Gold Price Rallies Above $2,000 After Dovish FOMC

The gold price turned upside after pausing at yesterday’s low of $1,973. The precious metal has climbed as high as $2,040 today.

Now, it has retreated a little and is trading at 2,035 at the time of writing. XAU/USD edged higher as the USD depreciated versus its rivals after the FOMC.

The US dollar plummeted after the Federal Funds Rate, FOMC Statement, and FOMC Economic Projections were published. However, the FOMC Press Conference was decisive, punishing the greenback. The FED announced a potential 75 bps cut in 2024.

Today, the fundamentals should move the rate again. As expected, the SNB left the monetary policy unchanged. The SNB Policy Rate remained at 1.75%.

Later, the Bank of England is expected to keep the Official Bank Rate at 5.25%, but the Monetary Policy Summary and MPC Official Bank Rate Votes could have an impact.

In addition, the ECB should maintain the monetary policy. Only the ECB Press Conference could change the sentiment.

Also, don’t forget that the US will release the retail sales data. The Retail Sales and Core Retail Sales indicators could announce a 0.1% drop, while Unemployment Claims could be reported at 219K in the last week.

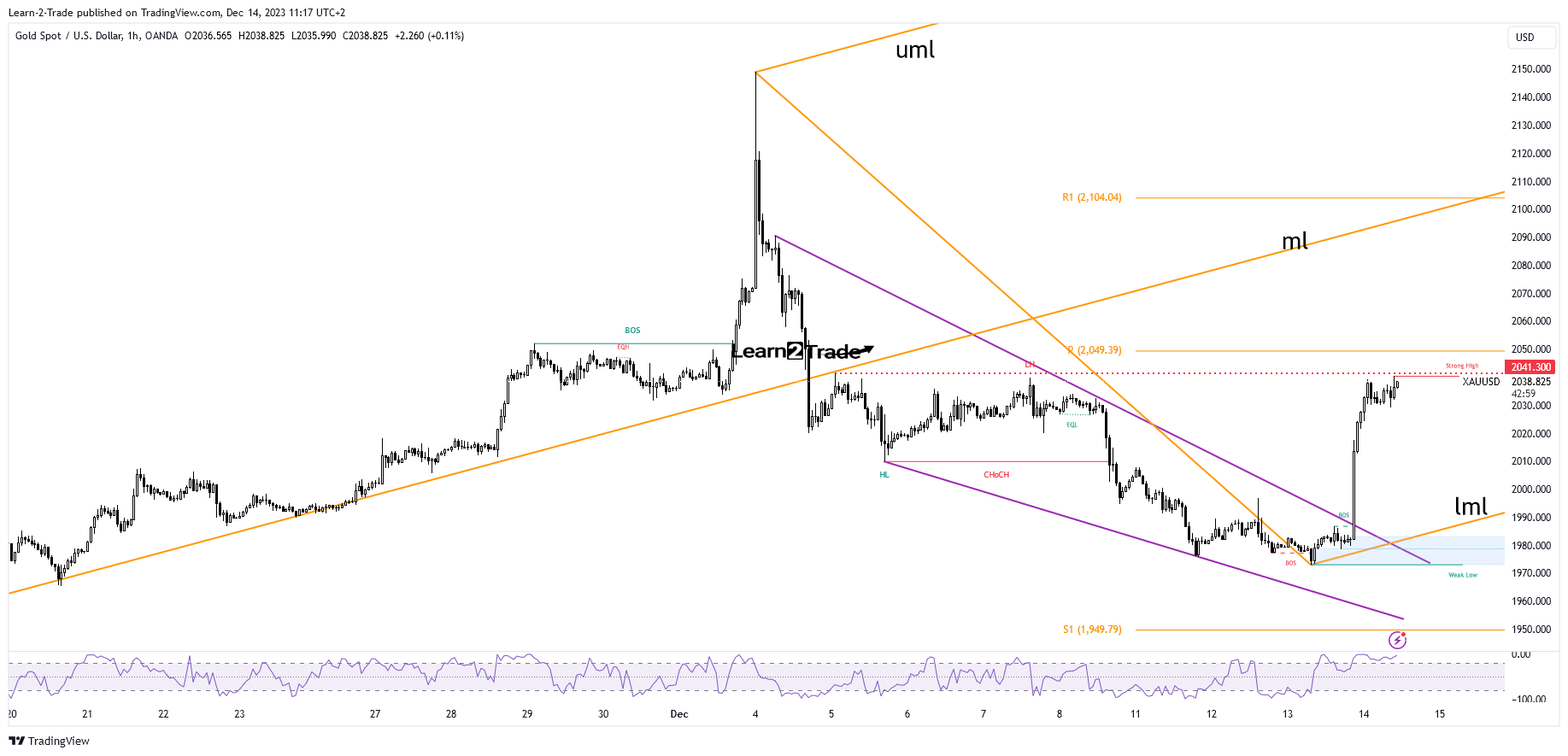

Gold Price Technical Analysis: 2,041 Static Resistance

(Click on image to enlarge)

Gold 1-hour chart

Technically, the XAU/USD rallied after breaking the Falling Wedge pattern. The price action revealed exhausted sellers.

Now, it was almost at the former high of $2,041. This stands as a static resistance. It remains to see how it reacts around it, as false breakouts may result in a new sell-off in the short term.

The weekly pivot point of $2,049 also represents an important upside obstacle. I’ve drawn an ascending pitchfork where the median line (ml) is seen as a major target if the rate continues to grow. The XAU/USD validates more gains by taking out the immediate resistance levels.

More By This Author:

USD/JPY Price Stalls Below 146.0, Focus Shifts On FOMC

GBP/USD Price Analysis: Pound Dives as UK GDP Contracts

USD/CAD Forecast: Dollar Recovers Ahead of Fed Rates

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more