Tuesday Talk: Up But Under 4500

Both the S&P 500 and the Dow closed higher on Monday to end their five day losing streak, while the Nasdaq closed slightly lower than it's Friday close.

Closing at 4,469 the S&P 500 was up 10 points but still well below 4,500; the Dow Jones Industrial average was up 262 points, closing below 35,000 at 34,870. The Nasdaq closed at 15,106, down 10 points. Currently market futures for all three indices are red: S&P futures are trading down 5 points, Dow futures down 49 points and Nasdaq futures down 25 points. Traders and investors will be closely watching the August CPI numbers which the U.S. Department of Labor will release later today. A moderate decrease in the rate of inflation from July is expected. Most actives on the Big Board yesterday were across sectors with some tech and COVID pharma stocks taking hits.

Chart: The New York Times

Monday's biggest loser was COVID-19 superstar Moderna (MRNA) which dropped 6.6%, closing at $419.72.

Meanwhile, tech giant Oracle (ORCL) beat analyst expectations for their fiscal Q1earnings for their quarter which ended August 31. TalkMarks contributor Zacks Equity Research provides the analysis in their article, Oracle Surpasses Q1 Earnings Estimates. This is some of what they have to note:

"(Oracle reported)...quarterly earnings of $1.03 per share, beating the Zacks Consensus Estimate of $0.97 per share. This compares to earnings of $0.93 per share a year ago...This quarterly report represents an earnings surprise of 6.19%. "

"Oracle posted revenues of $9.73 billion for the quarter ended August 2021, missing the Zacks Consensus Estimate by 0.46%. This compares to year-ago revenues of $9.37 billion. The company has topped consensus revenue estimates three times over the last four quarters...Oracle shares have added about 38.6% since the beginning of the year versus the S&P 500's gain of 18.7%."

"The current consensus EPS estimate is $1.10 on $10.25 billion in revenues for the coming quarter and $4.63 on $42.25 billion in revenues for the current fiscal year."

Oracle stock closed at $88.89 per share yesterday, down $0.79. Currently shares of Oracle are down $3.04 pre-market open.

