Thoughts For Thursday: Traders Have A Short Term Grail Quest

Almost doesn't count, certainly not when it comes to financial pinnacles like the one facing the S&P 500. It tried to reach its current challenge yesterday but closed shy of 5,000 at 4,995. Five points!

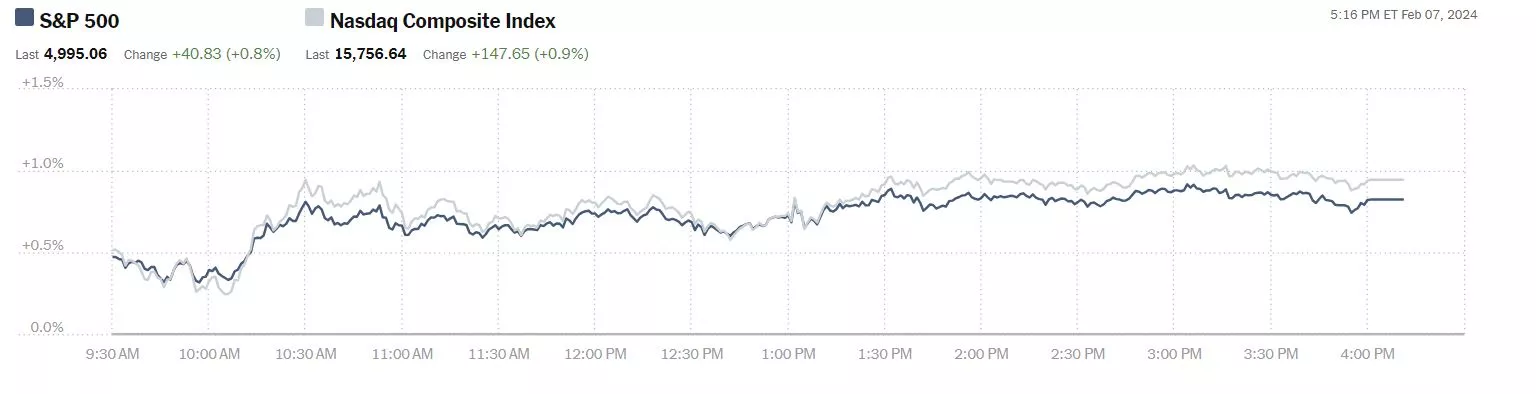

Wednesday the S&P 500 closed at 4,995, up 41 points, the Dow closed at 38,677, up 156 points, and the Nasdaq Composite closed at 15,757, up 148 points.

Chart: The New York Times

Most actives were led by Ford (F), up 6%, followed by Tesla (TSLA), up 1.3%, and Advanced Micro Devices (AMD), up 1.8%.

Chart: The New York Times

In morning futures trading S&P 500 market futures are down 8 points, Dow market futures are down 8 points and Nasdaq 100 market futures are down 30 points.

In an "In the Spotlight" column for TalkMarkets contributor Stephen Innes looks at The 5000 Summit Push (S&P 500).

"On Wednesday, U.S. stocks experienced a significant surge as investors assessed robust corporate profits and witnessed major technology companies extending their upward trajectory. These movements occurred amidst ongoing discussions regarding the timing of potential interest rate cuts.

Even as U.S. yields backed up a touch, notably, the S&P 500 approached the 5,000 mark for the first time, hinting at mega-cap tech's de-coupling from bond yields but supported by an upbeat macro story, where the economy continues to operate at an above-trend pace with no material signs of falling below trend in the near-term...

It's becoming increasingly evident that equities are unfazed and indifferent to the Federal Reserve's less dovish stance, which suggests that unless there is a substantial deterioration in the labor market, the central bank's baseline expectation for 2024 includes three rate cuts...

The current market pricing, as of Wednesday, incorporates an expectation of a 75 basis point reduction in interest rates, along with a fair-minded premium intended to address lingering concerns about the possibility of a hard economic landing.

Interestingly, equities seem to have become indifferent to the movements in rates and bonds, particularly after the Federal Reserve removed its tightening bias. The behavior of rates and bond markets is cartoonish and probably worth ignoring as bond bears are, for all intent and purposes, in hibernation.

While it's tempting to subscribe to market pricing as a more accurate gauge of future policy trajectories compared to official statements from the Fed, it's important to note that rate markets have been forever in overshoot and undershoot mode throughout this economic cycle. Hence, seldom have rates speculators been the absolute guiding light.

In summary, every corner of Wall Street has revised its U.S. growth forecast upward for 2024. This optimistic backdrop has also supported earnings growth, which has been crucial for equities, particularly amid pressure from higher interest rates..."

