EUR/USD Outlook: Euro Gains As ECB Maintains Hawkish Stance

Friday’s EUR/USD outlook is bullish as the currency rallied, propelled by the European Central Bank’s unwavering commitment to a hawkish stance. In a surprising twist on Thursday, the ECB deviated from anticipated rate cuts. Moreover, policymakers restated their commitment to fighting inflation, contributing to the strengthening of the currency.

However, investor expectations remain unaltered despite this stance, with rate cuts still priced in for next year. Pepperstone’s Weston suggested that the ECB is better positioned to cut rates given low growth and a rapid decline in inflation.

Meanwhile, there is more clarity on the timing of potential US interest rate cuts. Federal Reserve Chair Jerome Powell signaled on Wednesday that the era of tightening monetary policy is likely over. Additionally, discussions about cuts are now coming “into view.” Consequently, there was a decline in the dollar, with the dollar index hovering close to the four-month low on Thursday. The dollar has fallen by nearly 2% and is heading for its most substantial weekly drop since July.

Furthermore, the anticipated Fed cuts for 2024 have been brought forward, with a growing number of investors now expecting cuts to start around March. Markets are currently pricing in a 75% likelihood of a rate cut by the Fed in March.

EUR/USD key events today

- German Flash Manufacturing PMI

- German Flash Services PMI

- US Empire State Manufacturing Index

- US Flash Manufacturing PMI

- US Flash Services PMI

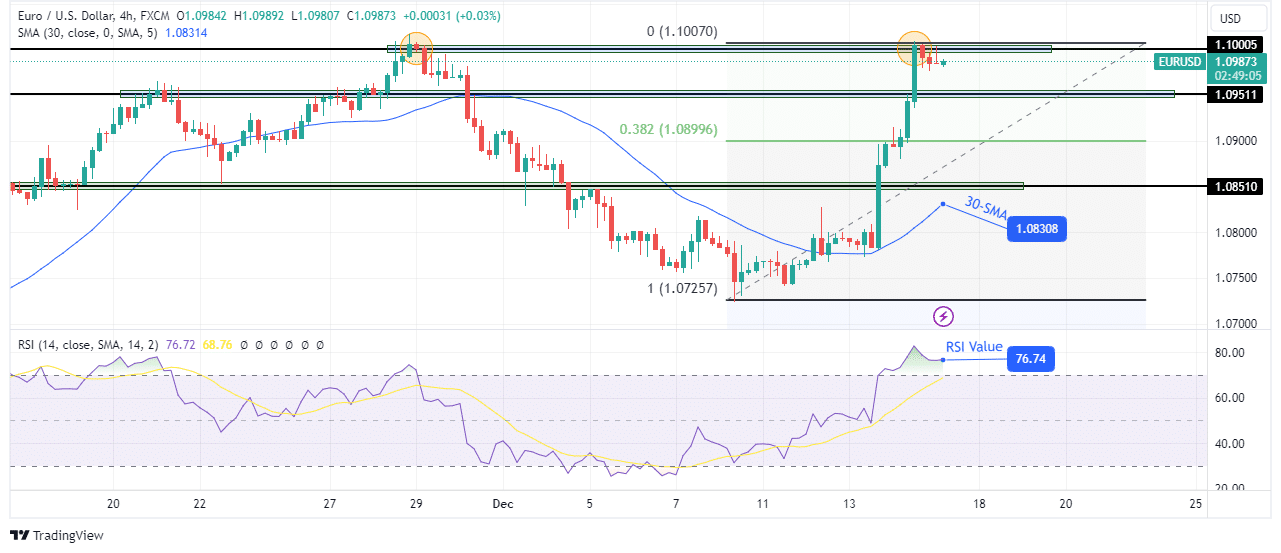

EUR/USD technical outlook: Bulls encounter historical reversal zone

(Click on image to enlarge)

EUR/USD 4-hour chart

The bullish bias for EUR/USD is strong, as the price has risen sharply to the 1.1000 key resistance level. Consequently, it trades far above the 30-SMA, showing a steep bullish move. Moreover, the RSI is in the overbought region, an extreme for bullish momentum. The bulls were strong enough to break above multiple resistance levels without pause.

However, they are currently facing a level that has led to a previous reversal in the trend. Therefore, the price might start falling from the 1.1000 key level to retest lower support levels. The pullback might drop to the 0.382 Fib retracement level before the uptrend continues.

More By This Author:

Gold Price Rallies Above $2,000 After Dovish FOMC

USD/JPY Price Stalls Below 146.0, Focus Shifts On FOMC

GBP/USD Price Analysis: Pound Dives as UK GDP Contracts

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more