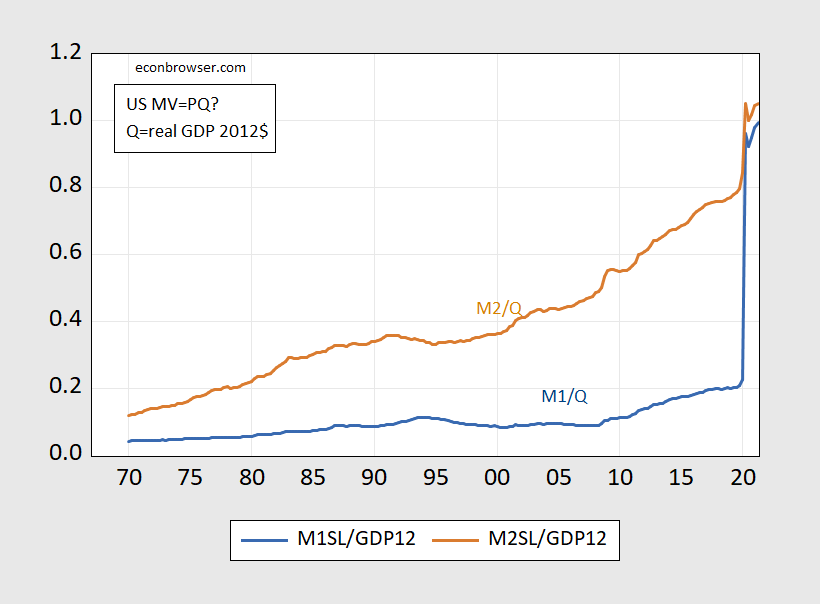

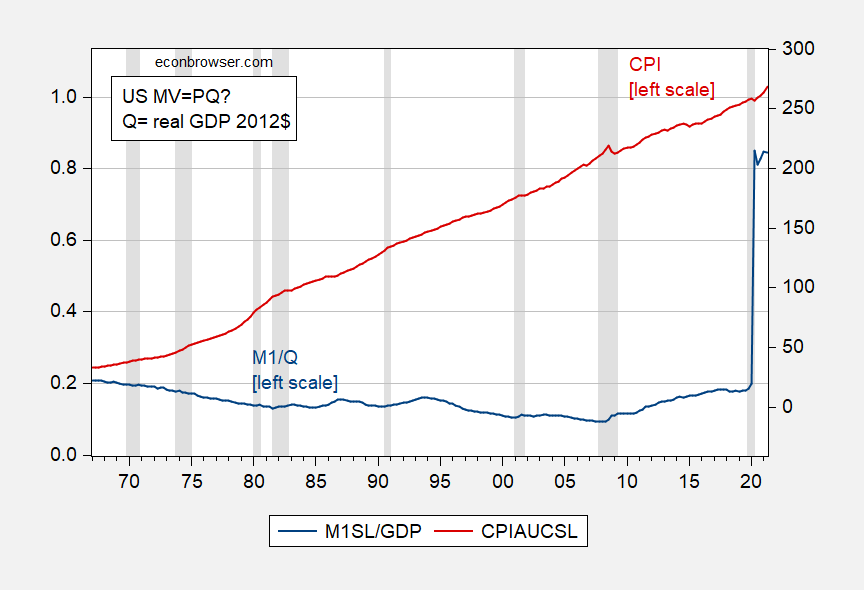

TalkMarkets contributor, economist Menzie Chinn in Two Pictures – Money To Income And The Price Level brings us two charts of the US money supply vs GDP to help readers understand (or at least contemplate) where the economy really with regards to inflation.

"Consider the following graphs. Figure 1 is M1 and M2 to real GDP (0.80 means 80%) for the United States. Figure 2 is M1 to real GDP on left scale, and CPI-all urban on the right scale (taking on a value of 100 in the period 1982-84).

Figure 1: M1 in billions of $ divided by real GDP in billions of Chained 2012$, Seasonally Adjusted at Annual Rates (SAAR) (blue), and M2 divided by real GDP (brown). Money is seasonally adjusted, end-of-quarter figures. Source: Federal Reserve via FRED, BEA, and author’s calculations.

Is this picture cause for worry, in terms of inflation? Can you explain why you think it is, or is not? Now consider this graph.

Figure 2: M1 in billions of $ divided by real GDP in billions of Chained 2012$, Seasonally Adjusted at Annual Rates (SAAR) (blue, left scale), and Consumer Price Index for all urban consumers (red, right scale). NBER defined recession dates shaded gray. Money is seasonally adjusted, end-of-quarter figures; CPI is average of monthly data. Source: Federal Reserve via FRED, BEA, and author’s calculations.

Does this picture change your views? Why, or why not?"

