Applied Materials Stock Forecast: Bullish Outlook Amid Technological Advancements And Geopolitical Context

Image Source: Pixabay

Highlights

- Applied Materials posted strong financial results for FY 2022, with total revenue and net income increasing by 12% and 11%, respectively.

- Despite slower projected revenue growth, the company has been advancing in its technological capabilities, particularly in the field of heterogeneous chip integration.

- The stock has appreciated significantly in the first half of 2023, outpacing many of its peers in the semiconductor industry.

- Geopolitical risks associated with AMAT’s significant exposure to China may be less significant than initially perceived, potentially adding to the investment appeal.

Company Overview

Headquartered in Santa Clara, California, Applied Materials Inc. is a highly prominent and influential supplier of equipment for semiconductor fabrication, flat panel liquid crystal displays (LCDs), and solar photovoltaic (PV) cells and modules. Furthermore, the company provides crucial deployment and support services related to the equipment it supplies, further solidifying its presence in the global market.

In fiscal 2022, Applied reported its results across three segments—Semiconductor Systems, which accounted for 73% of total revenue, Applied Global Services at 22%, and Display and Adjacent Markets at 5%.

As the largest supplier of semiconductor manufacturing equipment worldwide, Applied Materials faces competition primarily from other major equipment manufacturers such as KLA Corporation (KLAC) and Lam Research Corporation (LRCX). Nevertheless, the company’s wide range of product offerings and unwavering commitment to cutting-edge technology have positioned it favorably in the market.

AMAT Stock Forecast: Robust Financial Results and Strong Market Position

Applied Materials concluded fiscal year 2022, ending on Oct. 30, 2022, with impressive financial performance that highlights its strong market position and growth trajectory. The company achieved a total revenue of $25.79 billion for the fiscal year, marking a notable 12% increase compared to the previous year. Additionally, its net income surged to $6.53 billion, representing an 11% rise from the fiscal year 2021 figure.

These outstanding financial results demonstrate Applied Materials’ resilience and its ability to capitalize on the growing demand for semiconductor-related equipment and services. Furthermore, the company maintains a robust balance sheet, with $26.7 billion in assets and $12.2 billion in stockholders’ equity as of the fiscal year-end in 2022.

While Applied Materials’ financial performance is commendable, it is important to note that the revenue growth rate falls short of expectations. According to Seeking Alpha’s AMAT Growth Grade Metrics, the revenue growth (year-over-year) stands at 7.26%, which is lower than the sector median and Applied Materials’ five-year average.

Additionally, the revenue growth, which indicates analysts’ consensus revenue estimates for two fiscal years forward, is only 2.29%. While these figures may not be particularly satisfying or attractive, they do represent positive growth and indicate a stable continuation of growth in the future following the significant boost experienced this year.

Applied Materials has exhibited commendable stock performance, with shares rising by 48.4% in the first half of 2023, according to data from S&P Global Market Intelligence. This positive performance aligns with the semiconductor industry’s overall upward trend, as many sector leaders entered 2023 at lower levels due to the Federal Reserve’s aggressive interest rate hikes and concerns about a potential recession.

The semiconductor industry experienced a favorable first half of 2023, with numerous sector leaders witnessing substantial recoveries after periods of uncertainty driven by the aggressive interest rate hikes and recessionary fears.

GuruFocus highlights Applied Materials, Inc. as one of the most profitable companies in the semiconductor industry. The company’s net margin of 24.36% surpasses 88.90% of firms in the Semiconductors industry, while its return on equity (ROE) of 51.18% outperforms 97.12% of similar companies.

These profitability metrics emphasize Applied Materials’ ability to generate strong returns and underscore its competitive position within the semiconductor industry.

AMAT Revolutionizes Chip Integration and Chipmaking with New Technologies

Applied Materials recently announced that they are advancing Heterogeneous Chip Integration with new materials and systems and also a new manufacturing platform to handle more advanced chips.

Applied Materials has unveiled advanced materials, technologies, and systems to enable chipmakers to integrate chiplets into 2.5D (two or more chips side-by-side on the same substrate) and 3D (two or more chips stacked on top of each other) packages using hybrid bonding and through-silicon vias (TSVs).

These solutions cater to the growing demand for heterogeneous integration (HI) and offer improved chip performance, power efficiency, and time to market. Applied Materials is a leading provider of HI technologies, empowering chipmakers to overcome the limitations of traditional scaling and enhance system capabilities.

