Asia Week Ahead: Falls In Inflation In Many Economies Could Help To Speed Up Rate Cuts

Image Source: Pixabay

Inflation dominates the Asian calendar, with declines expected in many economies.

Philippines: Inflation should drop to 3.3%

Even though there is no evidence yet that the July tariff cuts have had much impact on consumer rice prices, the absence of any further increases should be enough to deliver a substantial decline in inflation in August. We calculate that overall prices remained flat from last month, with non-rice food prices a slight drag offsetting some increases elsewhere. We don’t expect a repeat of the housing-related increase last month. The net result will be inflation dropping from 4.4% to just 3.3% YoY. We should see further falls in inflation next month. The BSP made a brave decision to cut rates last month ahead of the US Fed, and these data should enable them to cut rates again soon without imperilling the PHP.

North Asia: Inflation falls likely

The August CPI inflation print is the most anticipated Korean data for the week ahead. With a high base last year, headline inflation should ease below 2% for the first time since March 2021. Food prices are likely to add upward pressures but will be partially offset by falling gasoline prices. Getting inflation back below 2% raises the likelihood of a BoK rate cut in October.

Taiwan releases its CPI and PPI inflation data on Thursday. We are looking for CPI inflation to pull back a little bit in August from July’s 2.5% YoY read, forecasting 2.2% YoY. Barring a major surprise in the data, this month’s inflation read should not have much of an impact on the CBC’s rate decision in September, where we are looking for no change.

Indonesia: Small inflation uptick

NowCasts of Indonesia’s August inflation show it rising sharply from 2.1% in July to around 2.6%. However, we are hedging our bets a bit as they have been tracking a little wide recently and think a much smaller 2.2% YoY uptick is more probable. Bank Indonesia will probably wait for the Fed to start cutting before it conducts any of its own easing. However, the local inflation situation looks to be well under control.

Australia: 2Q24 GDP could come in flat QoQ

2Q24 GDP is the big release for Australia this week, and it should add to the sense that the economy is cooling and that the RBA will not need to tighten any further. That said, it may not add much to the already strained argument for a rate cut before the end of this year, which the market is still pricing (we think it will not happen until 1Q25). We anticipate some sizeable swings in the components of GDP. For example, the big drag from net exports in 1Q24 will likely diminish to almost nothing in 2Q24, but we will see a similar and offsetting reduction in inventories. A slightly stronger contribution from private consumption will probably be absorbed by a weaker net investment figure, though there may be some lift from the government sector. We think that could lead GDP to come in flat from the previous quarter and the year-on-year growth rate to decline to 0.6%YoY.

PMIs likely flat to down across the region

The National Bureau of Statistics publishes China’s official PMI data on Saturday. We expect the August PMI to remain broadly stable, with a slight downturn from 49.4 to 49.3. Manufacturing momentum has waned slightly in the last few months due to a downturn in auto production. The Caixin PMI is also scheduled for release on the coming Wednesday.

With strong global demand for Korean products, the Korean manufacturing PMI should stay above the 50 level. However, momentum could moderate, and we expect the PMI to edge down to 51 from the previous 51.4.

South Korea: August trade data

Over the weekend, Korea's customs office will release August trade data. Based on the early trade data, exports should grow solidly by 13.5% YoY in August. The most notable gain should come from semiconductors, while cars, vessels, and petroleum exports should rise strongly as well.

Japan: Improvements seen in data are proof of a recovering economy

Japan releases capital spending, labour earnings, and household spending data, all of which will show a recovery in the economy. Capital spending should improve in 2Q24 to 10% YoY (vs 6.8% in 1Q24) as investments in transportation and IT sectors increase. We also expect labour cash earnings and household spending to improve in July. Real cash earnings will record a second monthly rise. This should boost household spending. These outcomes will support the BoJ’s policy normalization efforts.

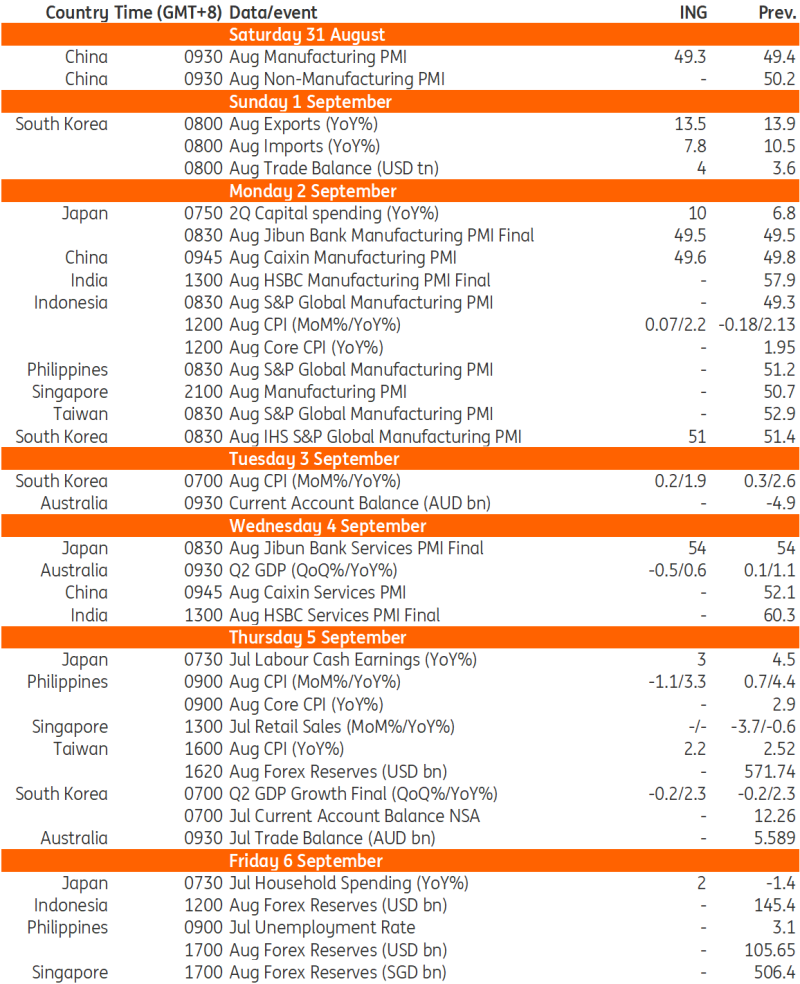

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Bank Of Canada: Three In A Row With 3% Rates TargetedItalian inflation Falls slightly

Polish CPI Up In August But Core Inflation Is Stable

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more