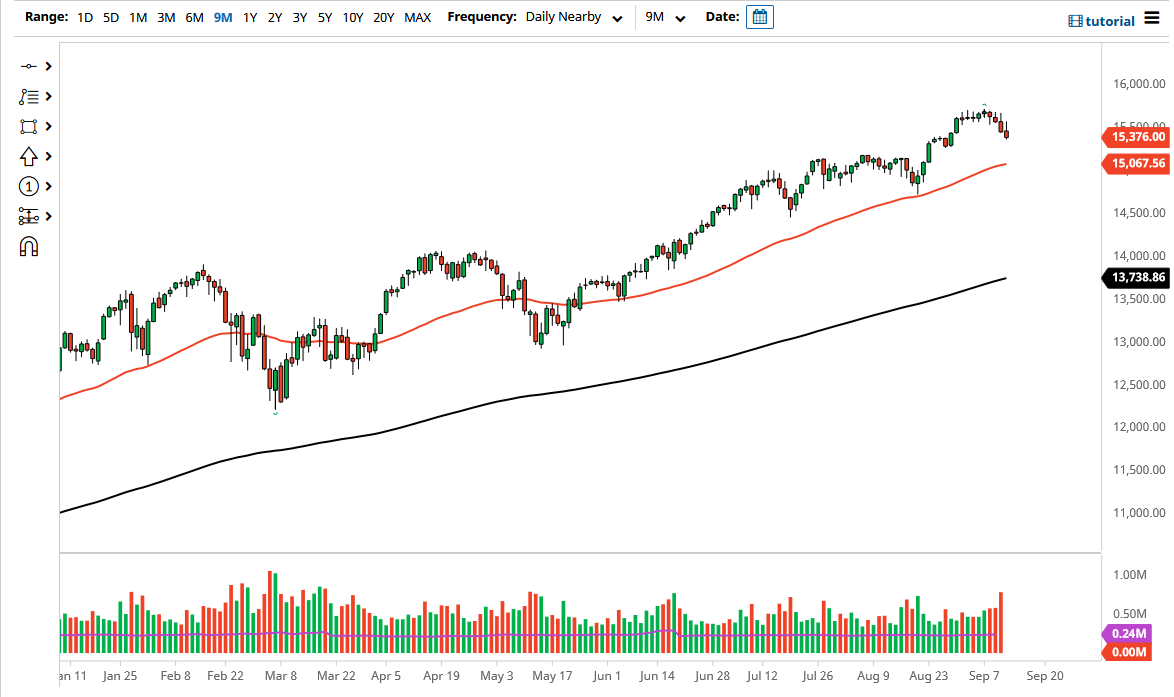

Though the Nasdaq did not pull upwards yesterday, contributor Christopher Lewis believes that despite Showing Weakness With Lost Gains this does not mean the path is not a continuation toward higher levels.

"The Nasdaq 100 (NDX) rallied significantly on Monday, but as you can see, gave up early gains to form yet another ugly candlestick. It looks as if we are going to continue to see downside pressure, perhaps opening up the possibility of a move to much lower levels. That being said, the 50-day EMA underneath is going to offer a certain amount of support, as it is an indicator that a lot of people have paid close attention to. Furthermore, we have an uptrend line that comes into the picture, so I think it is probably only a matter of time before we go higher."

