Business Cycle Indicators, Incorporating The Employment Release

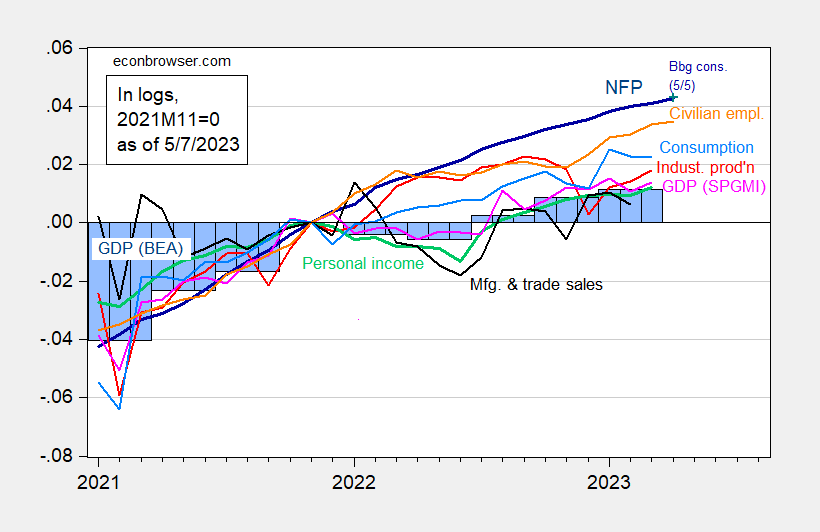

With the employment release, showing a deceleration in employment growth despite the upside surprise in April’s number, this is the picture of the series the NBER Business Cycle Dating Committee (BCDC), plus monthly GDP from S&P Global Market Intelligence (SPGMI) formerly Macroeconomic Advisers.

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 5/5 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Bloomberg consensus level calculated by adding forecasted change to previous unrevised level of employment available at time of forecast. Source: BLS, Federal Reserve, BEA 2023Q1 advance release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (5/1/2023 release), and author’s calculations.

As noted in this post, the actual level of employment is below the implied Bloomberg level, despite the outsized reported change, because of the downward revisions to previous months. The important point is that, as shown by the flattening slope, employment growth is declining. This is true across several indicators of employment.

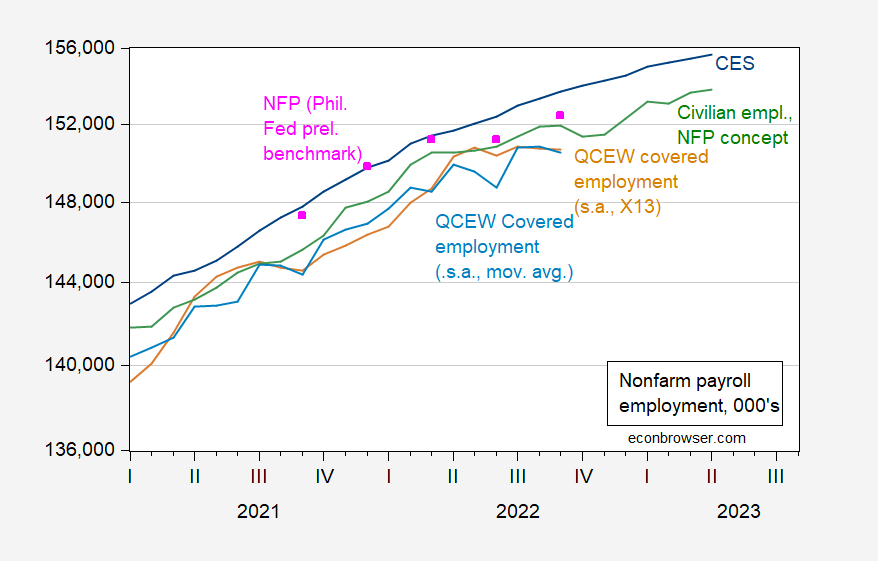

Figure 2: Nonfarm payroll employment from April 2023 CES release (blue), household series adjusted to NFP concept (green), QCEW total covered workers, seasonally adjusted using log transformed Census X-13 (tan), using multiplicative moving average (sky blue), Philadelphia Fed preliminary benchmark (pink squares), all in 000’s, s.a, all on log scale. Source: BLS via FRED, BLS, BLS QCEW, Philadelphia Fed, and author’s calculations.

Keeping in mind the data will be revised, there is no obvious sign of recession by 2023M04 — nor a recession having occurred in 2022H1 as some have speculated.

More By This Author:

Real Wages, Overall And Leisure/Hospitality

Of Nowcasts And Revisions

Productivity And Costs In Q1