Fading U.S. Inflation Keeps The Fed On The Path Of Rate Cuts

Inflation is on track to hit the 2% target early next year with the latest PCE deflator print giving the green light to a September rate cut. However, consumer spending remains very robust and this may make the Fed reluctant to move aggressively. Nonetheless, a soft jobs report on 6 September could still tip the odds in favour of a 50bp rate cut.

Image Source: Pexels

Inflation is on the path to 2%

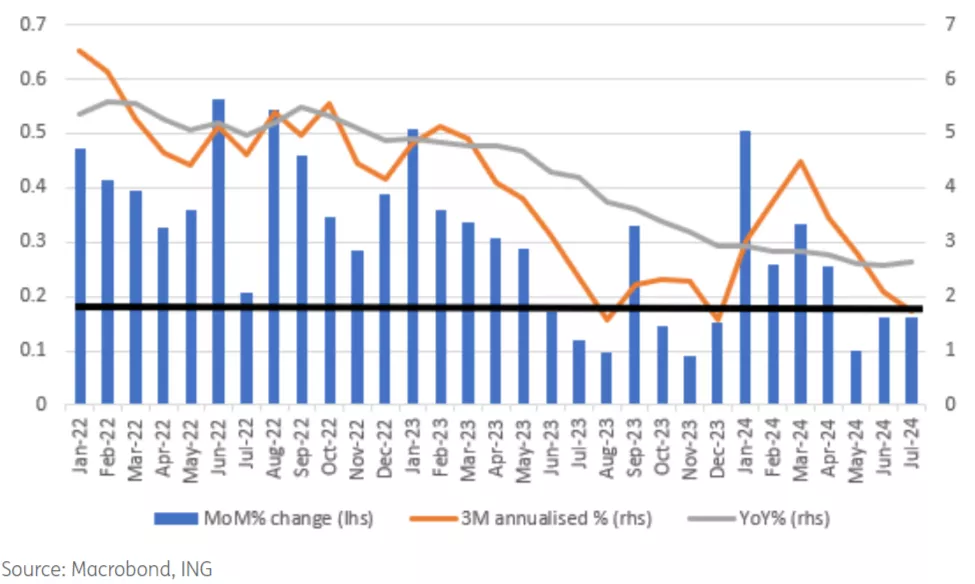

The Fed's favoured inflation measure, the core PCE deflator, has come in at 0.2% month-on-month, as expected, but the year-on-year remains at 2.6% rather than rise to 2.7% as the consensus predicted. To three decimal places it was 0.161% MoM so a very "good" 0.2% that keeps us on the correct run-rate to get annual inflation to 2% by early next year. A 0.17% MoM each month for twelve months would get us to the 2% YoY target and we have now had three consecutive prints that are below that with the 3M annualised rate now below 2%.

Core personal consumer expenditure deflator metrics

Spending is strong, but income growth remains weak

Elsewhere within the report real consumer spending rose 0.4% MoM versus the 0.3% expectation while there were upward revisions to April, May and June. It is a much stronger path than previously reported and means that even if we get "just" 0.1% MoM real spending prints for August and September we are looking at real consumer spending of 3.4% annualised within the third quarter GDP report. That strength, I suspect, would make the Fed very reluctant to cut 50bp on 18 September.

The income side is weak though. Real household disposable income rose just 0.1% MoM, the same as in June, raising the question – where is the money coming from to finance this spending? The obvious answer is that we are running down our savings and using debt. That is not sustainable so are we burning ourselves out? Well, the savings rate has dropped to just 2.9%. The only time we have ever been down here consistently is just ahead of the Great Financial Crisis. That suggests if unemployment does continue to climb there is less buffer to support consumer activity.

Personal savings rate (%)

A September rate cut is assured but the jobs report will determine the magnitude

Our most recent forecast update round coincided with the market volatility at the beginning of August and we changed our three 25bp rate cut call for this year to one whereby the Fed could cut by 50bp in September before reverting back to 25bp moves in November and December with the policy rate reaching 3.5% by summer 2025. The 50bp call perhaps looks a little aggressive now, but the coming week will be critical in determining what the Fed will do on 18 September.

The jobs report is the clear focus next week after recent weakness and downward revisions to payrolls. If we get a sub 100k on payrolls and the unemployment rate ticks up to 4.4% or even 4.5% then 50bp looks likely given Powell’s comment that “we don’t seek or welcome further cooling in labour market conditions”. However, if payrolls comes in around the 150k mark and unemployment rate stays at 4.3% or dips to 4.2%, as the consensus is currently predicting, we can safely say it will be a 25bp.

More By This Author:

Asia Week Ahead: Falls In Inflation In Many Economies Could Help To Speed Up Rate CutsBank Of Canada: Three In A Row With 3% Rates Targeted

Italian inflation Falls slightly

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more