EJ Antoni: Pro-Growth Supply Side Policies Will Support High Stock Prices

Image Source: Pexels

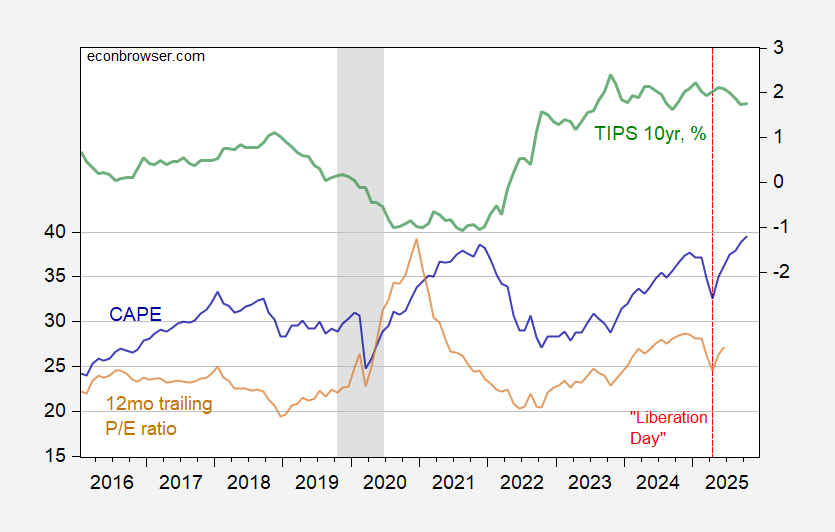

See this clip, at 2:17. Over the longer term, the stock prices should equal the present discounted value of dividends, themselves reflective of earnings and profits. That’s basic finance. That being said, there are over time substantial (apparent) deviations from the PDV of dividends (see Shiller, AER 1981), or big moves in the price-earnings ratio, defined in any way you want (12 month trailing, cyclically-adjusted, 1 year forward), as earnings fail to materialize, or the equity risk premium seemingly changes.

Overall, the cyclically adjusted price-earnings (CAPE) ratio is only slightly higher than the 2021M11 level, in the aggregate. On the other hand, the inflation protected 10 year yield is now a full 2.8 percentage points higher than then!

(Click on image to enlarge)

Figure 1: CAPE (blue, left scale), P/E ratio, 12 mo trailing earnings (tan, left scale), and TIPS 10 yr yield, % (green, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Shiller, Treasury via FRED, NBER, and author’s calculations.

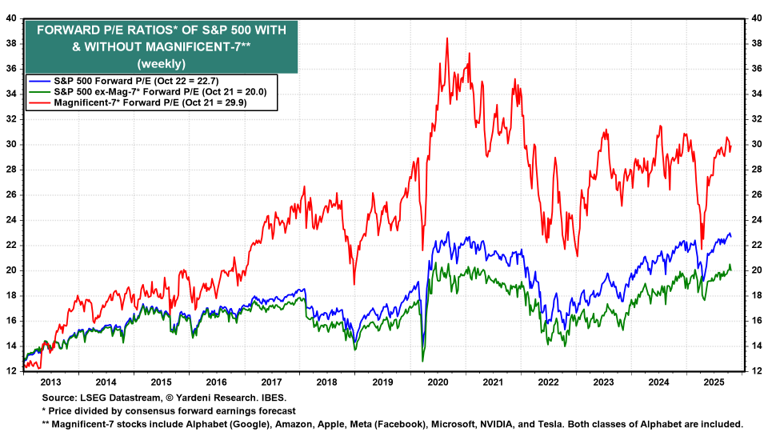

Here are the price-earnings ratios for the Magnificent-7 vs. S&P500 ex-Mag 7.

(Click on image to enlarge)

Source: Yardeni.com.

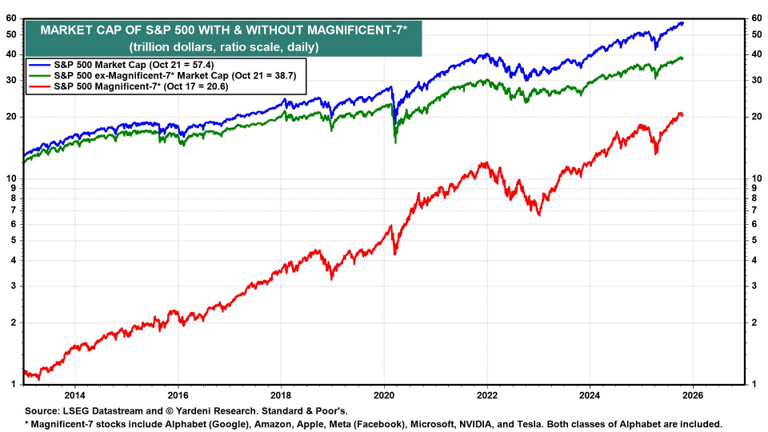

Does it matter that this particular sector seems, to me at least, potentially overvalued given current real interest rates? Well, perhaps, as current capitalization of Mag-7 is 35.9% of the S&P500.

(Click on image to enlarge)

Source: Yardeni.com.

So time will tell. Personally, I think the purportedly pro-growth policies (financial deregulation, dilution of capital requirements) alluded to will increase a likelihood of a “discontinuous change” in asset prices (recall, the 2008 financial crisis followed a period of financial regulatory disarmament, as discussed here).

More By This Author:

CPI Release: Instantaneous Core CPI, Nowcasted Core PCE Up Relative To 2024M12

“The Closing of the American Economy: Implications and Durability”

Imagine No IEEPA Tariffs