More And More Market Participants Don’t Believe The Fed Anymore

Image Source: Pexels

That’s Heritage Foundation economist EJ Antoni yesterday. Dr. Antoni continues:

Increasingly, people are realizing that the 2% target is long gone. We’re looking at 3% basically as the implicit target. Now we’re in for a lot of pain. So the question is just, is this going to be 1920 or is it going to be 1929

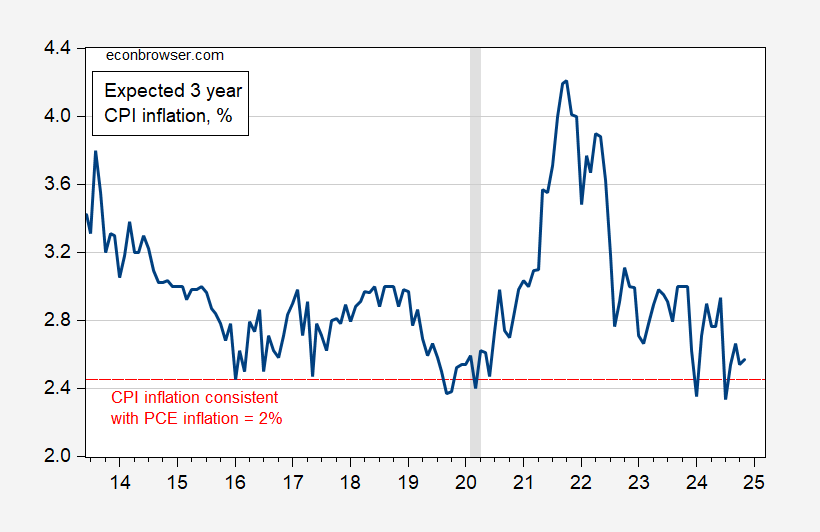

I wondered what the basis for this assertion was. As usual with Dr. Antoni, it’s hard for me to determine. Take a look at 3 year median expected CPI inflation of consumers.

Figure 1: 3 year median expected CPI inflation deviation from 2.45% target (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

Seems to me that the Fed’s coming close to re-establishing credibility, insofar as households are concerned.

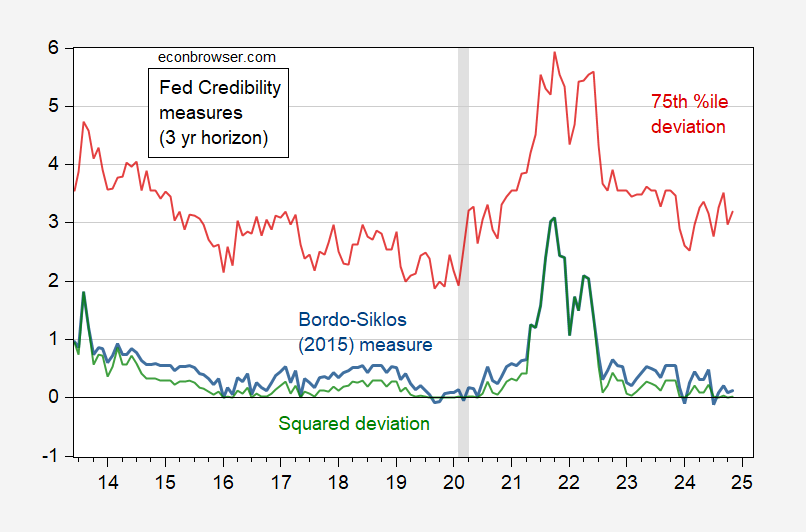

One can measure Fed credibility with respect to its inflation target in a variety of ways. I use plot three measures.

Figure 2: Bordo-Siklos (2015) credibility measure using 2.45% target (blue), squared deviation of expectation from 2.45% target (green), 75th percentile deviation from 2.45% target (red). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

It’s true the folks at the 75th percentile remain skeptical — but no more so than at the end of the Trump 1.0 administration. The Bordo-Siklos measure seems almost dead on.

More By This Author:

Business Cycle Indicators For November 2024Canada And Recession

Business Cycle Indicators As Of Mid-December