Image Source: Pixabay

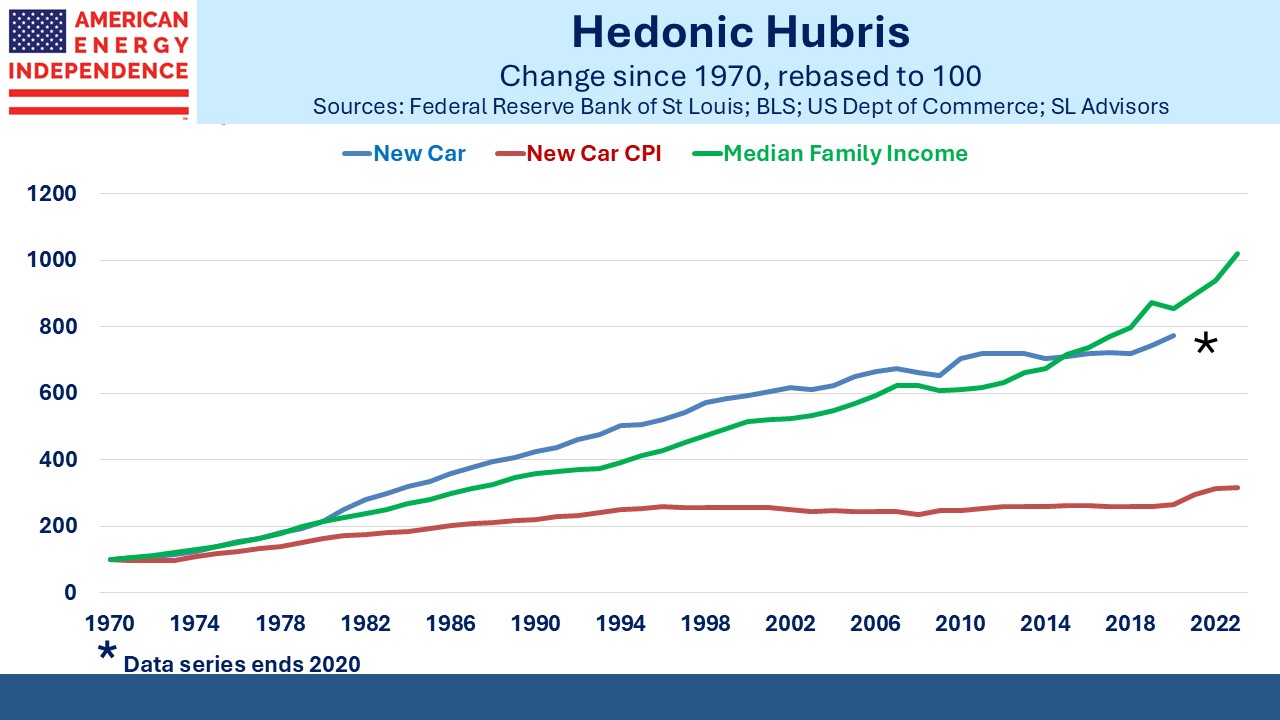

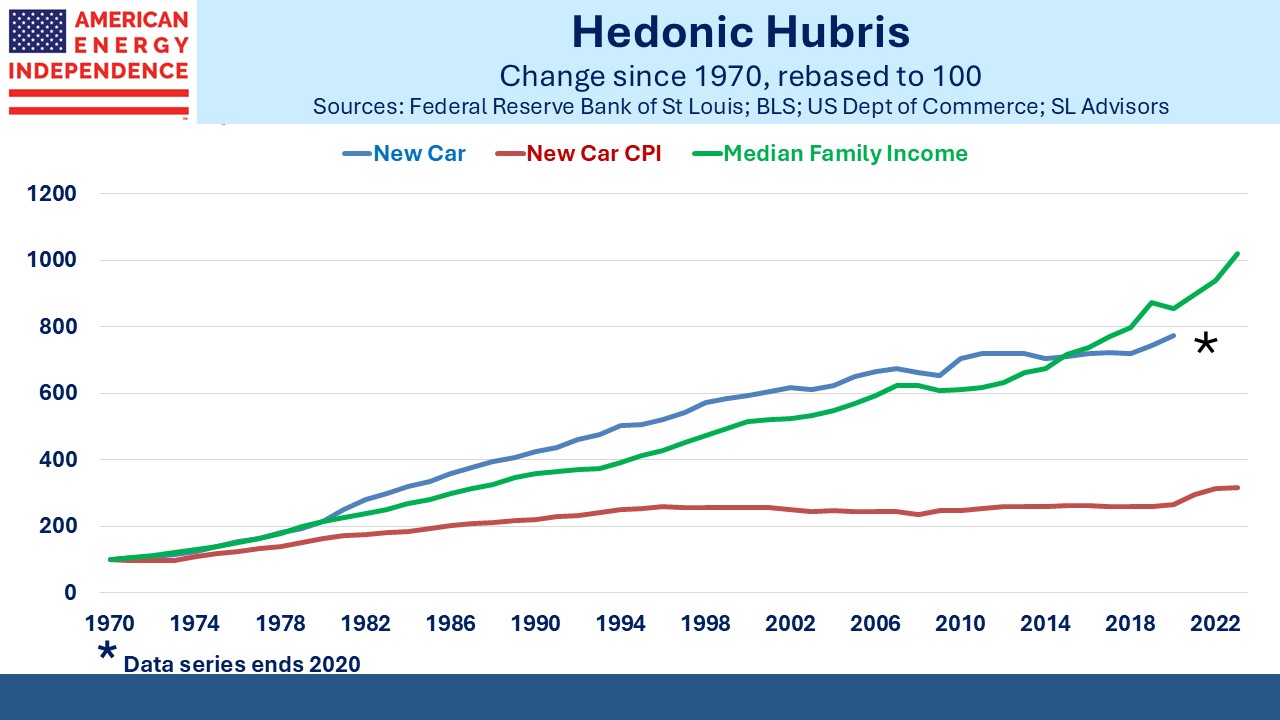

The other day I read a tweet complaining that since 1971 household family income had increased 5.5X (from $10K to $55K) while the median cost of a new car has gone up by 12X ($4K to $48K). It’s not quite correct. Median family income has risen to $101K, so has almost kept up. But it did remind me that car price inflation as calculated by the Bureau of Labor Statistics (BLS) has substantially lagged car prices. Car CPI has averaged 2.2% since 1970, resulting in a mere tripling and far less than actual prices.

The reason is what the BLS calls hedonic quality adjustments – not to be confused with hedonistic, although indulging in the latter might help consumers accept the result of the former.

The CPI is calculated on the basis of a basket of goods and services of constant utility. This last phrase is critical, because it means that any improvement in a product or service that provides increased utility gives you more for your money – in other words, a price cut. CPI seeks to keep this constant.

(Click on image to enlarge)

It’s a concept only familiar to economists, and we have written about it before (see Why Inflation Isn’t What You Think). Non-BLS economists – which is to say, most of us – think about how much more a new car costs than it did last year. Or an iphone, flight or house. We don’t think of improved quality as a theoretical price cut.

Economists around the world love hedonic quality adjustments. In their tribe this is not a controversial topic. However, I am increasingly convinced that their application is uneven, unintuitive to users of inflation statistics and not helpful to anyone interested in maintaining their standard of living.

In 2013 I wrote about airfares (Why Flying is Getting More Expensive) and noted that the only quality adjustment the BLS had made was to factor in easier cancellation terms as an implicit price reduction. Since then, few would dispute that flying coach has become a degrading experience with less legroom, no meals and a general feeling of being cargo rather than people. The BLS never makes adjustments for a decrease in quality, even though it’s certainly the case with flying. And I’d suggest that regular travelers to New York City on NJ Transit could identify another form of transportation where quality has dropped.

What’s the hedonic quality adjustment for regular delays?

