Equity Indices Itching To Move Higher N/T

Unlike its large-cap cousins such as the S&P 500 and the Nasdaq 100, the Russell 2000 gained last week. It is too early to read too much into this. But odds favor strength in all these indices in the sessions ahead – if nothing else just to unwind short-term oversold technical conditions.

(Click on image to enlarge)

Last week – a holiday-shortened week – the Russell 2000 rallied 1.1 percent. In contrast, the S&P 500 was down 0.5 percent and the tech-heavy Nasdaq 100 down 0.7 percent.

Last week contained two trading sessions each from this year and last. Small-cap bulls would like to argue that this is a sign of things to come this year, arguing that these stocks are being accumulated as soon as 2025 was rung in. While this may turn out to be the case in the end – regardless small-caps outperform mid- to large-caps on an absolute or relative basis – it is premature to reach that conclusion, as 2025 is two trading sessions old.

That said, the bulls did achieve last November something that eluded them for three whole years. The small cap index peaked in November 2021 at 2459, before dropping all the way to 1641 in June 2022; that low was successfully tested in October of both 2022 (1642) and 2023 (1634). It then rallied all the way to 2300 last July, with 2260s offering stiff resistance from the middle of that month; that level continued to act as a hurdle until November 6 when markets celebrated President-elect Donald Trump’s win in the election held on the 5th. Come November 25, the Russell 2000 eked out a new intraday high of 2466 but only to then run out of steam and reverse lower, going on to lose 2260s last month, which is where the index (2268) closed last Friday. Once this level gets reclaimed – likely – momentum can swing the bulls’ way. Of course, it then becomes a matter of how far they can take this. At 2340s lies trendline resistance from last November’s peak (Chart 1).

(Click on image to enlarge)

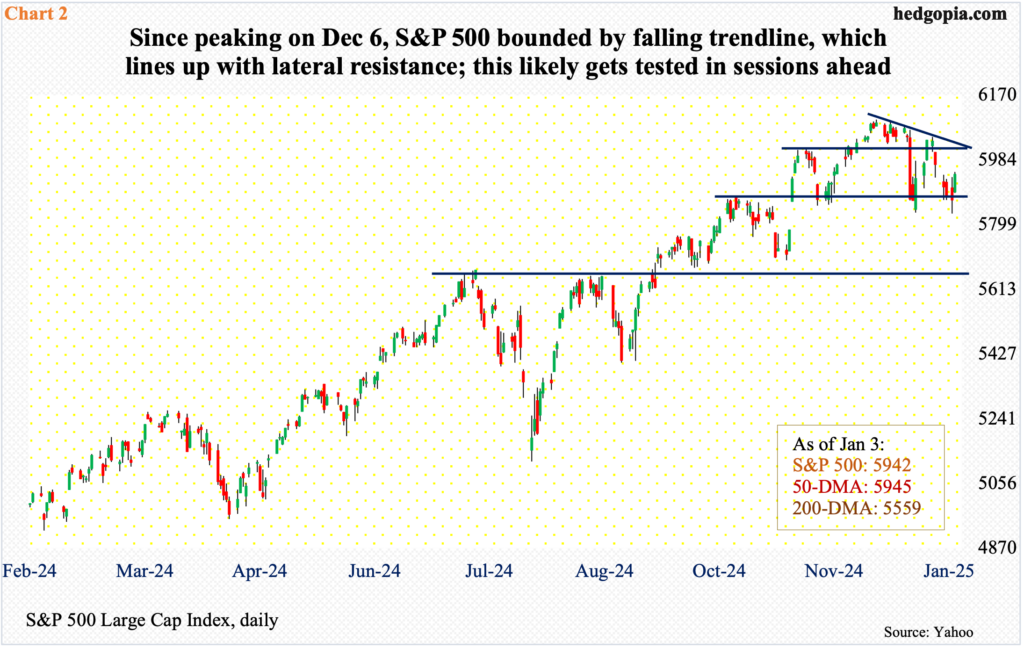

A similar trendline on the S&P 500 lies at 6020s. The index closed last week at 5942. Having defended horizontal support at 5870s twice in the last three weeks, large-cap bulls were able to put their foot down – sort of.

Earlier, the S&P 500 peaked at 6100 on the 6th last month. From that high, rally attempts have progressively stopped at the aforementioned trendline resistance at 6020s, which coincides with a horizontal hurdle (Chart 2). It remains to be seen if large-cap bulls will be able to mop up all the supply that is likely to show up at that price point.

(Click on image to enlarge)

Offers are also likely to increase at 21480s on the Nasdaq 100. This level represents trendline resistance from December 16 when the index peaked at 22133. Since that high, it has been trending lower with lower highs (Chart 3).

The good thing from tech bulls’ perspective is that the index remains above crucial horizontal support at 20600s, which was last tested late November last year.

Last Thursday, the 50-day was breached intraday but saved by close, with the index remaining above the average for nearly four months now. Last week, it also reclaimed short-term resistance at 21100s.

All these three indices, on the daily chart, are itching to head higher for now.

More By This Author:

VIX Spike Reversal Last Week Probably Suggests Lower Volatility In Sessions Ahead

CoT - Peek Into Future Through Futures; How Hedge Funds Are Positioned

S&P 500 On Pace For Back-To-Back 20%-Plus Gains

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more