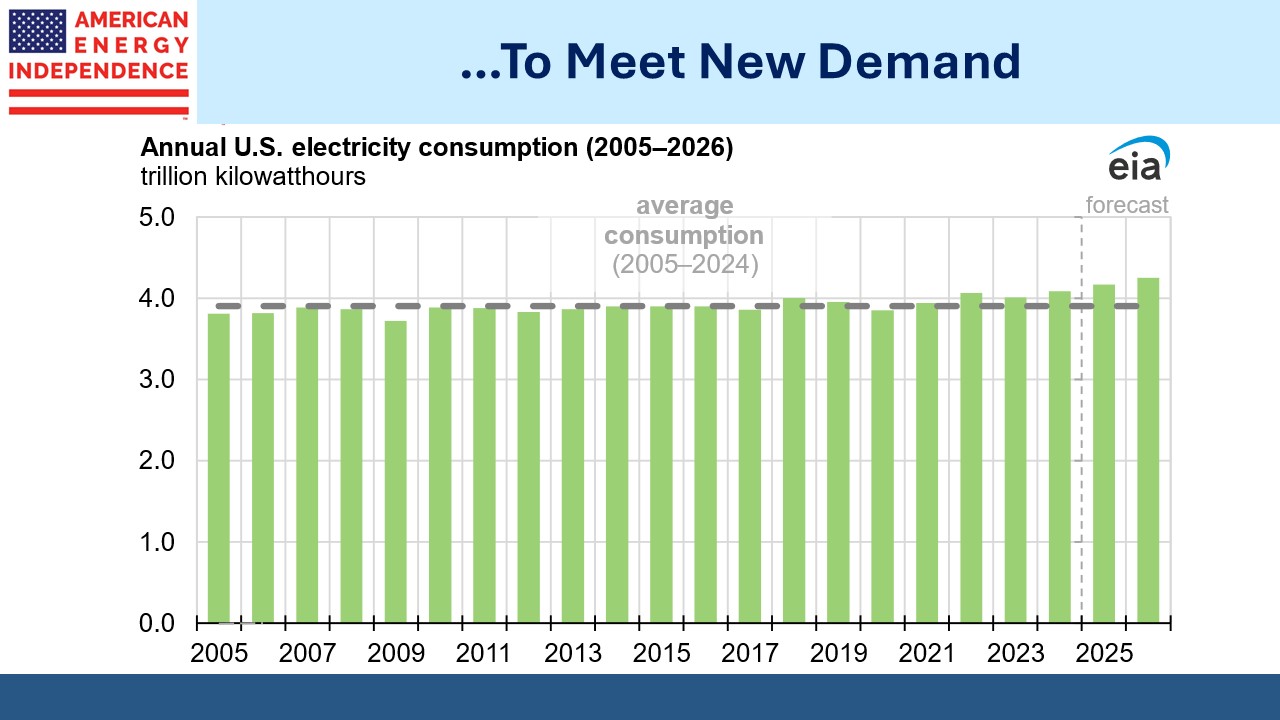

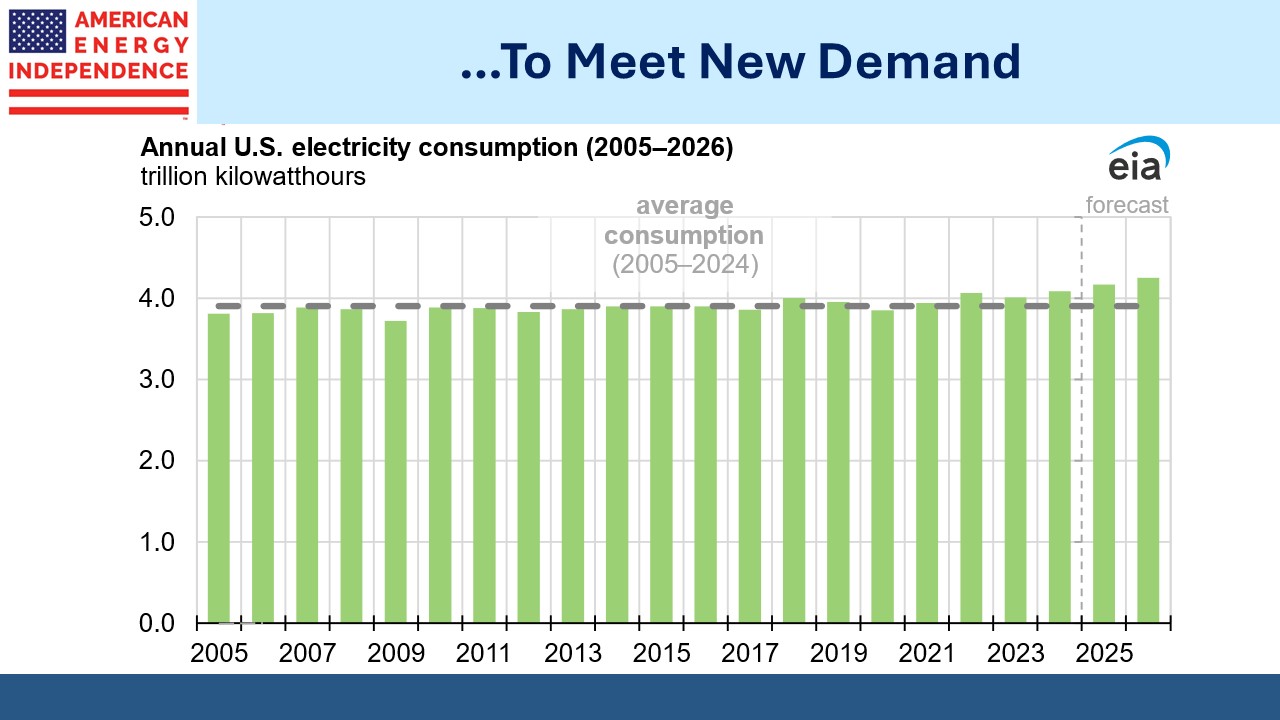

Last week, the Energy Information Administration (EIA) released their Short Term Energy Outlook (STEO). People are often surprised to learn that US power demand has remained the same for the past couple of decades – at around 4,000 Terrawatt Hours (TwHs). The economy and population have kept growing, but energy efficiency has kept improving.

Electricity demand changes slowly. Utilities need to plan for new supply years in advance to allow enough time to add new generation and supporting infrastructure. So, although the projected increase looks visually small, it’s a long time since the industry has had to plan for any meaningful increase.

The PJM grid system, which extends from mid-Atlantic states to Tennesse and Illinois, is forecasting 2% annual demand growth over the next decade. ERCOT, which covers Texas, is expecting similar annual growth through 2030. The EIA expects 2% demand growth across the country this year and the next, although this will be spread unevenly with some areas seeing 2-3X as much.