The other problem with these adjustments is that they’re applied to indivisible objects. For example, if an improved car provides you with greater utility, what exactly can you do with the excess? Today’s new car provides more utility whether you like it or not. You can’t take the extra and apply it somewhere else. You’re unlikely to conclude that increased utility in one purchase allows you to accept reduced utility in another, such as an airplane ticket. Only BLS economists think like that.

From 2019-21 during the pandemic, household incomes rose 3%, lagging new car prices (+14%) along with most other things. Voters remembered in November.

But the real mistake lies in thinking that keeping up with inflation means keeping up with the neighbors. Social security payments are linked to CPI, but that just means slipping to a lower percentile of income over time. It’s even more important for anyone planning retirement in a decade or two. Assuming that today’s household expenses will increase at inflation so their savings only need to keep up will turn out to be inadequate.

A more realistic goal is to target median family income. That has increased by 4.4% pa over the past decade, versus CPI at 2.8%. $100K in household expenses in 2013 required $154K in 2023 to maintain its purchasing power relative to the median. If it grew at the CPI the family would have $131K and would have fallen behind their peers of a decade earlier.

The median family income has roughly kept track with car prices over the past fifty years, which has enabled car prices to increase well ahead of car price inflation. It simply shows that car price inflation as calculated by the BLS isn’t a very useful figure. For savers this applies to inflation statistics more generally.

So make your new year’s resolution to grow your savings at a more appropriate rate. We will naturally suggest that midstream energy infrastructure has a better chance than most investments of delivering.

And if this New Year’s Day discussion of hedonic BLS weaknesses is challenging your foggy brain, I hope you can blame it on excessive hedonism the night before.

We have two have funds that seek to profit from this environment:

Catalyst Energy Infrastructure Fund (MLXIX, MLXCX, MLXAX)

Pacer American Energy Independence ETF (USAI)

More By This Author:

Natural Gas Is The Solution

The Climate Benefits Of LNG

Energy Lifts Poor Countries Up

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their ...

more

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

less

How did you like this article? Let us know so we can better customize your reading experience.