Business Cycle Indicators As Of March 1st

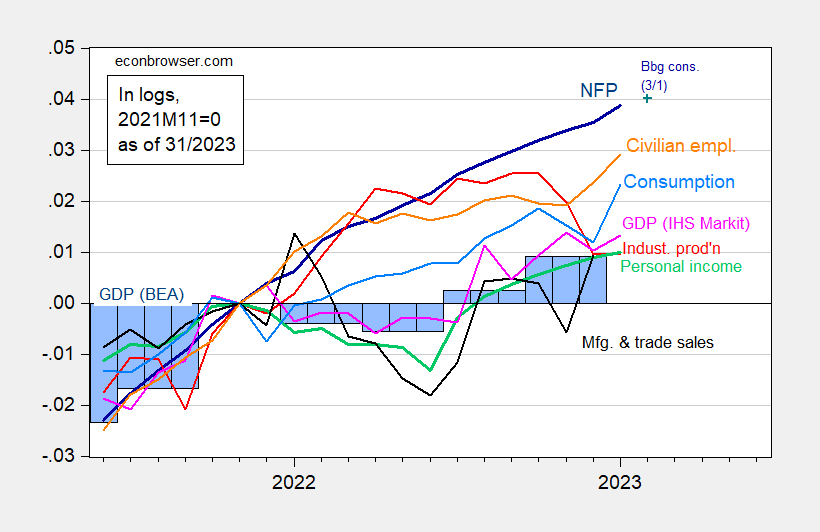

S&P Global (formerly Macroeconomic Advisers) released its monthly GDP for January, indicating a rebound in activity – 0.3% m/m growth. Adding this to a graph of key indicators followed by the NBER BCDC yields the following:

(Click on image to enlarge)

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 3/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Source: BLS, Federal Reserve, BEA 2022Q4 2nd release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers) (3/1/2023 release), and author’s calculations.

More By This Author:

Market Expectations On Fed Funds, Spreads, Inflation Post-CPI Release

Oil Prices, Gasoline Prices

Not A Recession … Yet