USD/JPY Price Stalls Below 146.0, Focus Shifts On FOMC

The USD/JPY price ended its minor retreat and is now fighting hard to post a meaningful recovery. The pair is trading at 145.81 at the time of writing, far above yesterday’s low of 144.72.

Fundamentally, the greenback seems determined to take full control as the US reported higher inflation in November. The Consumer Price Index registered a 0.1% growth versus the 0.0% growth estimated, while Core CPI announced a 0.3% growth, matching expectations.

Today, the Japanese Tankan Manufacturing Index and Tankan Non-Manufacturing Index came in better than expected, but the JPY remains sluggish in the short term.

Later, the US will release the PPI, which is expected to report a 0.0% growth after the 0.5% drop in the previous reporting period, and the Core PPI indicator.

Still, the week’s most important event is the FOMC rate decision. The Fed is expected to keep the Federal Funds Rate at 5.50%.

Still, the FOMC Economic Projections, FOMC Statement, and FOMC Press Conference represent high-impact events. A hawkish speech on higher inflation in the US could boost the greenback.

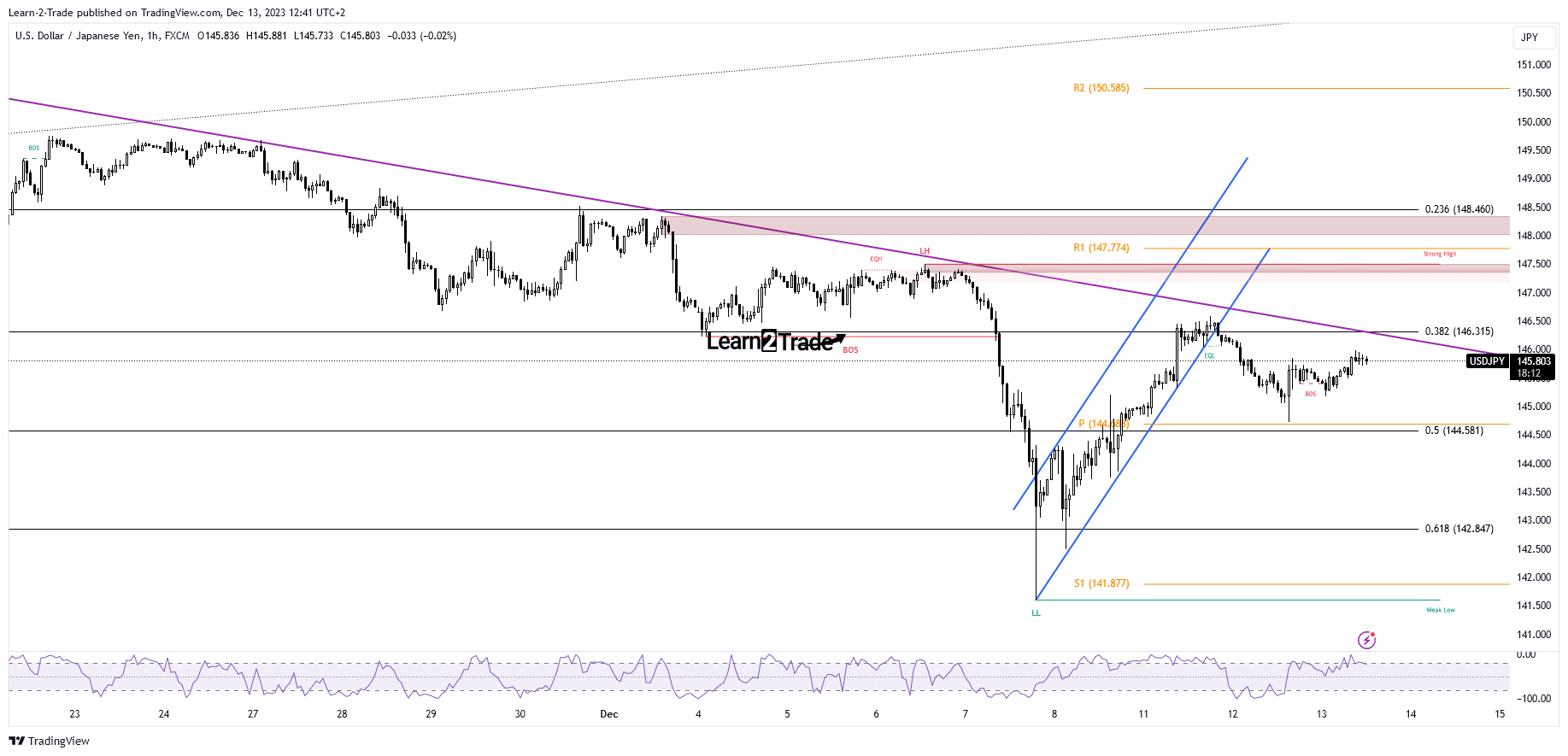

USD/JPY Price Technical Analysis: Near Key Resistance

USD/JPY 1-hour chart

Technically, the currency pair rebounded within an up-channel pattern. It has failed to reach the downtrend line. Now it has escaped from this chart formation. The price failed to stay above the 38.2% (146.31) retracement level, signaling exhausted buyers.

Now, it has turned to the upside after registering only a false breakdown with great separation below the 145.00 psychological level. Still, the price could drop again if it stays below the downtrend line. Only taking out this dynamic resistance may announce a larger growth. On the other hand, a broader downside movement could be triggered by a new lower low.

More By This Author:

GBP/USD Price Analysis: Pound Dives as UK GDP ContractsUSD/CAD Forecast: Dollar Recovers Ahead of Fed Rates

USD/CAD Outlook: Struggling Under 1.36 Amid Surging Oil Prices

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more