TM contributor Joseph Y. Calhoun III points out that even the ISM data are not robust enough to signal the economy will head into recession in his piece Market Morsels: ISM And Recession.

"The ISM manufacturing survey has been below 50 for 15 months in a row and sits today at 49.1. This survey, along with a lot of other manufacturing data and anecdotes, has been cited repeatedly by the economic bears as evidence we are heading for recession. That, of course, hasn’t happened and that is consistent with this indicator. Yes, below 50 does indicate contraction – of manufacturing. But that doesn’t mean the entire economy is in contraction. Manufacturing is only about 24% of total GDP so it would be hard for manufacturing, by itself, to push us into recession...

Don’t take my word for it. This is directly from the ISM’s latest release of the manufacturing survey in January:

The Manufacturing PMI® registered 49.1 percent in January, up 2 percentage points from the seasonally adjusted 47.1 percent recorded in December. The overall economy continued in expansion for the 45th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.)

The low for this manufacturing slowdown was 46 in June of last year so we really never even got close to recession. Why? Because the slowdown in manufacturing was driven by the supply chain issues from COVID. And, oh by the way, it’s ending."

In the "Where to Invest" Department contributor Mark Vickery likes Q4 earnings in Disney, PayPal, Wynn Resorts All Outperform On Earnings, Sales.

"The Walt Disney Co. (DIS), fresh from its announcement of a sports platform alliance with Fox and Warner Bros. Discovery this morning, posted beats in its fiscal Q1 earnings report after the closing bell this afternoon. Earnings of $1.22 per share easily surpassed the 97 cents expected (and 99 cents per share reported in the year-ago quarter), on revenues of $23.5 billion which modestly outperformed the $23.47 billion in the Zacks consensus. Shares are up +7% in late trading on the news, adding to its +9% gains from the start of the year.

This marks the fifth-straight earnings beat for the global entertainment conglomerate, which happens to match the five quarters since CEO Bob Iger returned to his post in November 2022. Disney+ core subscribers did see some churn, -1.3 million in the quarter, but this was partially covered by the +1.2 million gains in its Hulu network. Disney+ core net adds are expected to be between 5.5-6 million, and the company issued a 45 cent per share cash dividend for good measure. Disney’s full-year earnings guide has been ratcheted up to $4.60 per share from $4.34 in the Zacks consensus.

PayPal (PYPL) also reported Q4 earnings after the regular closing day, outpacing estimates on both top and bottom lines. Earnings of $1.48 per share marked a 12-cent beat (and 24 cents higher year over year) on quarterly sales of $8.0 billion, beating the $7.88 billion projected and +9% year over year. But shares are trading down -4% in the late session, as guidance softens compared to some estimates. PayPal now has stiff competition from the likes of ApplePay and Google Pay.

Wynn Resorts (WYNN) also outperformed expectations on both top and bottom lines this afternoon, streaking past earnings estimates and posting $1.91 per share, far hotter than the $1.12 projected. Revenues of $1.84 billion improved over the expected $1.74 billion, as Operating Revenue increased +84% year over year. Partly this was due to Macau, China coming fully back online, bringing in +$309 million in the quarter, followed by $111.3 million in Las Vegas. Wynn Palace garnered a strong $411.3 million, and shares are up +3% in late trading."

TalkMarkets contributor Sheraz Mian likes Tech in Q4 Earnings: Tech Sector Back In Growth Mode.

"The key points:

- Total Q4 earnings for the 285 S&P 500 members that have reported results are up +4.4% from the same period last year on +3.5% higher revenues, with 81.1% beating EPS estimates and 64.6% beating revenue estimates.

- For the Tech sector, we now have Q4 results for 74.7% of the sector’s market capitalization in the index. Total earnings for these Tech companies are up +21.9% from the same period last year on +6.4% higher revenues, with 88.6% beating EPS estimates and 72.7% beating revenue estimates.

- The Tech sector is solely responsible for keeping the Q4 earnings growth pace in the positive territory. Had it not been for the Tech sector's strong growth, the +4.4% earnings growth for the companies that have reported already drops to a decline of -2.7%.

