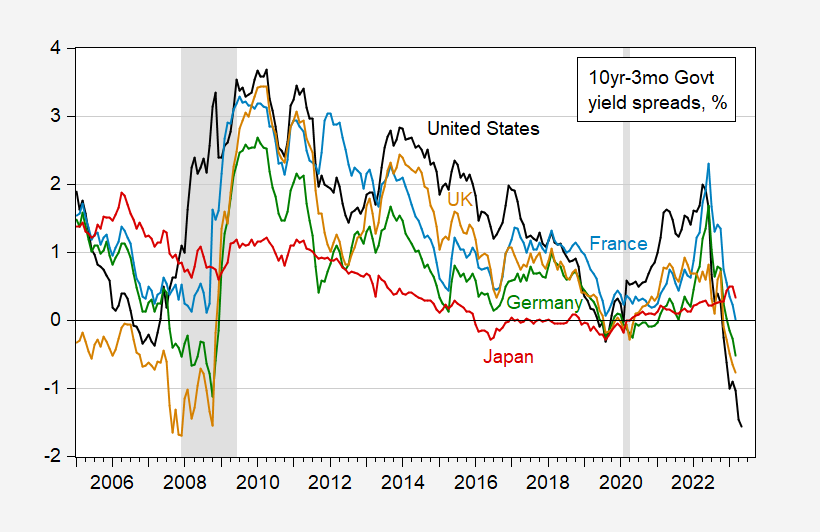

Term Spread Inversion And Non-Inversions

The 10yr-3mo term spread is remarkably synchronized for some large advanced economies.

Figure 1: 10 year – 3 month spreads for US (black), Germany (green), France (light blue), UK (tan), Japan (dark red), all in %. NBER defined US peak-to-trough recession dates shaded gray. Source: OECD, NBER.

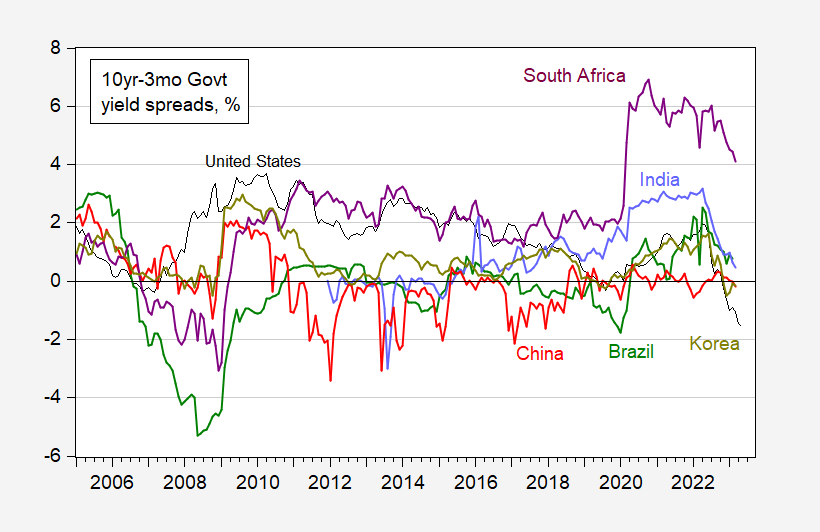

Not so much for emerging markets:

Figure 2: 10 year – 3 month spread for US (black), Brazil (green), India (blue), China (red), South Africa (purple), Korea (chartreuse), all in %. Source: OECD, Investing.com.

What does this mean for future economic activity? Stay tuned.

More By This Author:

The Labor Market – Bargaining Power, Wages, Inflation

World Bank’s Global Economic Prospects, June 2023

FT-Booth School June Survey Of Macroeconomists: Recession Start In 2024