The UK In Recession? Expected Or Unexpected?

Image source: Pixabay

With two quarters of GDP decline in the UK according to the current vintage of data, it’s reasonable to ask if the UK is in recession. ONS discusses the limitations of using the two-quarter rule of thumb here. Figure 2 of this study illustrates the dangers of relying upon the two-quarter rule when the GDP data are subject to revision. See additional discussion using the “technical” definition, AP, CNN, Bloomberg. It’s also of interest to consider whether statistical methods relying on financial indicators would have predicted a recession, variously defined.

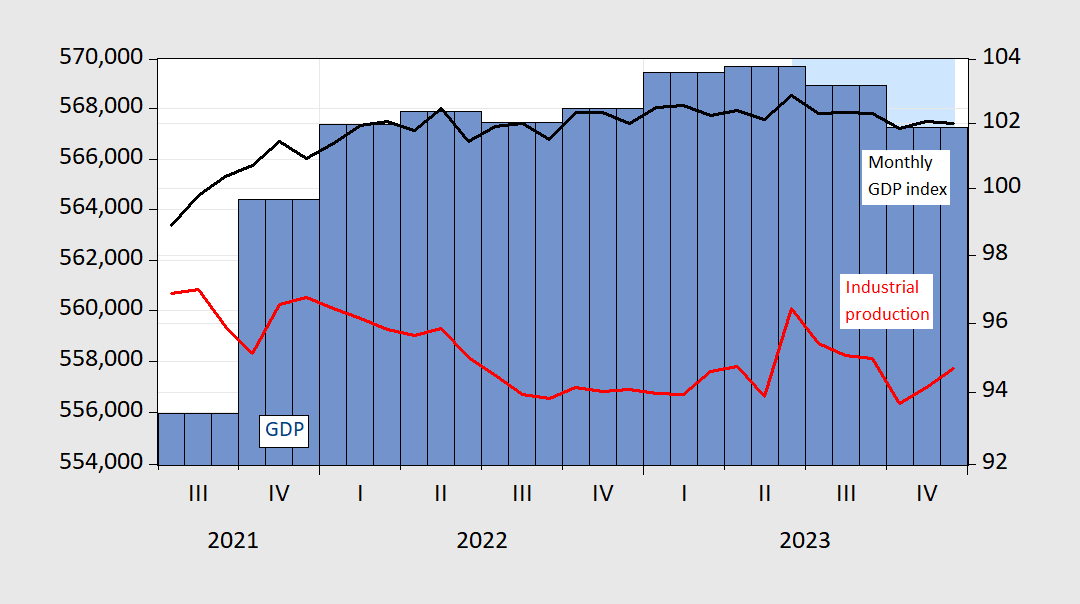

Here’s a picture of GDP, monthly GDP, and industrial production ex-construction:

Figure 1: Real GDP (blue bar, left log scale), monthly real GDP (black line, right log scale), industrial production ex-construction (red, right log scale). Source: ONS. A hypothesized peak-to-trough 2023M06-2023M12 recession shaded light blue.

I mark the end of the recession at 2023M12 since I have no additional data past that time, and BoE Governor Bailey argues the recession might already be over.

As a counterpoint, NIESR observes:

…the state of the UK economy is better described by the fact that GDP fell between the first quarter of 2022 and the final quarter of 2023.

So perhaps the recession is 2022Q2 to 2023Q4, peak-to-trough.

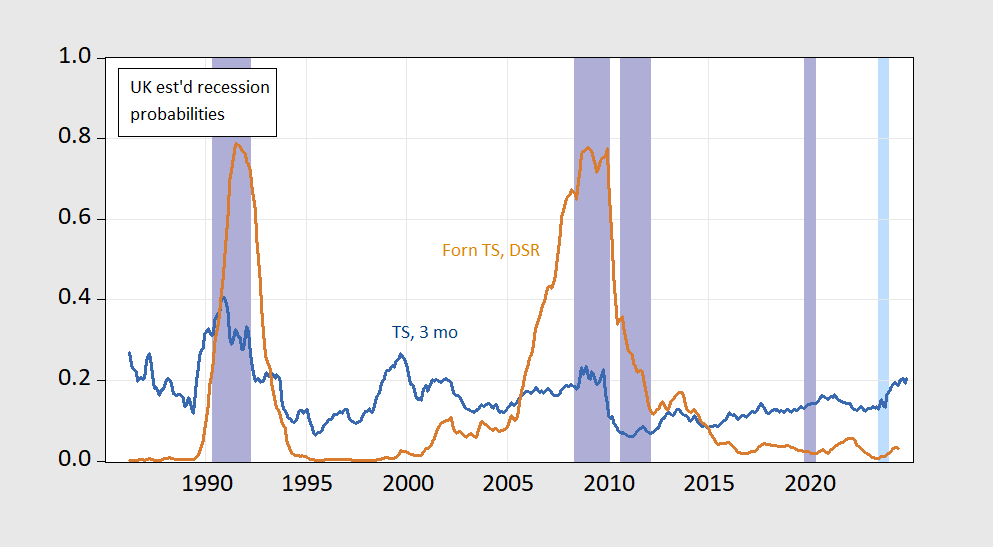

Would we have predicted either of these recessions (if indeed one or the other is a recession)? I compare an estimate from a simple 10yr-3mo spread plus short rate (blue line), against a foreign term spread plus debt service ratio (tan line), the latter suggested by Chinn-Ferrara (2024).

The answer is likely no (for a 1985-2022 sample), unless a very low threshold was used.

FIgure 2: Estimated probabilities from probit model on spread and short rate (blue line), and on foreign spread, debt service ratio (tan line). ECRI defined peak-to-trough recession dates shaded lilac. Hypothesized 2023M06-M12 recession shaded light blue. Source: author’s calculations and ECRI.

While a debt-service model based regression specification has a much higher pseudo-R2 (0.38), the implied recession probabilities are quite low for 2023. Interestingly, the spread plus short rate has a very low pseudo-R2 (0.08), but accords a much higher probability of recession — although well short of 50%. This is in contrast with research which indicates the spread is a good predictor of recessions (Mills, Capehart and Goodhart, 2019), although their sample was much longer than the one I used.

More By This Author:

CFNAI For January, WEI For Mid-February

Fed Funds Vs. Spreads In Recession Prediction

Other Metrics For Evaluating Recession Onset And The “Technical Recession” Of 2022H1