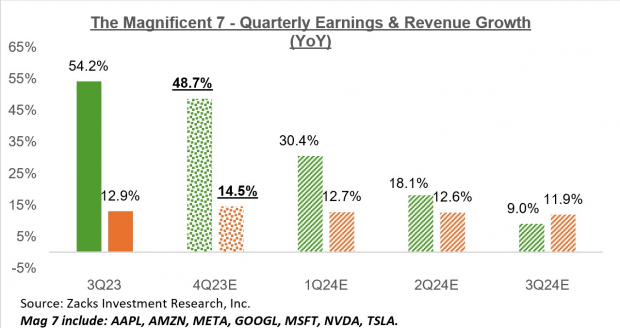

- For the Magnificent 7 companies, combining the actual results for the 6 companies that have come out with estimates for the one still-to-come company, total Q4 earnings are on track to be up +48.7% from the same period last year on +14.5% higher revenues.

You can see the group’s earnings and revenue growth picture in the chart below.

Image Source: Zacks Investment Research

The Mag 7 companies combined are on track to account for 23% of all S&P 500 earnings in Q4; they account for 29.3% of the index’s total market capitalization. Had these 7 stocks been a sector, they would have the second biggest weight in the S&P 500 index, behind the Tech sector, which currently accounts for 37.3%. The Finance sector, which at one time was the biggest sector in the index, currently accounts for 12%.

Importantly, the Mag 7 earnings outlook is steadily improving. The +30.4% earnings growth expected for the group in 2024 Q1 is up from +25.7% last week, with estimates for the following quarters also going up.

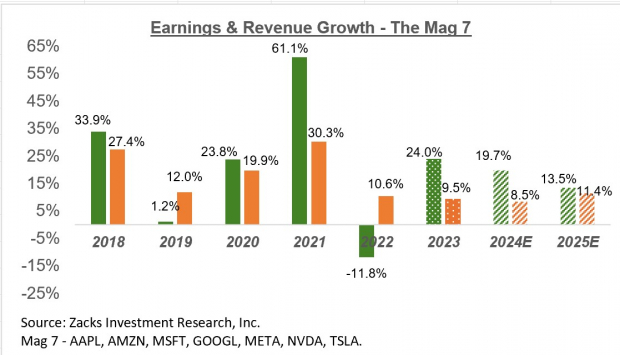

The chart below shows the group’s growth picture on an annual basis.

Image Source: Zacks Investment Research

Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

Given the expected moderation in the U.S. economy’s growth trajectory due to the cumulative effects of Fed tightening, these estimates likely need to come down. But the +4.7% revenue growth expectation is hardly aggressive, considering that the U.S. economy produced a nominal GDP growth rate in excess of +6% last year.

The rest of the 2024 earnings growth is coming from margin expansion, with 2024 net margins for the index going up to 12.4% from last year’s 11.7%. Embedded in this margin expectation is the view that the inflation cycle has run its course and the associated cost pressures that weighed on profitability over the last two years ease.

Please note that this year's expected margin of 12.4% for the index takes this key metric to where it was in 2021. We don’t see this margin (or revenue) outlook as unreasonable or out-of-sync with the economic ground reality."

We close the column today with a look at an economic powerhouse that continues to tank. Contributor Lynn Song provides some very cautious optimism regarding the outlook for China in China: Jan CPI Inflation Fell To The Lowest Level Since 2009, Likely To Mark The Bottom.

"China's January CPI inflation came in at -0.8% YoY, which is the lowest level since September 2009, and marked the fourth consecutive month of negative headline inflation.

By category, the primary drag on inflation continued to be food prices, which fell by 5.9% YoY, the lowest level on record. As expected, pork prices (-17.3% YoY) continued to be a major drag on inflation, while fresh vegetables (-12.7% YoY) and fruit (-9.1% YoY) also contributed to the drag. Food inflation has been in negative territory for 7 consecutive months. However, it is worth noting that this month's data may look particularly poor due to the holiday effect from last year's Lunar New Year occurring in January, while this year's is set for February. Household demand for food products (especially pork) for the holiday feast results in food prices surging around the holiday period.

However, non-food inflation also came in somewhat softer than expectations at 0.4% YoY...

Headline CPI fell to 14 year low

The weaker-than-expected headline numbers will likely add fuel to the fire of the debate over whether or not China is facing deflation risks.

In our view, the deflation argument is overstated, and the base effects makes January's data look worse than they are. Sequential data paints a more upbeat picture. In MoM terms, headline CPI rose 0.3%, food CPI rose 0.4%, and non-food CPI rose 0.2%. While a far cry from the above-target inflation levels seen in many other economies, these numbers do not imply China is stuck in a deflationary spiral."

That's a wrap for today.

Onwards and upwards for the S&P 500!

Peace.

More By This Author:

Tuesday Talk: A Good Month - Two Days To Go

Thoughts For Thursday: Indices Continue Climbing

Tuesday Talk: Spiking