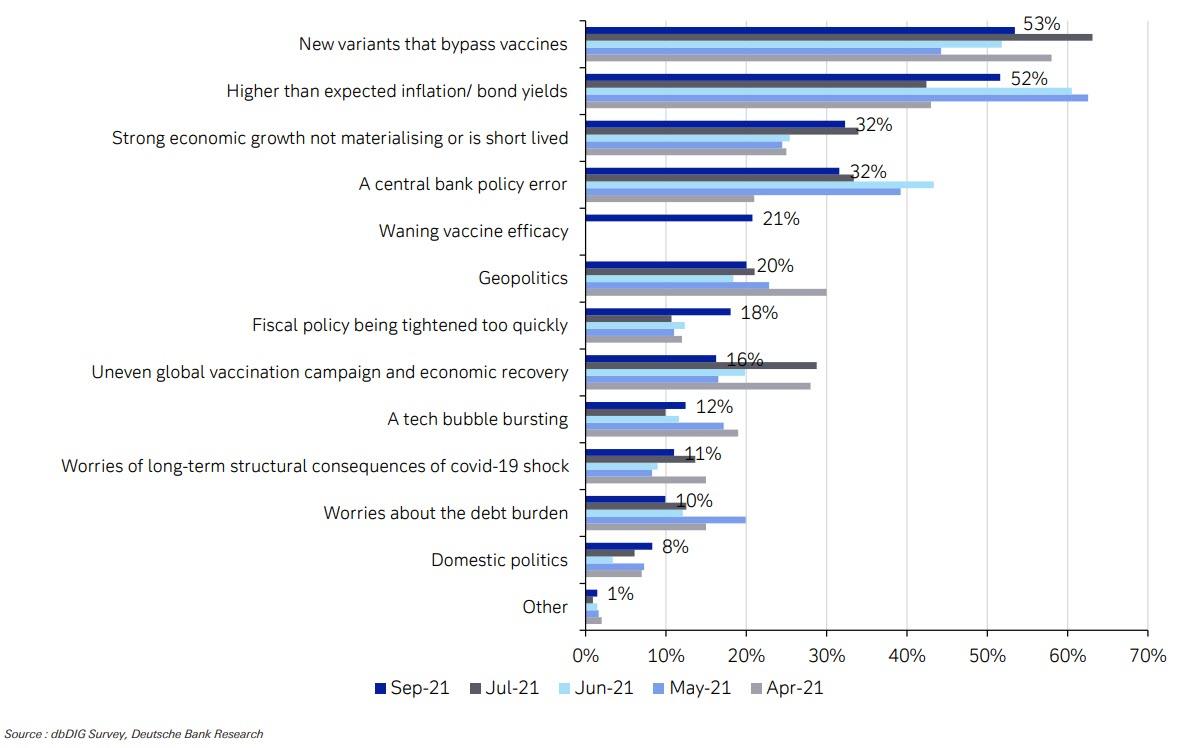

Elsewhere TM contributor Tyler Durden reports that Over 2/3rds Of Investors See At Least 5% Correction By Year-End, Blame Vaccine-Beating Variants.

"Despite increasingly authoritarian efforts to mandate (and enforce) a jab in every Americans' arm (whether young and 'safe' or merely naturally immune), more than half of professional investors surveyed by Deutsche Bank see "new variants bypassing COVID vaccines" as the biggest risk to current market stability."

Durden includes several of the questions in the Deutsche Bank (DB) survey with accompanying charts. It's far from conclusive evidence and I would not be so quick to say that:

"It appears that professional investors have all read the bearish Wall Street notes... and agree."

One of the questions posed in the survey is: "Which of the following do you think pose the biggest risks to the current relative market stability?"

Below are the responses:

In a TalkMarkets exclusive Ingrid Hedgershot steps back from the carousel ride and looks at some Quarterly Movers & Shakers that may be of interest to readers. It's a short, but solid list. I've condensed her remarks here, so read the full article for all the details.

"During the past three months, the S&P 500 index increased 7.3% thanks to the strong economic recovery from the pandemic. All the following high-quality stocks generated strong double-digit gains during the same period.

Regeneron Healthy Growth (REGN)

Regeneron reported second-quarter revenues rose 163% to $5.1 billion with net income jumping 245% to $3.1 billion. This excellent performance included $2.76 billion in revenue attributable to REGNCOV, the firm’s COVID-19 antibody cocktail which has proven potent against all known variants...During the past three months, Regeneron’s stock generated a healthy 33% gain. Hold.

Nike 45% Return On Equity (NKE)

Nike reported 2021 sales of $44.5 billion, up 19% from last year, with earnings up 126% to $5.7 billion and EPS up 123% to $3.56. During fiscal 2021, Nike generated a winning 45% return on shareholders’ equity...In fiscal 2022, Nike expects revenue to top $50 billion. Over the last four years, Nike’s stock has raced higher holding up a 203% total return trophy. Hold.

Microsoft $27 Billion Buyback (MSFT)

In fiscal 2021, Microsoft’s revenue increased 18% to $168.1 billion with net income jumping 38% to $61.3 billion and EPS up 40% to $8.05. Return on shareholders’ equity for the year was an impressive 43%...Over the last 11 years, Microsoft’s stock is up elevenfold with the gains rising into the clouds. Hold.

Apple $66 Billion Buyback (AAPL)

Apple rang up a juicy 36% jump in fiscal 2021 third-quarter sales to a record $81.4 billion with net income increasing 93% to $21.7 billion and EPS doubling to $1.30...After paying dividends of $10.8 billion and repurchasing $66.2 billion of its stock, Apple ended the quarter with $193.6 billion in cash and investments on its shiny balance sheet. Over the last 11 years, Apple has provided a sweet 1,569% total return. Hold.

Alphabet $24 Billion Buyback (GOOG)

Alphabet reported strong second-quarter results with revenues jumping 62% to $61.9 billion and net income up more than 165% to $18.5 billion. Free cash flow more than doubled during the first half of the year with the company repurchasing about $24.2 billion of its stock as part of its $50 billion share buyback authorization...Hold.