Dr. Sundar Ramamurthy, Group Vice President and General Manager of HI, ICAPS, and Epitaxy, Semiconductor Products Group at Applied Materials, emphasized the rapid growth of heterogeneous integration. He stated that this approach enables chip and systems companies to overcome the limitations of traditional 2D scaling by efficiently packing more transistors and wiring into 2.5D and 3D configurations. The result is improved system performance, reduced power consumption, smaller form factors, and accelerated time to market.

Moreover, Applied Materials, Inc. has launched Vistara, its most significant wafer manufacturing platform innovation in more than a decade. The new platform, which was developed over four years by hundreds of engineers, aims to address increasing chipmaking challenges related to complexity, cost, speed, and sustainability.

- Vistara’s flexibility allows chipmakers to use a wide range of chamber types, sizes, and configurations. It also allows for an integrated series of manufacturing steps to be completed in one system. This flexible design enables the creation of innovative transistors, memory components, and wiring, while also reducing particle and defect risks.

- Vistara’s intelligent design aims to reduce costs and speed up production. The platform is fitted with thousands of sensors, feeding real-time data to Applied’s AIx software. The intelligence built into the platform helps engineers use machine learning and AI to optimize production processes, maximize uptime, and predict maintenance needs.

- Vistara is also designed with sustainability in mind. The new platform is more energy-efficient, using less power compared to previous models. Vistara also requires less cleanroom space, meaning fewer carbon-intensive construction materials are needed.

Applied Materials’ latest HI solutions and the new manufacturing platform demonstrate the company’s commitment to advancing the industry’s ability to meet the demands of evolving chip designs. By providing cutting-edge technologies, Applied Materials empowers chipmakers to embrace new possibilities in heterogeneous chip integration and address the complex challenges of modern chip manufacturing.

