GBP/USD Extends Mean Reversion As Investors Brace For Fed

Photo by Colin Watts on Unsplash

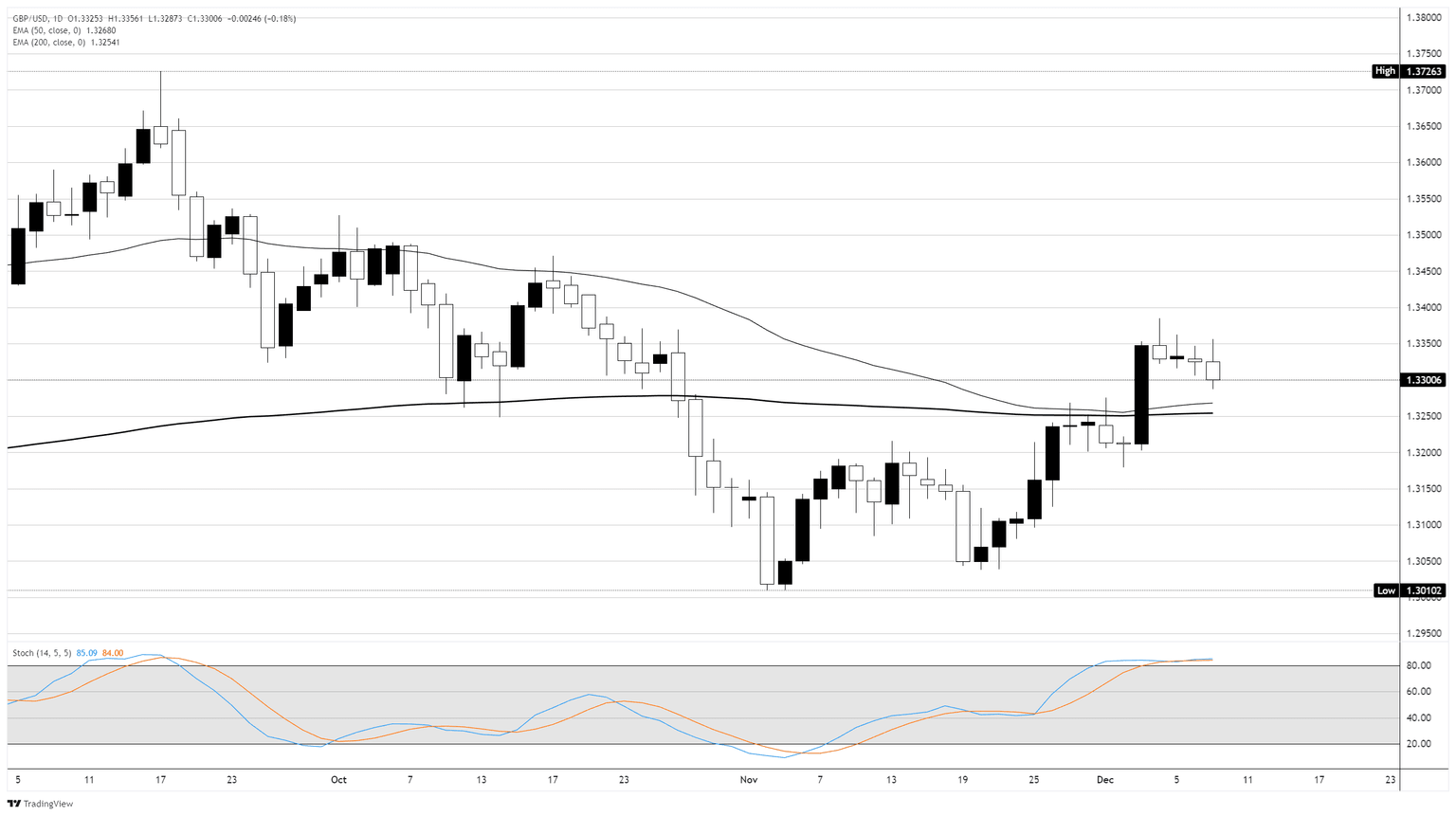

GBP/USD eased back toward the midrange on Tuesday, shedding around one-fifth of one percent after facing an intraday technical rejection from the 1.3350 level. Price action has slumped back into the 1.3300 handle and is holding just north of the long-term 200-day Exponential Moving Average (EMA) near 1.3250 as markets hunker down for the last Federal Reserve (Fed) interest rate decision of 2025.

Fed on deck, rate cut expected but tone matters

Investors are mainly focused on the Fed's interest rate decision scheduled for December 10, which is widely anticipated to result in a third consecutive quarter-point reduction. Fed funds futures currently suggest about an 87% probability of a cut, a significant increase from a month earlier. Market participants believe that the outcome of this rate decision, along with Fed Chair Jerome Powell’s messaging in one of his final press conferences before the rate decision, could influence market sentiment for the rest of December. This is especially true as markets grapple with persistent inflation, delayed economic data, and the ongoing transition toward new Fed leadership in 2026.

Beyond this immediate decision, analysts note that markets are already eyeing the next phase of Fed leadership and potential shifts in communication strategies amidst a year marked by unpredictable expectations. With the Fed’s dual mandate still under pressure from uneven inflation and slowing labor markets, investors are keenly observing whether policymakers can keep an accommodative approach in 2026 or if economic conditions will necessitate a more cautious stance.

BoE lurks around the corner

This week, UK economic data releases are quite subdued, but the Pound Sterling will prepare for a busy schedule next week, leading up to a possible interest rate cut by the Bank of England (BoE). The BoE's policy positions are generally more diverse than the often cautious statements from the US Federal Reserve. However, BoE officials have been increasingly open to the idea of further rate cuts, especially since the latest Monetary Policy Committee (MPC) meeting, where a narrow majority decided to keep rates unchanged.

GBP/USD daily chart

(Click on image to enlarge)

More By This Author:

Dow Jones Industrial Average Stumbles Ahead Of Fed Rate Call

GBP/USD Shuffles Its Feet As Investors Await Key Central Bank Moves

Dow Jones Industrial Average Sheds 200 Points As Treasury Yields Rise