Accenture $2.8 Billion Buyback (ACN)

Accenture reported excellent third-quarter results with revenues up 21% to $13.2 billion and net income jumping 26% to $1.6 billion. During the first nine months, Accenture paid $1.7 billion in dividends and repurchased $2.8 billion of its common stock...Hold.

Ulta Beauty 60% Rebound In Sales (ULTA)

Ulta Beauty rang up a 60% rebound in second-quarter sales to $2.0 billion with a net income of $250.9 million...Ulta Beauty ended the quarter with 58 Target “store within a store” locations and plans to have 100 open by the end of the third quarter. In the past three years, Ulta’s stock has gained a pretty 35%. Hold.

Paychex New $400 Million Buyback (PAYX)

Paychex reported strong fourth-quarter results with revenues up 12% to $1.0 billion and net income up 19% to $263 million. Double-digit growth during the fourth quarter was aided by a record 85% client retention level. Return on shareholders’ equity was a superb 37% for the year. Paychex is well-positioned for growth in fiscal 2022 with total revenue anticipated to grow approximately 7% generating adjusted EPS growth of 10%-12%...Hold.

Bank Of Hawaii Increased Dividend 4% (BOH)

Bank of Hawaii reported net income jumped 74% to $67.5 million in the second quarter...The dividend currently yields a coconut-sized 3.3%. The bank’s long-term goal is to pay out 50% of net income in dividends...Over the past year, the Bank of Hawaii has provided a hula-dancing 73% total return. Buy.

Intel $2.4 Billion Buyback (INTC)

Intel reported second-quarter revenues increased 2% to $19.6 billion with EPS up 4% to $1.19...Management raised guidance with 2021 revenue expected to be approximately $77.6 billion with EPS of $4.09. Capital expenditures are expected in the $19 billion to $20 billion range. Intel believes it is at the beginning of a decade of sustained growth as the digitization of everything continues to accelerate. Intel has chipped in a 10% total return over the last year. Buy.

Mastercard $3.1 Billion Buyback (MA)

Mastercard reported second-quarter revenue rose 36% to $4.5 billion with net income charging 46% higher to $2.1 billion. This solid growth reflected the continued recovery in domestic and cross-border spending...As of June 30, 2021, the company’s customers had issued 2.9 billion Mastercard and Maestro-branded cards. During the first half of the year, Mastercard’s free cash flow increased 15% to $3.6 billion with the company paying $873 million in dividends and repurchasing $3.1 billion of its common stock with $6.4 billion remaining authorized for future share repurchases. During the first half of the year, Mastercard also invested $4.2 billion in acquisitions which are contributing to revenue growth. Revenue growth in the third quarter should be in the mid-20% range. Over the last seven years, Mastercard’s stock has charged higher providing a 375% total return. Buy.

Oracle $21 Billion Buyback (ORCL)

Oracle reported fourth-quarter revenues increased 8% to $11.2 billion with net income increasing 29% to $4.0 billion and EPS up 38% to $1.37... During fiscal 2021, Oracle generated a record $13.8 billion in free cash flow with the company returning nearly $24 billion to shareholders through dividend payments of $3.0 billion and share repurchases of $21 billion..During the past 10 years, Oracle has reduced its shares outstanding by more than 44%. Management expects growth to accelerate during 2022 and beyond as the fast-growing cloud business becomes a larger portion of the business...Over the past eight years, Oracle has provided a divine 195% total return. Buy.

Hedgershot's list includes both growth and value stocks with strong track records. These picks may offer some tranquility and peace of mind for Jane and Joe investors tired from a year of chasing cryptoassets and meme stocks.

As always, caveat emptor.

That's a wrap for this Tuesday. Have a good week and get vaccinated.

Ertainly the two largest threats are indeed that some variation in the virus that is a version that none of the vaccinations affect will appear and spread rapidly.

That, in conjuction with the fact that the central bank (the Fed) will of course make policy errors, either unknowinly or intentionally to help their friends, are the big concerns that I see.

The other concern, not listed, is that the maniacs will do another insane and evil act of terror just because they can. And the result will ultimately be a huge loss of freedom in the name of preventing climate change, which will have no effect on climate change but certainly wil be a large step in the direction towards a police state.