Canadian Dollar Makes Fresh Headway Following Another Fed Rate Cut

Photo by Michelle Spollen on Unsplash

The Canadian Dollar (CAD) found fresh 11-week highs against the US Dollar (USD) on Wednesday. The Bank of Canada (BoC) held interest rates steady, while the Federal Reserve (Fed) delivered its third straight interest rate cut, propping up the Loonie and sending the Greenback lower.

The BoC held rates flat once again, with BoC Governor Tiff Macklem reiterating patience-based rhetoric that pushed back on market expectations for possible interest rate cuts in the future. Despite markets clamoring for cheaper funding costs through lower interest rates, the BoC remains leery of dropping interest rates any further.

The Fed delivered a third straight interest rate cut, giving investors what they wanted, however Fed Chair Jerome Powell cautioned against expectations for further rate moves in the near term, with the Federal Open Market Committee (FOMC) broadly seeing room for only 50 basis points in further rate reductions across 2026 and 2027.

Daily digest market movers: Canadian Dollar climbs on Fed rate cuts

- The Canadian Dollar’s midweek gains pushed the USD/CAD pair into an eleven-week low, testing below 1.3800 for the first time since September.

- The BoC held interest rates at 2.25%, while the Fed eased its policy rate band to 3.75-4.00%.

- The Fed also announced an uptick in Quantitative Easing (QE) programs including bond purchasing.

- The BoC’s stubborn rate announcement comes the week before key Canadian Consumer Price Index (CPI) inflation figures are due. Next Monday, Loonie traders will get to see how right the BoC was to keep rates on hold.

- Despite a third straight interest rate cut, Fed Chair Jerome Powell cautioned markets against hoping for any further extreme moves from the Fed, at least as long as he’s still the Chair, which ends early next year.

Canadian Dollar price forecast

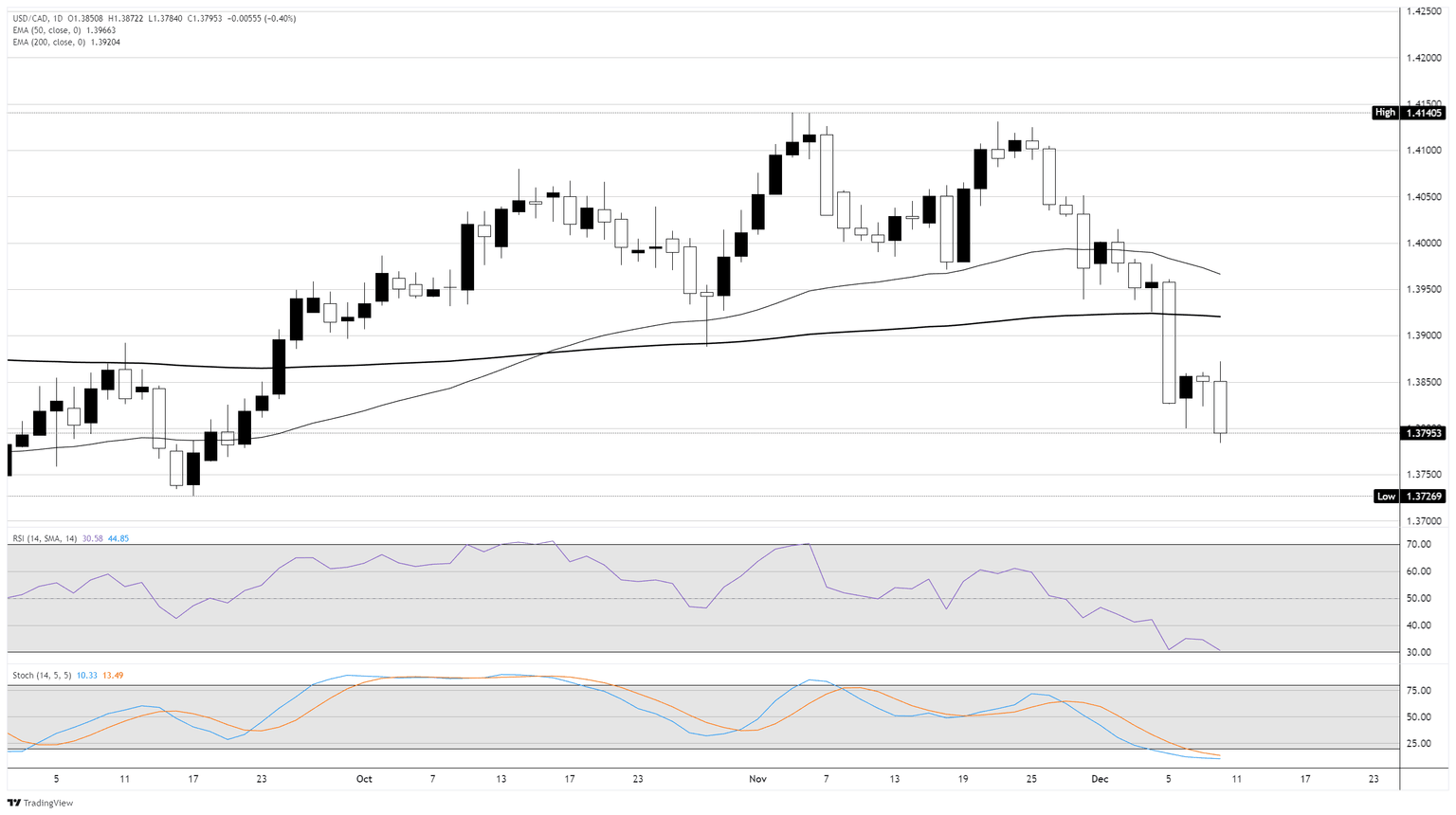

From the momentum perspective, USD/CAD is showing clear downside pressure. Price has broken below both the 50-day and 200-day EMAs, and the recent candles indicate strong bearish follow-through after the rejection near the 1.41 resistance zone. Momentum indicators support this shift: RSI has fallen into the mid-40s and continues trending lower, signaling weakening bullish strength, while Stochastics sits near oversold levels but has not yet shown a decisive bullish crossover. This combination typically reflects a market where sellers remain in control, even if short-term bounces occur.

The next key level visible on the chart is the support zone around 1.379–1.372, highlighted by the recent low and historical price reactions. A sustained break below that range would signal continued trend weakness, while a stabilization above it—paired with a momentum reversal on RSI or Stochastics—would hint at potential consolidation rather than a full trend shift. For now, momentum remains tilted to the downside, and traders often watch for whether oversold indicators start firming up or whether price continues to accelerate lower.

USD/CAD daily chart

(Click on image to enlarge)

More By This Author:

Dow Jones Industrial Average Soars 580 Points On Third Straight Fed Rate Cut

GBP/USD Extends Mean Reversion As Investors Brace For Fed

Dow Jones Industrial Average Stumbles Ahead Of Fed Rate Call