GBP/USD Price Analysis: Pound Dives As UK GDP Contracts

Wednesday witnessed a stronger bearish GBP/USD price analysis, as the British pound took a hit following the revelation of a 0.3% contraction in the UK economy in October. This downturn raises the possibility of the Bank of England contemplating an earlier interest rate cut.

Notably, the pound has climbed by approximately 3.8% against the dollar this year, its strongest annual performance since 2019. The surge came from the anticipation that the Bank of England may delay rate cuts compared to other central banks.

Meanwhile, Tuesday saw the pound grappling for direction as US inflation slowed in November and British wage growth cooled in October. US consumer prices showed a 3.1% year-on-year increase at the end of November, slightly lower than October’s 3.2%.

Still, in the European morning session, the pound dipped following data indicating a 7.3% year-on-year increase in British earnings excluding bonuses for the three months to October, down from 7.8% in September. Meanwhile, analysts had expected a decline to 7.4%.

The recent data introduces the possibility of a shift in the stance of the three hawks who voted for a hike in November. Chris Turner from ING noted the risk of them now favoring a hold. Economists and traders anticipate a likely 5.25% interest rate hold. However, they will listen attentively for indications of potential future rate cuts. Simultaneously, the Federal Reserve is scheduled to announce interest rates on Wednesday.

GBP/USD key events today

- US Producer inflation

- FOMC policy meeting

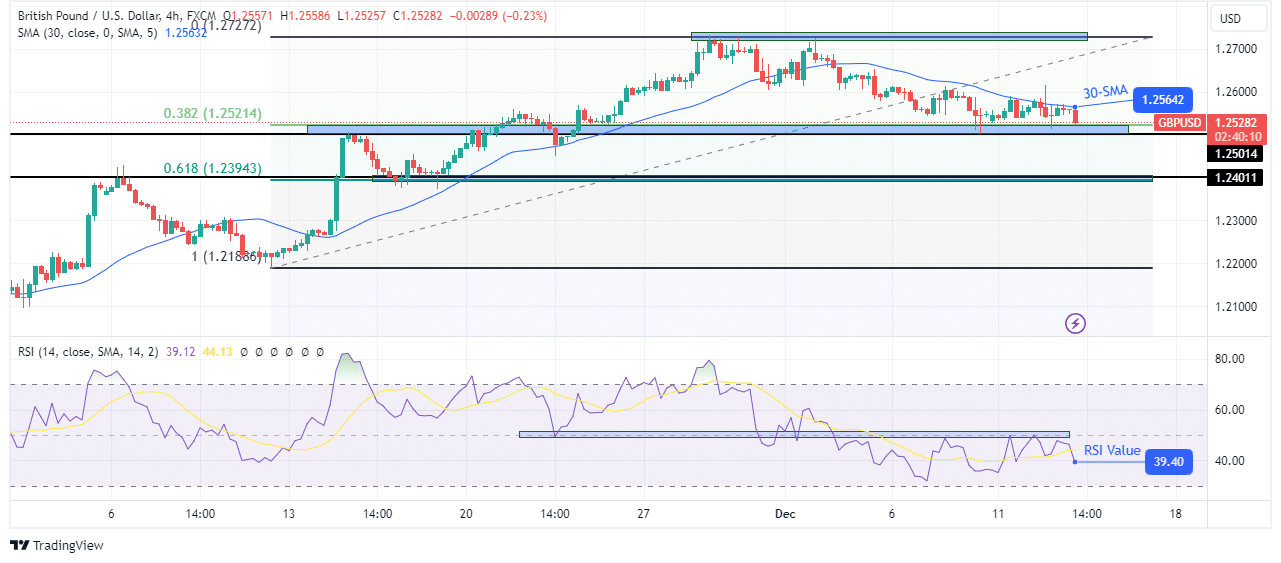

GBP/USD technical price analysis: Bears challenge 0.382 fib level

(Click on image to enlarge)

GBP/USD 4-hour chart

The pound is pushing lower after respecting the 30-SMA resistance. The downtrend had paused after the price got to the 0.382 fib level. However, the bearish bias is strong since bears have kept the price below the 30-SMA. Moreover, the RSI has stayed below the 50 mark, supporting bearish momentum.

At the moment, bears are retesting the support at the fib level. Soon, the price will likely break below this and the 1.2501 support level to continue the downtrend. The next support zone is at the 0.618 fib and 1.2401 key levels.

More By This Author:

USD/CAD Forecast: Dollar Recovers Ahead of Fed RatesUSD/CAD Outlook: Struggling Under 1.36 Amid Surging Oil Prices

GBP/USD Price Recovers From US NFP-Led Losses

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more