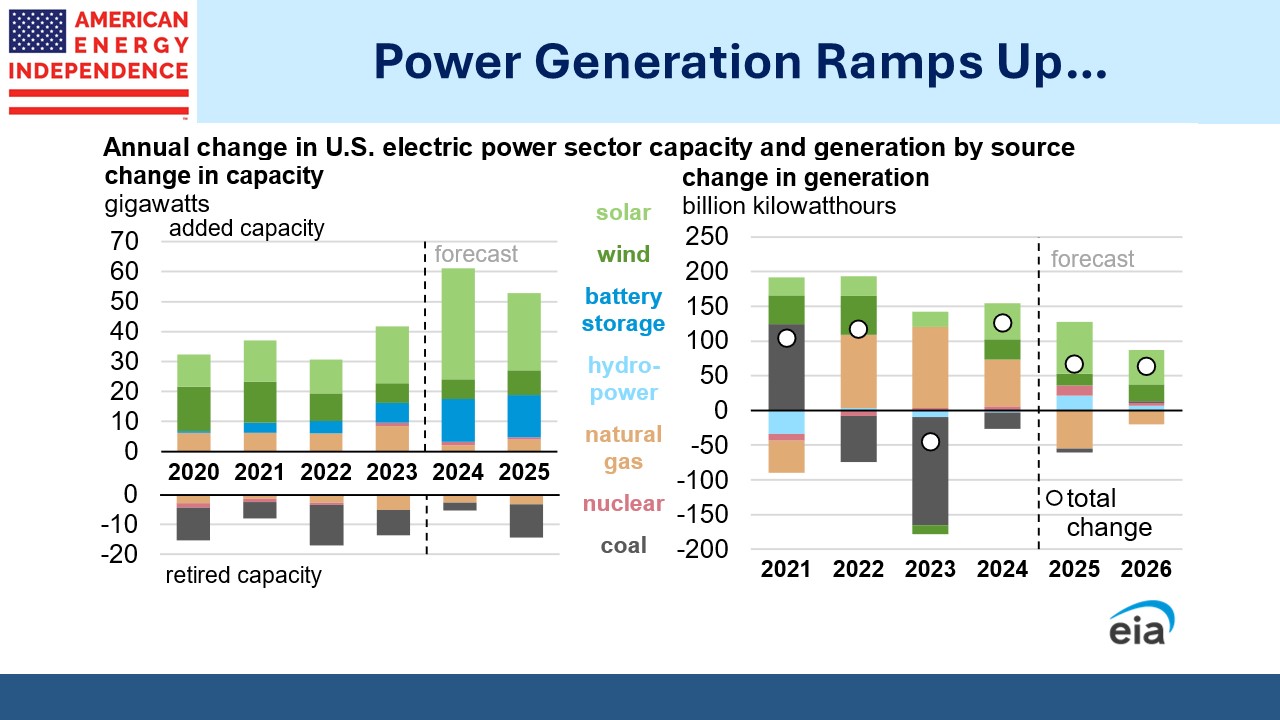

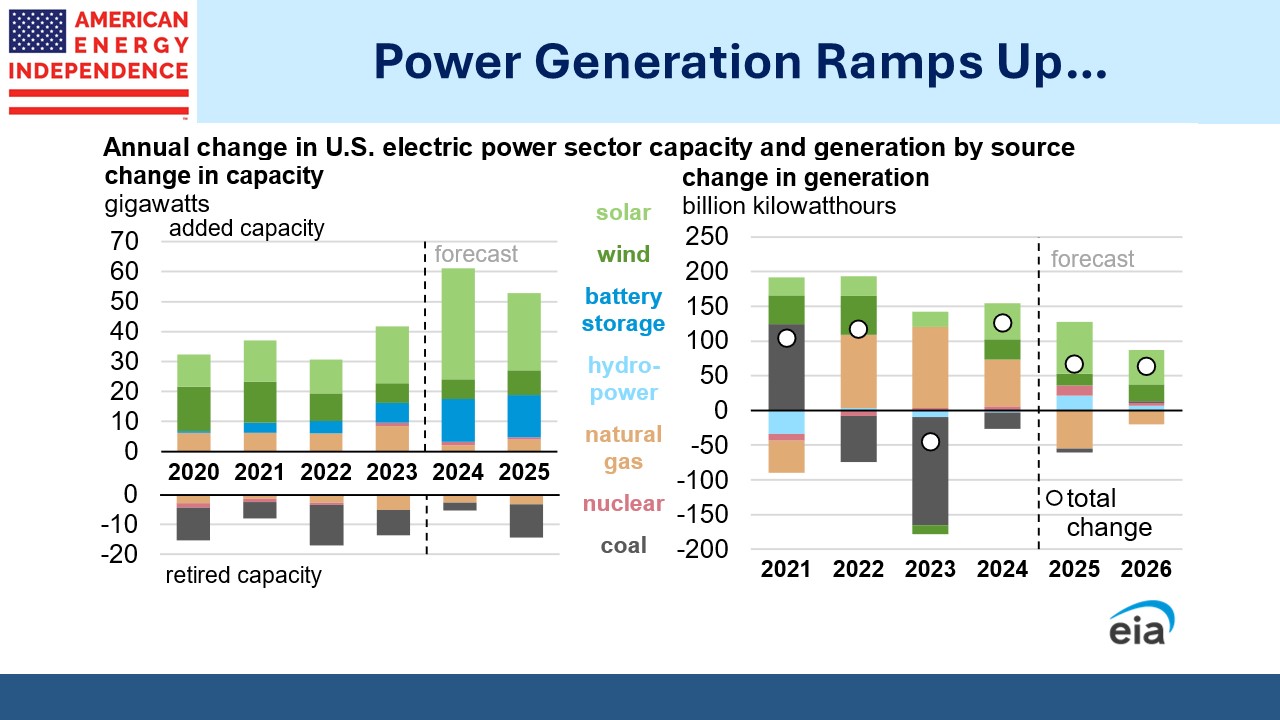

Renewables’ advocates typically promote added generation capacity as evidence of the energy transition to solar and wind, although as we regularly note the real transition is to natural gas. Last year, the US added 50 gigawatts of solar and wind capacity, which produced an additional 50 billion kilowatt hours.

Adjusting for the different orders of magnitude, and assuming the new capacity came online smoothly during the year (i.e., was available for half the year on average), capacity utilization comes to around 28%. That’s less than a third the uptime of natural gas power plants, which are also needed to compensate for the absence of solar and wind during dark and windless conditions (wonderfully named Dunkelflaute in German). We also added 10 gigawatts of battery storage.