Geopolitical Factor

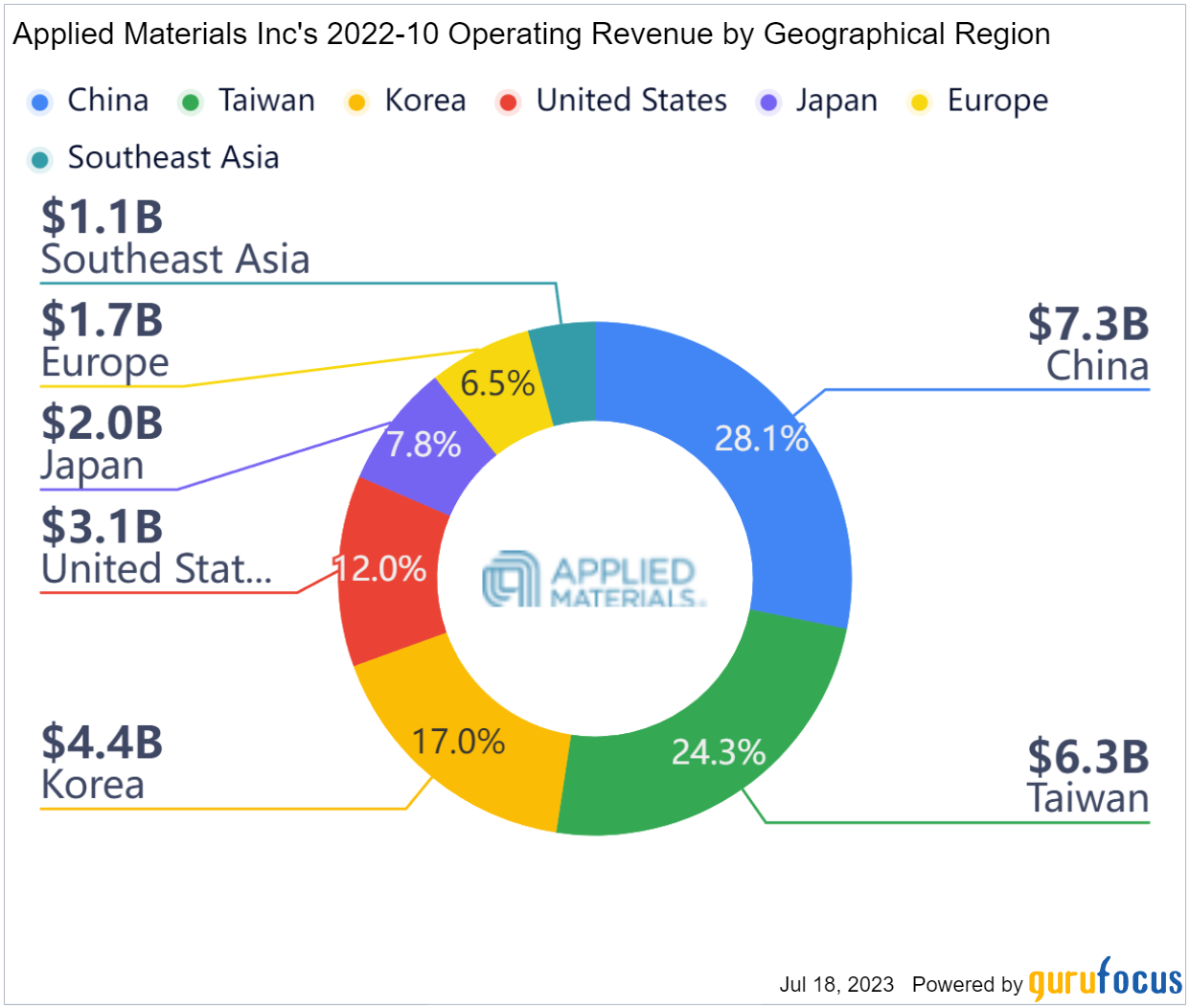

The company derives a substantial portion of its operating revenues from China, accounting for 28.1%. Several investors perceive this as a potential risk due to the ongoing complex diplomatic relationship between the U.S. and China. Nevertheless, I maintain that the geopolitical risks facing AMAT aren’t as significant as some may perceive.

On July 17, 2023, the Semiconductor Industry Association (SIA), a prominent trade group in the U.S., called on the Biden administration to avoid imposing additional restrictions on semiconductor sales to China. This call for leniency came as top executives from leading U.S. semiconductor firms were preparing to meet with policymakers in Washington D.C. this week to advocate for their positions on China-related policies.

The lobbying effort from the SIA and other industry leaders suggest a preference for a more flexible approach to the China market. This might lower the geopolitical risks for AMAT and other companies heavily invested in the Chinese market, thus validating my belief that the perceived geopolitical risks might be overstated.

Viewpoints on AMAT from Analyst Community

Based on Yahoo Finance, there were 21 analysts presenting recommendation trends in July 2023, among which 5 rated the stock a Strong Buy, 15 a Buy, and 1 rated the stock as a Hold. The recommendation rating is 2.2 at Buy. The average price target from 25 analysts is around $126.08, which is within the range of the lowest $77.49 price point and the highest $155.86 price point.

However, the current price at $142.66, which is higher than the average, could see strong enthusiasm from the market.

From TIPRANKS, there are 13 Buy ratings, 6 Hold ratings, and 1 Sell rating from 20 analysts’ ratings in the past three months. The expected average target stock price is $145.78, which is in the range of the lowest $112.00 price point and the highest $175.00 price point. The average price targets also represents a 0.88% increase from the previous price.

From Seeking Alpha, the Wall St. Rating is a Buy(4.03), and there are 16 out of 32 analysts suggesting a Strong Buy for the stock in the last 90 days.

AMAT Stock Forecast: Conclusion

Applied Materials, Inc. (AMAT) demonstrates robust financial performance, innovation in chip integration technology, and resilience in the semiconductor equipment industry, making it an attractive investment opportunity. Despite potential slower revenue growth, continued advancements underscore its market leadership. AMAT’s stock has shown significant appreciation in H1 2023, and the geopolitical risks related to China seem less severe than previously believed.

It is worth noting that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the stock. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success With The AMAT Stock Forecast

I Know First has been bullish on the AMAT stock forecast in the past. On July 19, 2022, the algorithm issued a forecast for the stock price and recommended AMAT as one of the best mega-cap stocks to buy. The AI-driven AMAT stock prediction was successful on a one-year time horizon, resulting in profits of more than 52.22%.

More By This Author:

Investment Strategies: Who Is Winning In The Battle Of Active Vs Passive Investors

Identifying The Dimension Where Deterministic Chaos Is Alive In The Stock Market

Market Anomaly: Weekend Effect Of Monday And Friday Stock Returns

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more