Tuesday Talk: Not Clear Yet

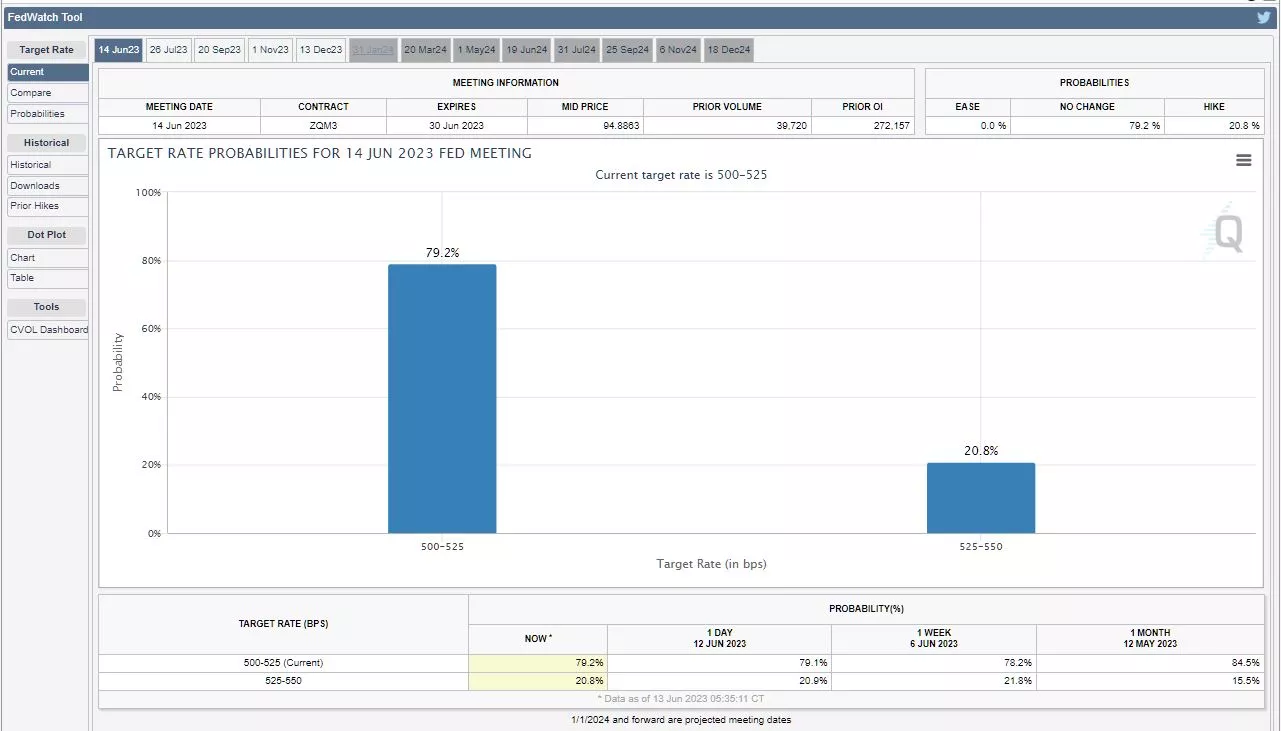

The air may have cleared in Manhattan, but it is not yet clear if the Fed will raise rates by a quarter point or engage in a rate hike pause, at tomorrow's FOMC meeting.

As this hits the ether the current reading on the CME FedWatch Tool is 79.2% pro-pause.