Nobody knows if this was money well spent necessarily, but we did use less coal, which was unambiguously good because it’s the highest emitter of greenhouse gas emissions per unit of energy output.

(Click on image to enlarge)

The EIA STEO is forecasting that natural gas derived power generation will drop by 55 TwHs this year, even while total demand will rise by around 70 TwHs. They expect increased solar power to approximately equal the new demand.

We think that’s an unreasonably pessimistic natural gas forecast. Natural gas has been gaining market share over the past decade, rising from 28% in 2014 to 42.5% last year. Over that time, it’s captured more than half of the incremental demand, and the rise in 2024 totaled to 76%.

We know data centers are driving the increase in power demand, and that they need reliable power that’s not dependent on the weather. Midstream companies such as Williams report high levels of interest in “behind the meter” arrangements by which a data center contracts directly with a gas supplier to supply a dedicated power plant. This bypasses the grid and can offer a faster solution.

(Click on image to enlarge)

The US Department of Energy thinks AI could consume up to 12% of all US power generation within the next three years. Energy consulting firm Enervus thinks as many as 80 new gas power plants could be added by 2030, representing 46GW of new capacity. This is almost 20% more than was added over the past five years.

So, a forecast that the share of US electricity generated from natural gas will decline this year seems to overlook what we know is happening with AI, and the clear commitment of the incoming Trump administration to favor domestic hydrocarbon production.

The STEO forecasts that LNG exports will reach 16 Billion Cubic Feet per Day (BCF/D) by 2026, up from 12 BCF/D last year. Pipeline exports will also grow, by 1.4 BCF/D as flows to Mexico increase.

(Click on image to enlarge)

