Alternative Business Cycle Indicators

NBER BCDC indicators discussed here. Alternative below.

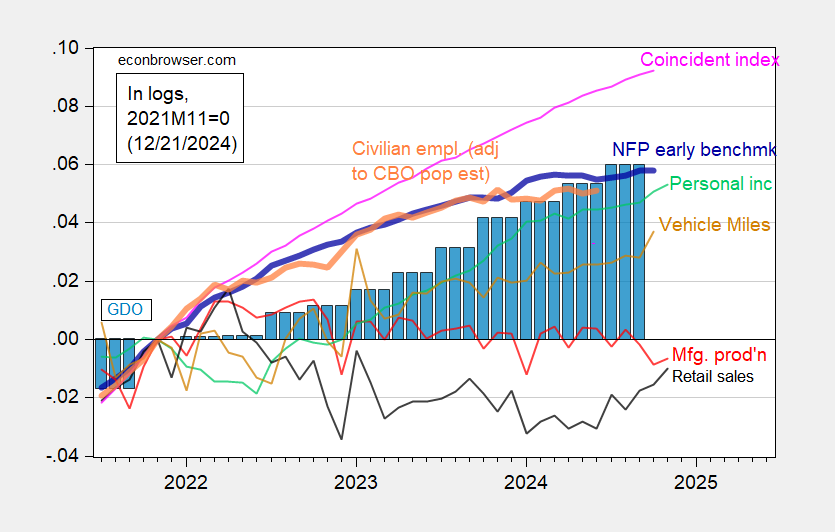

(Click on image to enlarge)

Figure 1: Implied nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted using CBO immigration estimates (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q3 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 release), and author’s calculations.

Early benchmark and manufacturing suggest a slowdown. Other indicators do not.

More By This Author:

An Alternative Perspective On PCE Deflator Inflation: Instantaneous Inflation

More And More Market Participants Don’t Believe The Fed Anymore

Business Cycle Indicators For November 2024