Conference Board Revises 2024 Outlook Up

…to 1% y/y [1]. Their Leading Economic Indicator edges up slightly [2]. Justin Ho discussed their brightening view on Friday’s Marketplace.

Interestingly, the Conference Board sees near zero growth in 2024Q2-Q3. This is consistent with the term spread based predictions which show a high probability of recession in 2024Q2.

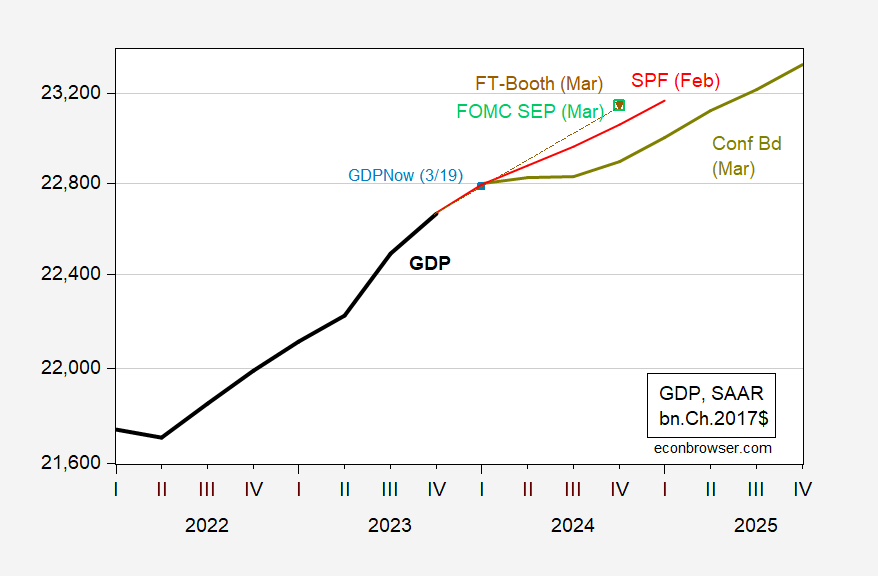

Figure 1: GDP (bold black), CBO projection (blue), Survey of Professional Forecasters (red), FT-Booth median forecast (brown inverted triangle), FOMC Summary of Economic Projections March 20 (open light green square), GDPNow of 3/19 (light blue square), Conference Board as of 3/21 (chartreuse), all in bn.Ch.2017$. Source: BEA 2024Q4 2nd release, Philadelphia Fed SPF, Booth School, Federal Reserve Board, Atlanta Fed (3/19), Conference Board, and author’s calculations.

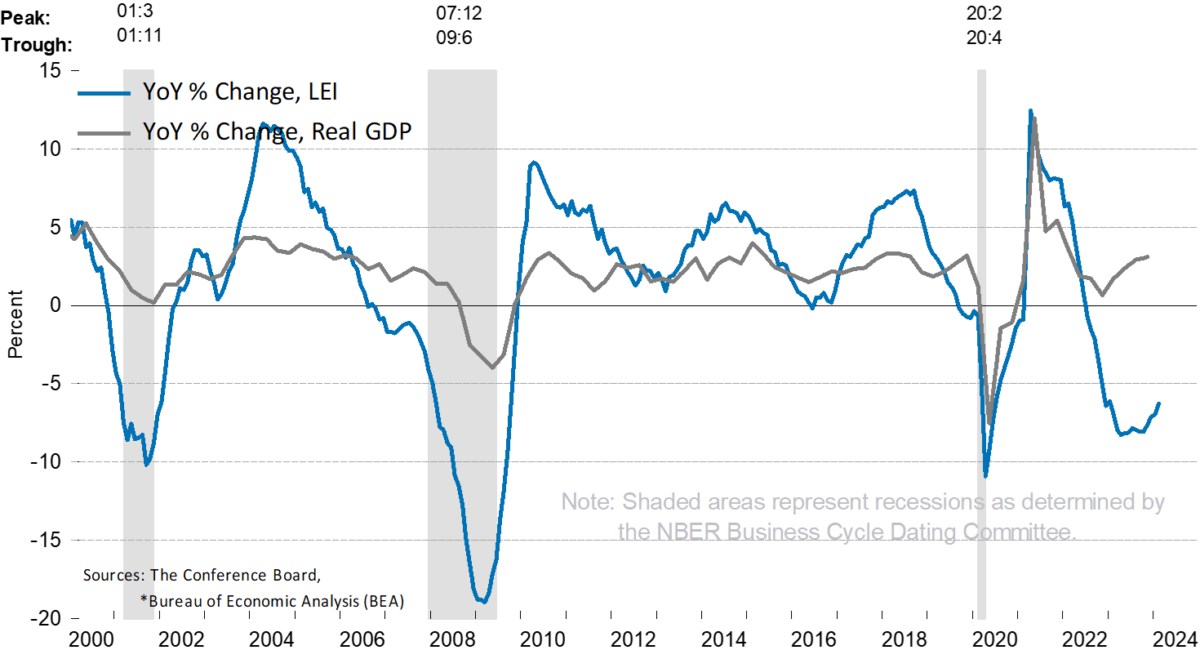

The lower path for GDP vis a vis SPF or FT-IGM survey median is likely due in part to the depressed level of their Leading Economic Indicator which only turned slightly positive in February.

Source: Conference Board.

The literature from the Conference Board indicates that LEI turning points lead GDP turning points by 7 months, so September 2024.

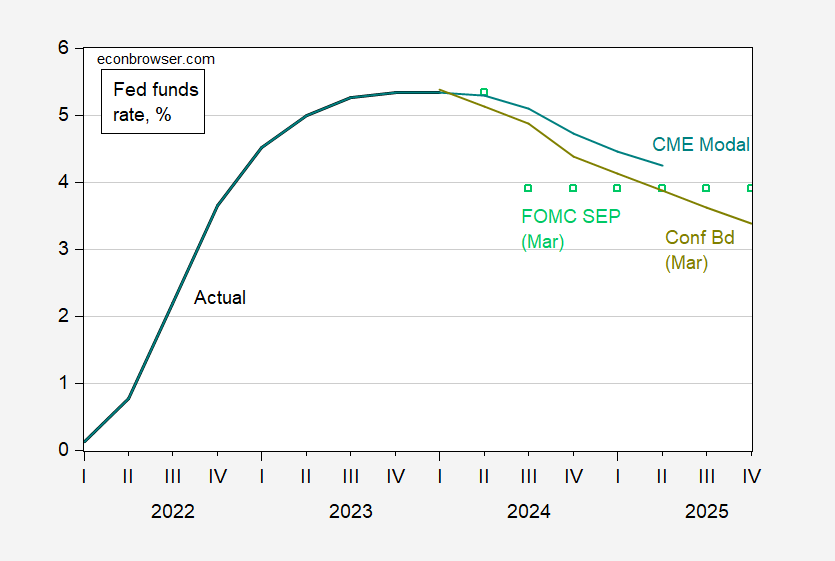

The Conference Board forecasts a lower Fed funds probably as a consequence of the lower projected growth.

Figure 2: Fed funds rate (black), FOMC March 2024 SEP (light green squares), Conference Board forecast (chartreuse), CME modal forecast as of 3/23 (sky blue). Source: FRB via FRED, FRB, Conference Board, CME, and author’s calculations.

More By This Author:

Are You Better Off Than You Were 4 Years Ago

FOMC March SEP On GDP

Is The Fed Looking At FAIT? If So, What Would It Imply?