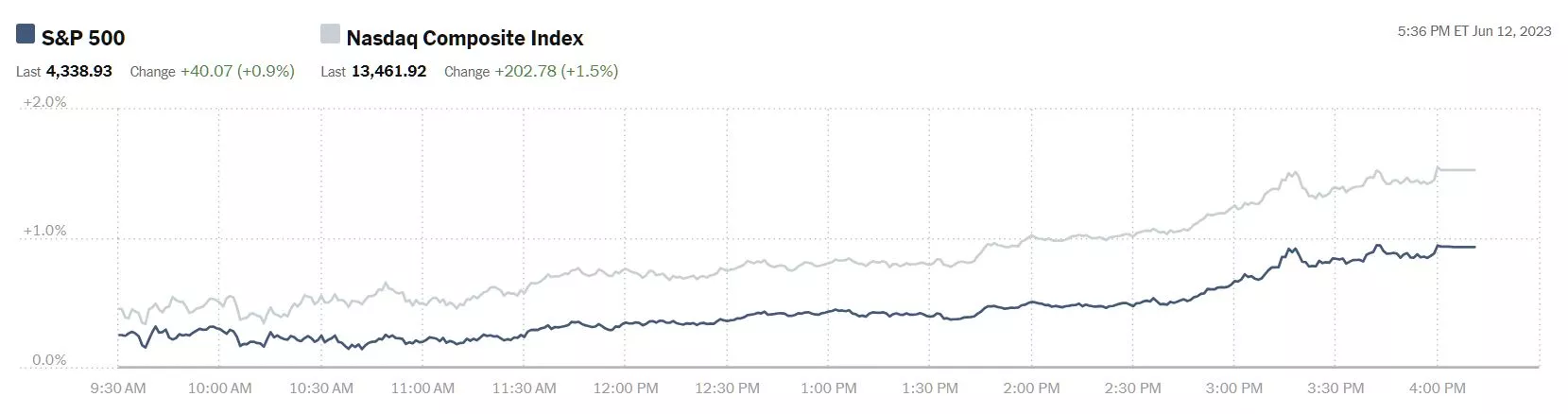

The market kicked-off the week in a somewhat buoyant manner with the S&P 500 closing up 40 points at 4,339, the Dow closing up 190 points, at 34,066 and the Nasdaq Composite closing 203 points higher at 13,462.

Chart: The New York Times

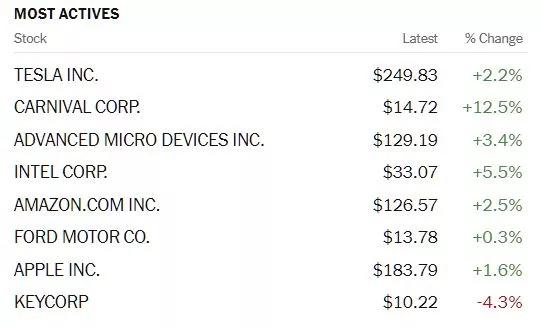

Seemingly most often, most active, Tesla (TSLA) again headed the list yesterday up 2.2%, followed by Carnival Cruise Lines, (CCL) up 12.5%, and Advanced Micro Devices (AMD), up 3.4%.

Chart: The New York Times

Currently in morning futures action, S&P 500 market futures are trading up 6 points, Dow market futures are trading down 2 points and Nasdaq 100 market futures are trading up 55 points.

TM contributor Patrick Munnelly covers current sentiment prior to the release of May's CPI data and the German ZEW expectations index, later today in his Daily Market Outlook - Tuesday, June 13.

"In Europe, the German ZEW survey results, which are due this morning, are expected to show a fourth consecutive decline in the expectations index. Nevertheless, this is unlikely to dissuade the European Central Bank (ECB) from proceeding with a rate hike on Thursday.

This afternoon, the US May Consumer Price Index (CPI) inflation data is expected to indicate a decline, with a forecasted decrease from 4.9% to 4.2%, while the core rate (excluding food and energy) is predicted to fall from 5.5% to 5.3%. The Federal Reserve will commence its two-day policy meeting today and it is anticipated that they will pause after a series of interest rate hikes in the past ten meetings."

Europe up 1, US down 1...?

Contributor ARTInvest featured in a TalkMarkets "In the Spotlight" piece looks at The Sustainable Wealth Wave: How ESG Investing Is Changing The Game.

"The concept of the "triple bottom line" that emerged in the 1990s eloquently captured the interconnected significance of the "three Ps": people, planet, and profit. This focus has led to the development of corporate social responsibility (CSR) strategies, which form the foundation of ESG investing."

"A study by PwC involving 325 investors found that 79% considered ESG risks as important factors in investment decision-making, while 49% were willing to divest from companies not taking sufficient action on ESG issues...

ESG Investing Defined

It is crucial to understand the three primary criteria that form the basis of ESG performance evaluation: Environmental, Social, and Governance factors...

Environmental (E)

The "E" in ESG represents how companies manage their environmental impact. This encompasses a company's carbon footprint, which can be categorized into direct (Scope 1) emissions, emissions from the purchase and use of energy (Scope 2), and supply chain emissions (Scope 3).

Furthermore, other environmental factors taken into consideration include waste management, the company's impact on air and water quality, and deforestation...

Social (S)

The "S" in ESG focuses on how companies treat their workers and the communities they operate in. The social aspect of ESG can include factors such as employee engagement, inclusivity, gender and diversity, data protection, labor standards, human rights, and community relations.

Companies that prioritize the well-being of their employees and contribute positively to society are more likely to attract talent and maintain a strong brand reputation, ultimately contributing to their long-term success.

