CPI Release: Instantaneous Core CPI, Nowcasted Core PCE Up Relative To 2024M12

Image Source: Pexels

Grocery inflation slightly above September ERS forecast for 2025 y/y, furniture prices continue to (technically speaking) zoom up.

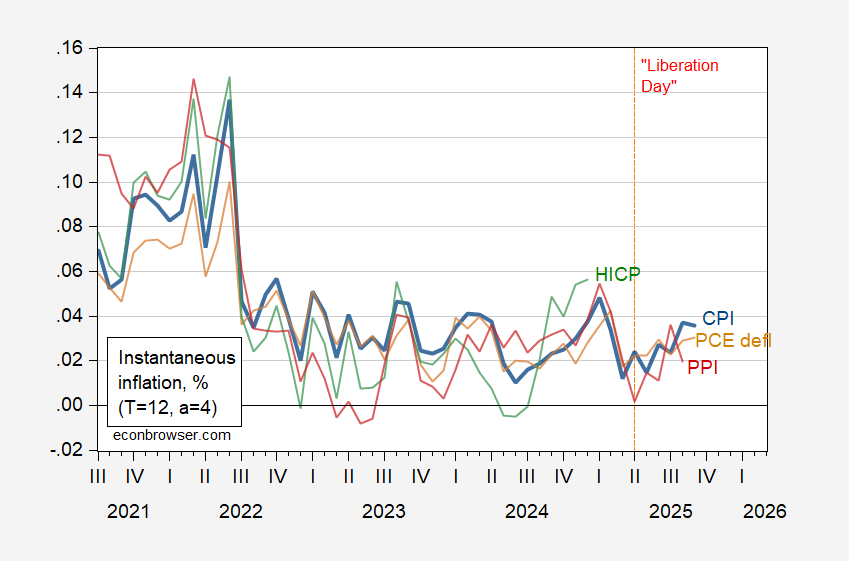

Headline:

Figure 1: Instantaneous inflation for CPI (bold blue), PCE deflator (tan), HICP (green), and PPI (red), per Eeckhout (2023), T=12, a=4. PCE deflator September observation is Cleveland Fed y/y nowcast of 10/25. Source: BLS, BEA via FRED, Cleveland Fed, and author’s calculations.

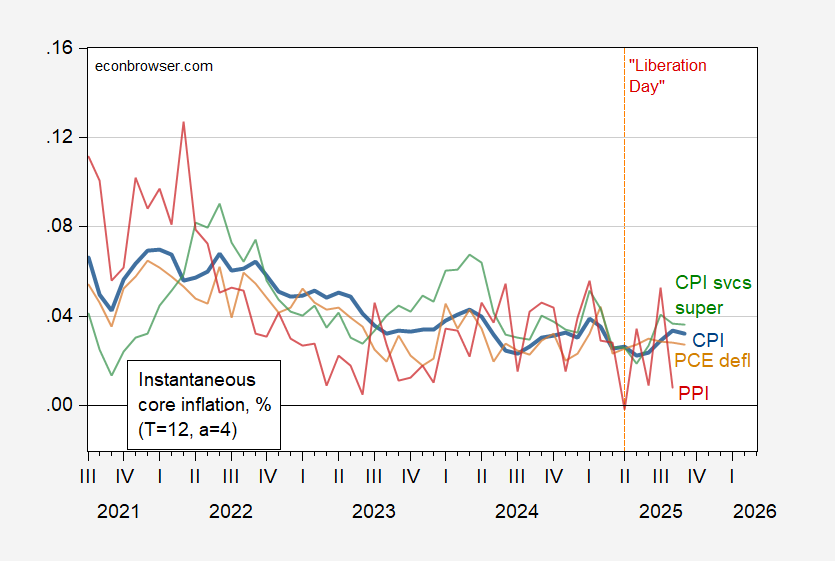

Core:

Figure 2: Instantaneous inflation for core CPI (bold blue), core PCE deflator (tan), services supercore CPI (green), PPI core (red), per Eeckhout (2023), T=12, a=4. PCE deflator September observation is Cleveland Fed y/y nowcast of 10/25. Source: BLS, BEA via FRED, Cleveland Fed, Paweł Skrzypczyński, and author’s calculations.

