Foreign Developed-Market Stocks Led Asset Classes Last Week

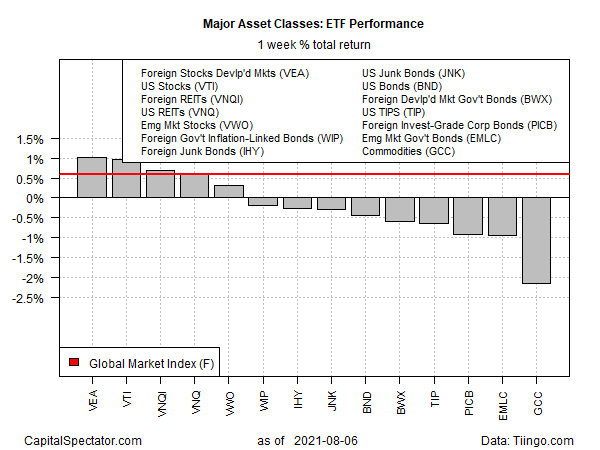

Shares in developed markets ex-US topped returns for the major asset classes last week, based on a set of exchange-traded funds. Overall, it was a mixed week with a wide range of gains and losses.

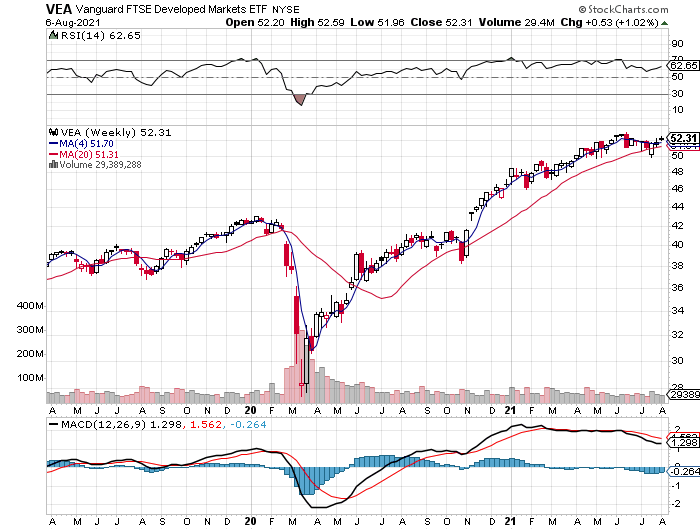

The strongest gainer: Vanguard FTSE Developed Markets (VEA) rallied 1.0% in the trading week through Friday, Aug. 6. The rise marks the third straight weekly advance, lifting the fund close to a record high.

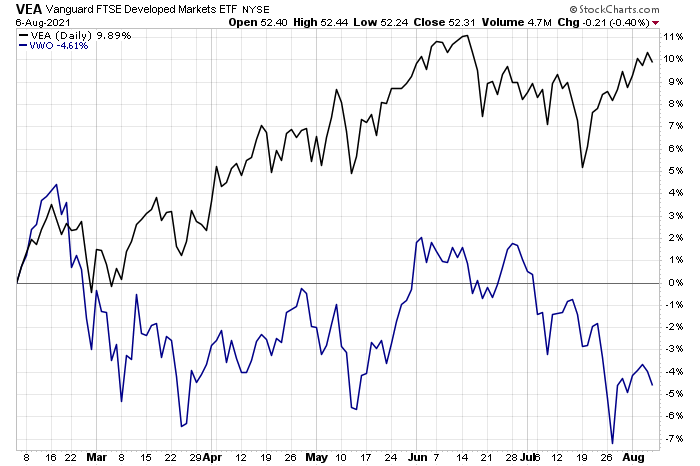

Within the equities ex-US space, VEA’s recent upside trending behavior stands in sharp relief vs. emerging markets. Over the past six months, VEA is up roughly 10% vs. a near 5% loss for Vanguard FTSE Emerging Markets (VWO) over that span.

The biggest loser last week: broadly defined commodities. WisdomTree Continuous Commodity (GCC), which equal weights a diversified mix of commodities, tumbled 2.2%. The slide marks the first weekly loss for the ETF in four weeks.

An ETF-based version of the Global Market Index (GMI.F) rose 0.6%. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights via ETF proxies.

For the one-year window, US stocks continue to lead – by a hair. Vanguard Total US Stock Market (VTI) is up a stellar 36.9% on a total-return basis over the past 12 months. That’s fractionally ahead of the second-best one-year performer: Vanguard US Real Estate (VNQ), which is up 36.5% over the past year.

US investment-grade bonds (BND), along with foreign developed-market government bonds (BWX), are the only one-year losers at the moment for the major asset classes. The ETFs are down 1.5% and 1.2%, respectively, for the trailing 12-month window.

GMI.F’s one-year gain is a strong 23.9%.

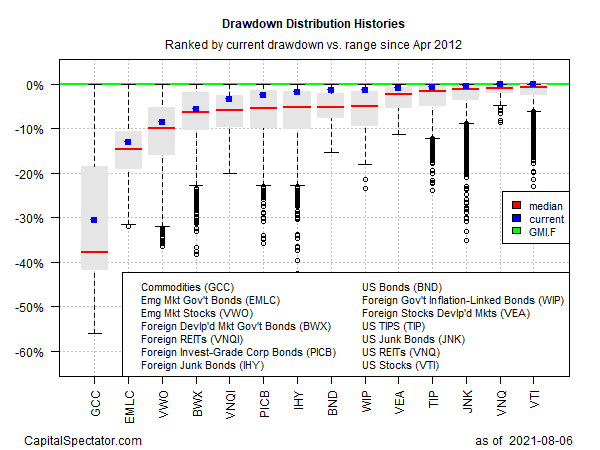

Ranking the major asset classes with current drawdown still shows that most of our proxy ETFs currently enjoy peak-to-trough declines of no more than -5%. US stocks (VTI) are the current leader for this metric with a 0% peak-to-trough decline as of Friday’s close. Meanwhile, commodities (GCC) are posting the deepest drawdown: slightly deeper than -30%.

GMI.F’s current drawdown is a slight -0.2%.

Disclosures: None.