Governance (G)

The "G" in ESG encompasses how companies are run, including their internal systems of control, procedures, practices, and how they mitigate and respond to violations. Good governance policies foster transparency, ensure that industry best practices are followed, and encourage an open and ongoing dialogue with regulators.

Governance factors include company leadership, audit committee structure, shareholder rights, lobbying, whistleblower programs, political contributions, and methods for the prevention of bribery and corruption. Strong governance is crucial for a company's long-term success, as it helps minimize the risk of scandals, fines, and damage to the company's reputation.

ESG Performance

ESG investments have demonstrated remarkable resilience during economic downturns, as evidenced by their performance during the 2008 financial crisis and the market turmoil in 2020 and 2021. Companies with strong ESG practices were better equipped to weather these storms, providing investors with more stable returns.

A study by MSCI showed that ESG stocks outperformed traditional ones during the 2008 crisis, experiencing lower declines and faster recoveries. Similarly, during the challenging market conditions of 2020 and 2021, ESG equity funds outperformed their non-ESG counterparts, despite the broad market selloff.

In 2021, 40% of actively managed ESG funds beat their benchmarks, almost as well as conventional funds. However, in 2020, the actively managed ESG funds performed even better; 57% of them beat their benchmarks, while only 43% of conventional funds did so."

See the full article for additional background information on ESG investing.

Economist and contributor Dean Baker weighs in on AI, Job Loss, And Productivity Growth.

It is an excellent column which deserves your full attention but below is some of what he has to say:

"What percent of jobs were affected by computers? The answer would probably be pretty close to 100 percent, if by “affected” we mean in some way changed. If by affected, we mean eliminated, then we clearly are talking about a much smaller number."

"Thinking of AI like we did about computers is likely a good place to start. First of all, we should remember that there were predictions of massive layoffs and unemployment from computers and robots for decades. This did not happen."

"...let’s say that we could use AI to eliminate 47 percent of current jobs over two decades. If we held GDP constant over this period, that would roughly correspond to the 3.0 percent annual productivity growth we saw during the post-World War II boom. And, just as we saw high levels of employment through the post-war boom (unemployment got down to 3.0 percent in 1969), we could maintain high employment if the economy had the same sort of rapid growth that we had in that quarter century."

" (Sharing AI gains with society in general)...we may well see a similar story (to that of computing technologies) with AI, where highly paid professionals use their political power to limit the uses of AI and ensure that it doesn’t depress their incomes. This also is an issue with ownership of the technology itself. If we don’t allow for strong patent/copyright monopolies in AI, and make non-disclosure agreements difficult to enforce, we can ensure the technology is more widely spread and cheap. This would mean that the gains are widely shared and not going to a relatively small group of Bill Gates types."

"The moral of the story is that there is nothing about AI technology that should lead to mass unemployment and inequality. If those are outcomes, it will be the result of how we structured the rules, not the technology."

In the "Where To Invest Department" contributor Tim Travis provides a current list in High-Yield And Attractively Valued Dividend Stocks.

"I’d like to discuss some of the high dividend yields that are available currently, which provide both a solid income and appreciation potential. The stock market is extremely bifurcated between the 7 or 8 largest stocks, which are now trading at higher valuations than they were prior to the bear market beginning in 2022, and the majority of the market which is mostly just treading water. This has opened up very attractive opportunities for investors willing to not follow the herd mentality into FANGMAN or whatever acronym you want to call the glamour tech stocks."

"Below are some stocks that offer an attractive combination of a low valuation and high dividend yields."

Stock Symbol Share Price Dividend Yield

1) AGO $54.02 2.07%

2) BXP $54.11 7.24%

3) C $48.30 4.22%

3) ALLY $28.00 4.29%

4) SPG $110.07 6.68%

5) KW $17.08 5.62%

6) VZ $35.47 7.36%

7) T $15.95 6.96%

8) BTI $32.52 8.25%

9) APA $33.41 2.99%

10) ENB $37.94 6.94%

11) BNPQY $30.18 6.95%

12) FRA $11.87 11.28%

13) ABBV $138.18 4.28%

14) MO $45.22 8.31%

These stocks are in a handful of different industries, and I believe that all have a very good chance at increasing their dividends into the future. The stocks might be out of favor in the short term due to fears of a recession, higher interest rates, pressure from generic competitors, etc., but in most cases, the risks are more than priced in."

Caveat Emptor.

This should keep you busy while waiting for the CPI data and FOMC rate decision to hit your Twitter (TWTR) feed.

Have a good one.

More By This Author:

Thoughts For Thursday: Hazy Days

Tuesday Talk: That Old Up and Down...

Informative