Fed Funds Vs. Spreads In Recession Prediction

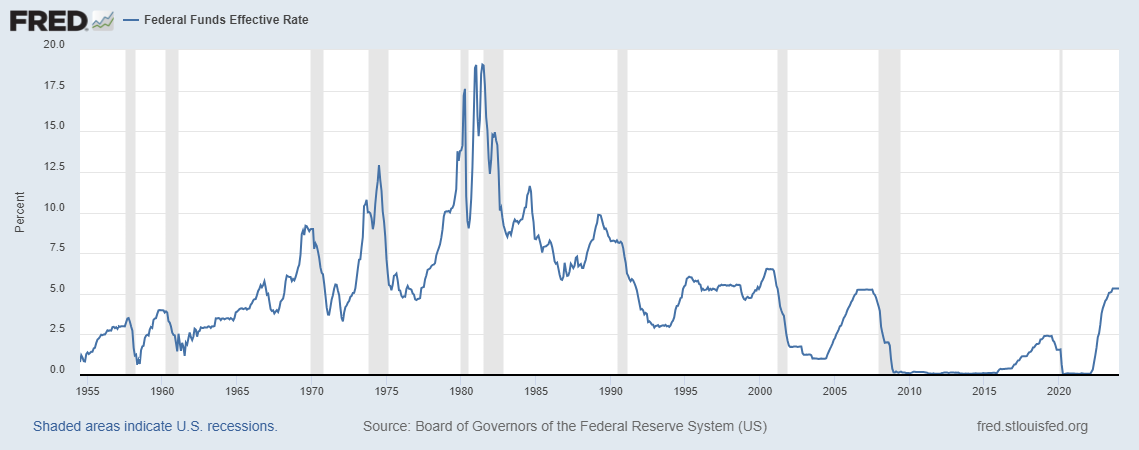

Reader Bruce Hall notes the correlation between Fed funds rate peaks and recessions, as a counterpoint to my use of spread inversions.

(Click on image to enlarge)

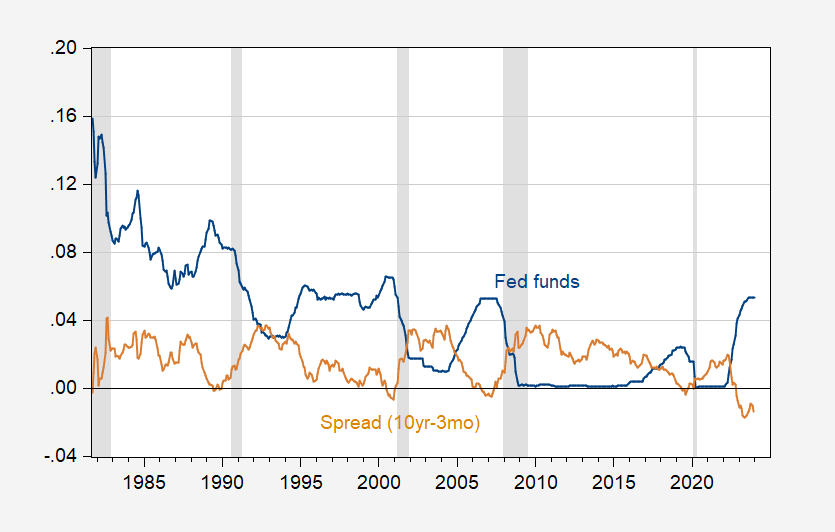

Let’s compare peaks to inversions:

Figure 1: Fed funds (blue), and 10yr-3mo Treasury spread (tan). NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, Fed via FRED, NBER.

Inversions and peaks precede recessions. Which one does better as a single predictor? I assess using a standard probit regression.

Figure 2: Probit regression on recession lead by 12 months on Fed funds (blue), and on 10yr-3mo Treasury spread (tan). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

The probit regression on the Fed funds has a pseudo-R2 of 0.07, while that on the spread has a pseudo-R2 of 0.27.

For my part, I’ll stick to the spread.

More By This Author:

Other Metrics For Evaluating Recession Onset And The “Technical Recession” Of 2022H1Recessions Defined And (Maybe) Predicted

Exchange Rate Pass Through Into Import Prices, CPI