Dow Jones Industrial Average Soars 580 Points On Third Straight Fed Rate Cut

Image Source: Unsplash

The Dow Jones Industrial Average (DJIA) climbed on Wednesday after the Federal Reserve (Fed) delivered its third straight quarter-point rate cut, lifting the Dow by over 1.2% and nudging the S&P 500 higher while the Nasdaq hovered near flat. The move lowered the federal funds rate to 3.50%–3.75% and was paired with renewed short-term bond buying, which pushed 2-year Treasury yields down. Markets interpreted the Fed’s acknowledgment of a softening labor market as a sign it may prioritize supporting jobs, even as inflation remains a concern.

Fed's Powell: The division is between holding rates steady from here vs. cutting

Although the Fed projected only one cut for next year, Chair Jerome Powell signaled that rate hikes are essentially off the table, a stance traders welcomed. Futures markets reacted immediately, pricing in a strong chance of two or more cuts in 2026. Stocks had drifted sideways heading into this final meeting of the year, but the Fed’s decision aligned with expectations and helped stabilize sentiment. The S&P 500 (SP500) now sits less than 1% below its late-October record after rebounding from a volatile November sparked by earlier mixed Fed signals.

Fed projects only 50 bps of additional rate cuts; lifts GDP forecasts

Regional banks were standout performers, with the KRE ETF and major regional lenders jumping more than 2% as falling rates boosted hopes for stronger lending activity. The rate decision was not unanimous: for the first time since 2019, three Fed members broke away from consensus, highlighting ongoing policy uncertainty. Overall, however, the broader market still welcomed clarity that further easing is more likely than tightening.

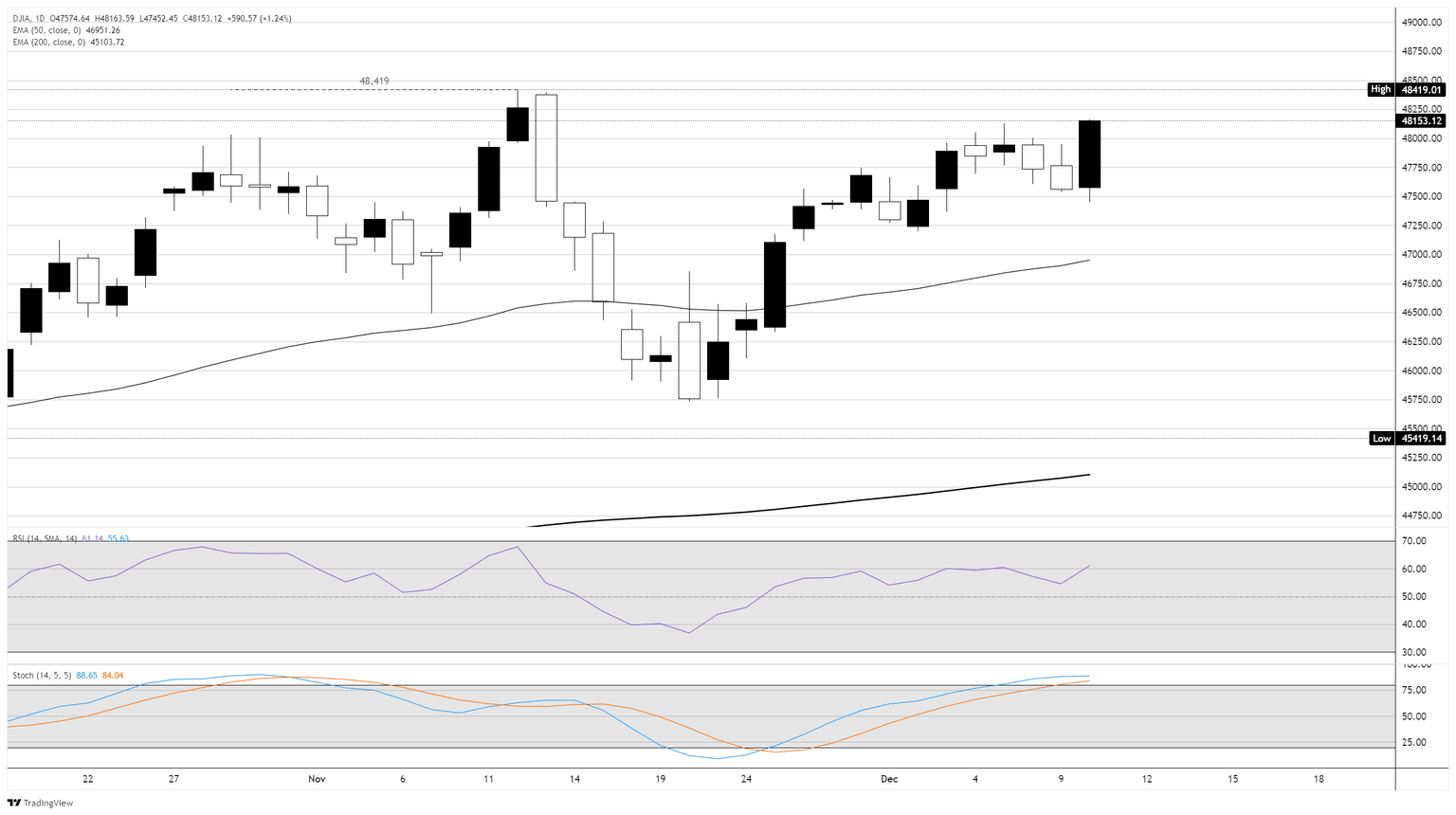

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

GBP/USD Extends Mean Reversion As Investors Brace For FedDow Jones Industrial Average Stumbles Ahead Of Fed Rate Call

GBP/USD Shuffles Its Feet As Investors Await Key Central Bank Moves