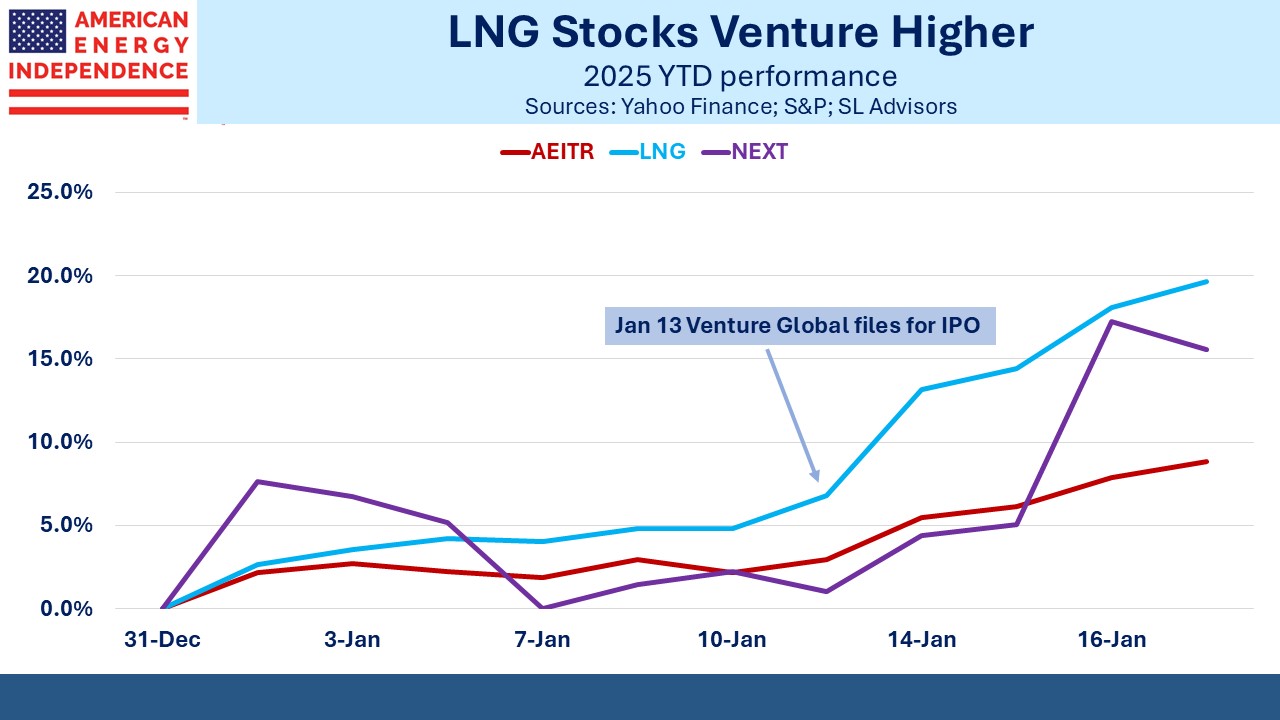

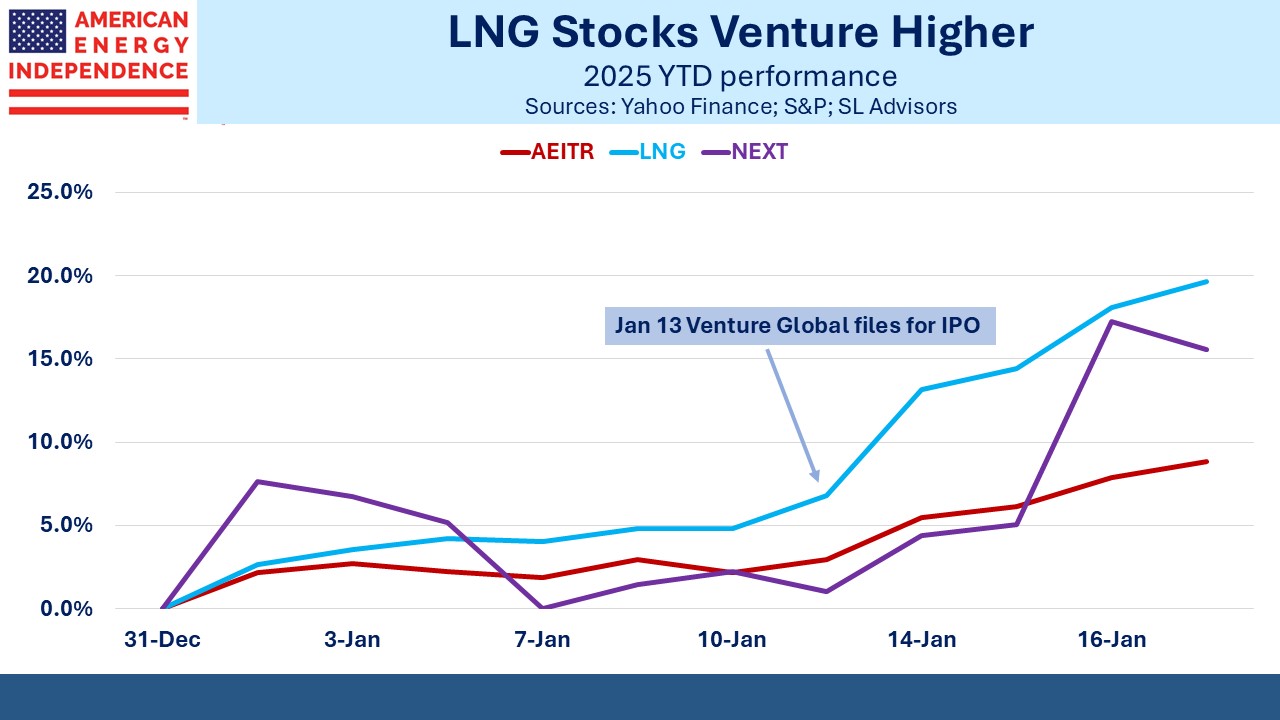

The LNG story received a boost from Trump’s November victory since it assured that the permit pause announced a year ago would be lifted. LNG terminals represent best-in-class energy infrastructure assets since they have 20-30 year contracts, providing unprecedented cash flow visibility.

Privately held Venture Global, which operates the Calcasieu Pass and Plaquemines LNG export terminals, is planning an IPO that could value the company at over $100 billion. The pricing looks a little ambitious to us, but it has drawn attention to publicly traded LNG companies Cheniere and NextDecade, whose comparatively cheap valuations have drawn in new buyers. Both stocks have rallied strongly since Venture Global announced its IPO.

US LNG remains one of the most attractive sectors, in our opinion. Cheap US natural gas and a president who wants energy dominance is a powerful combination. We think the return potential from LNG is not yet fully recognized by the market.

Two funds that seek to profit from this environment include the following:

- Catalyst Energy Infrastructure (MLXAX)

- Pacer American Energy Independence ETF (USAI)

More By This Author:

Economists Having Fun With InflationNatural Gas Is The SolutionThe Climate Benefits Of LNG

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their ...

more

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

less

How did you like this article? Let us know so we can better customize your reading experience.