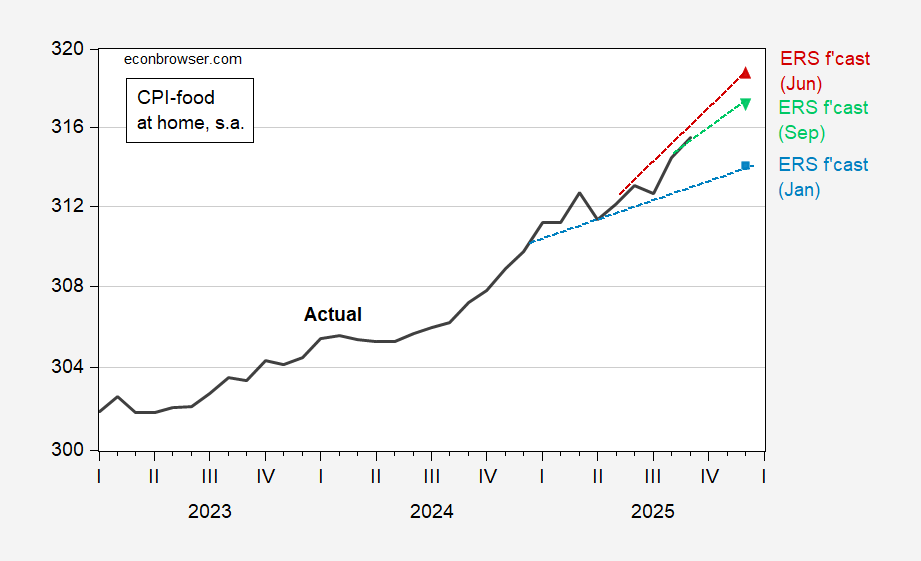

Food at home (level):

Figure 3: CPI food-at-home (black); ERS forecast of January (light blue square), ERS forecast of June (red triangle), ERS forecast of September (inverted green triangle), all on log scale. Source: BLS via FRED, ERS, and author’s calculations.

Note that the proportion of cell imputation in this release’s numbers was 40%, slightly higher than the previous month’s 36%, the highest proportion going back to 2019.

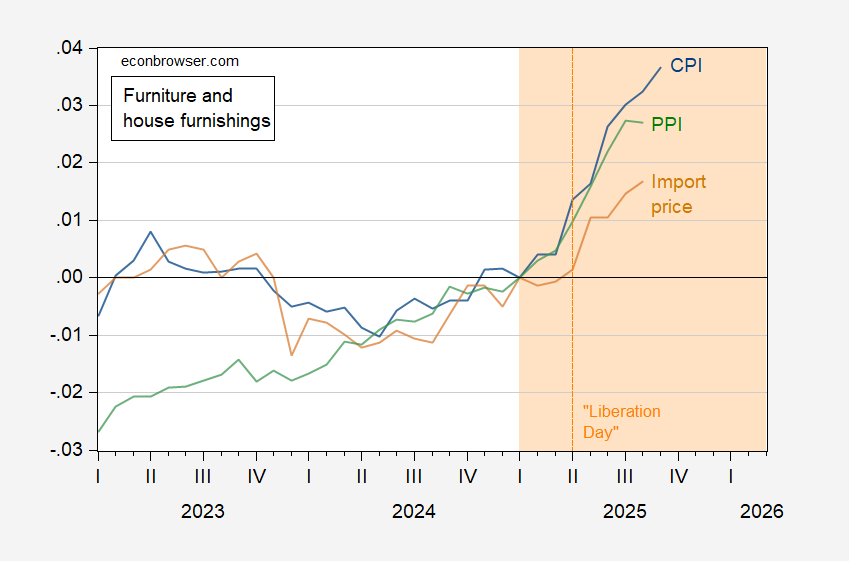

M Smith (Bloomberg) notes that private sector measures of durables indicate comparable (slightly higher) rates of inflation, consistent with tariffs having a measurable impact. Not that we needed such confirmation for such things as furniture.

Figure 4: Furniture and household furnishings component of CPI (blue), of PPI (green), import price index for furniture and household furnishings (tan), all in logs 2025M04=0. PPI seasonally adjusted using geometric moving average. Source: BLS via FRED.

A widening gap between the import price index (which does not include tariffs) and the CPI is indicative of a rising impact arising from tariffs.

The White House has indicated there likely won’t be a October CPI release (the September one only impelled because of the need to calculate the Social Security COLA). This seems pretty obvious as data should’ve been collected in October (which is nearly over) in order to compile the October release. It seems to me the Administration is perfectly happy with the failure to compile data, as it conceals the tariff-induced increase in prices at wholesale level, and will also conceal the potential slowdown in broader economic activity (such sa personal income, and final sales to private domestic purchasers). In this sense, ignorance is strength.

More By This Author:

“The Closing of the American Economy: Implications and Durability”

Imagine No IEEPA Tariffs

Circumventing The Trump Administration’s Data Suppression: Billion $ Weather/Climate Disasters Efforts