Bull Market Is In Play Until At Least 2022

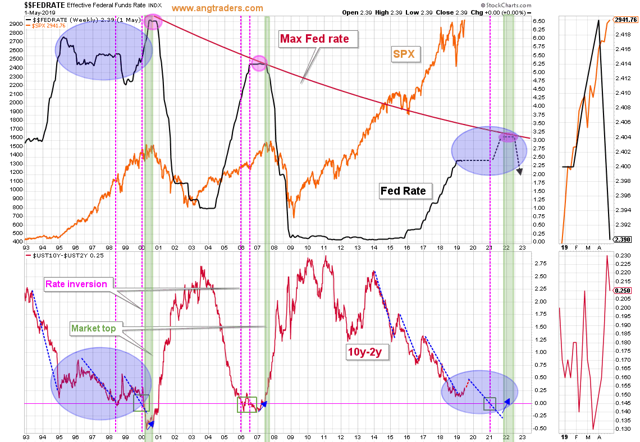

The most important rate differential is the 10y-2y rate, and this differential profile is increasingly similar to the pattern that started in 1995. That pattern coincided with the Fed holding the funds rate steady-to-lower for four years and with the SPX ripping higher the whole time. From this perspective, it would be reasonable to expect inversion of this rate pair in the middle of 2021 and the closest date for a recession would be 6-months later in 2022 (purple colored-areas in chart below).

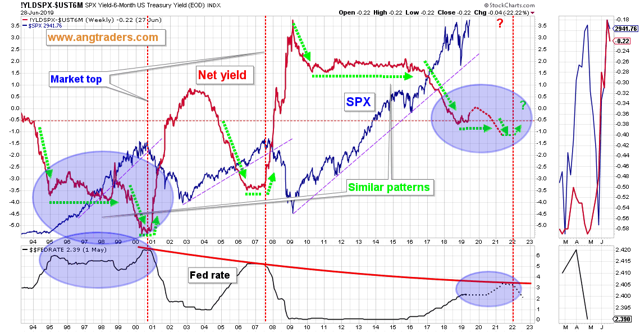

The one fundamental indicator that had us concerned was the net yield of the SPX (dividend rate minus 6-month T rate), but we now see that it fits with the pattern from 1995-1999, just like the situation with the 10y-2y that is discussed above; the timing of recession (at the earliest) is 2022 from the perspective of this pattern as well (chart below).

In summary: From the perspective of the Fed funds rate, rate differentials, and stock valuations the bull market should be in play until at least 2022.

I have to disagree with this.

Why is that?

So many reasons. The yields are inverted for one....and it’s getting worse. That always points to a recession being very soon. Second-we are in the longest expansion of the economy in history. The odds of it lasting another three years are a long shot (that’s just because we beat a record and records are records for a reason and usually don’t get shattered). Third-the disaster that is the world economy will eventually bleed over and infect us. All the turds stink. We just stink a little less right now and we are a flight to safety. Forth-interest rates. The fact we can’t raise rates above 2.5 without causing a market crash is a big clue. The fact that the only reason the market is where it is in the first place is that (low rates) and stock buybacks. Five-it is my personal belief the global banks will unpeg the whole thing next year to prevent a #Trump re-election. He’s a nationalist and a threat to globalization.

In addition, there is too much fear and expectation of a market failure. Other indicators we follow are actually showing a BOTTOMING pattern! We should have a short-term pullback in July, but it will be shallow.

I'd agree with that analysis.

Interesting perspective. It certainly beats those thinking the end will come in a few months every few months. I agree rates should usually show a topping pattern before a market drop, and even if they don't the market holds up a while before the crash.

Ditto.