TalkMarkets Tuesday Talk: Making Money "The Old-Fashioned Way"

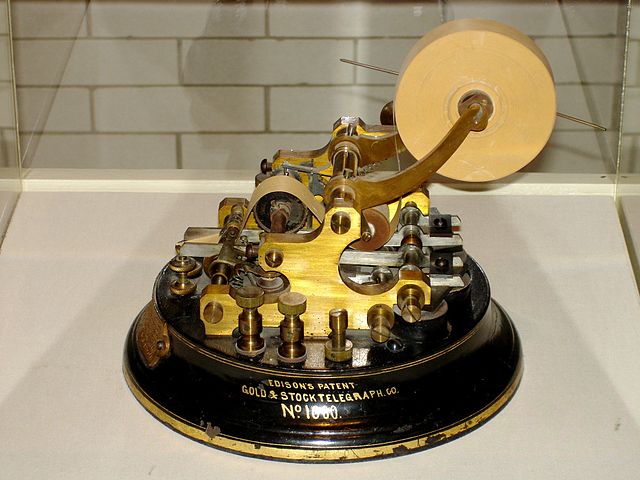

By H. Zimmer - Own work, CC BY 3.0, Wikimedia

When I was a growing up, the investment firm of Smith Barney (no longer around) used to run ads on television featuring the actor John Houseman touting the line “At Smith Barney we make money the old-fashioned way, we earn it”. That line was supposed to earn your trust. These days one can’t imagine either Wall Street or the Fed winning anyone’s trust with that line. However, earning it the old-fashioned way is proving to be a new truism for many newly laid off professionals whom, due to the COVID-19, recession have lost their jobs. Many are now working as stock-pickers in online warehouses and other types of employment typically reserved for students and high school grads. What a year of upheaval this has been.

This morning, the S&P futures are up 25 points, the Dow futures 183 points, and the Nasdaq futures 102 points, and this is with no recovery in sight. Crazy you say? Let's take a look at what our TalkMarkets contributors have to say...

Lance Roberts, in his article The Odds Are Stacked Against Investors In A Post-COVID Economy writes that “Investors are currently under the assumption the economy will make a “V-shaped” recovery and return to pre-pandemic levels. Given the surge in debts and deficits, a continuing demographic shift, and the lag of employment recovery, it is unlikely such an optimistic recovery will be possible in the short-term.”

As usual, Roberts graphs the facts using past downturns as data points and warns investors, that despite all the liquidity being provided by the Fed, “this time won’t be different”. Investors should be wary of falling for the siren song of the current market rally. In a short paragraph titled “The Future Of Low(er) Returns” he says:

“It is critical to remember the stock market is NOT the economy. The stock market should be reflective of underlying economic growth, which drives actual revenue growth. However, when investors pay more than $1 for a $1 worth of profits, there is an eventual reversal of those excesses.”

Sounds like as a good a definition of a “stacked deck” as any.

In the TalkMarkets “Featured Video” section Chris Ciovacco, walks us though his outlook and some new hypothetical year-end 2020 targets for the S&P 500.The TalkMarkets feature, The Short, Intermediate, And Long-Term Outlook For Stocks calls-out two half-hour videos of charts and commentary regarding the current state of the markets. Watch and learn.

This morning Warren Patterson and Wenyu Yao of ING Economics look at the Energy and Metals markets in their article, Struggling To Breakout. While it seems that oil prices will currently continue to push sideways around $40 per barrel, “oil is likely to continue trading in a rangebound manner for the remainder of the week”, the outlook for precious metals seems to be a continuation of the up trend in prices, “Precious metals traded higher on Monday, silver prices led the way, with the most active contract on COMEX trading above US$20/oz, as the continued move towards safe-havens and concern about mine supply helped prices jump to multi-year highs. Along with that, soaring gold prices have also remained a major supportive factor for the recent rally in silver.”

They also noted increased demand for base metals such as copper and zinc, as the Chinese economy continues to recover. On the other hand demand for aluminum is flat or down.

The team at Admiral Markets in EU Finds Agreement In Massive Stimulus Deal report that, “European leaders have finally struck a deal on a massive coronavirus recovery stimulus fund after a marathon summit of negotiations. The talks, which went on four days and nights, saw a split between frugal member nations who wanted to balance the cost of the stimulus program and member nations who have been hit the hardest by the virus.”

Though there has been much commentary about the expected severity of the EU recession Admiral staff report that the news has been welcomed heartily in the markets with both the DAX and the FTSE well in the green today.

“The deal is comprised of €390 billion in grants to member states who have been hit the hardest by the coronavirus pandemic, with Italy and Spain set to be the main beneficiaries. An additional €360 billion will be made available in the form of low-interest loans to all members of the bloc.”

Of course it is now up to the EU bureaucracy to put the plan into action, effectively. A daunting task indeed.

Reuters' Lipper Alpha Insight, in an article entitled "Home Time Means Online Sales Rocket," discusses the increase in online retail sales for DIY, home furnishings and delivered to your home meals as a result of the COVID-19 pandemic. Several data points show the surge in online retail sales means big bucks for those firms with strong online capabilities.

“Ultimately, retailers with a solid e-commerce strategy continue to show the capability to provide greater organization resilience to ensure business continuity during the pandemic. Various retailers and restaurants continue to tell us that the pandemic accelerated their e-commerce transformation, resulting in strong digital sales.”

Some of the companies highlighted are Lowe’s (LOW), Home Depot (HD), Lovesac (LOVE), Papa John’s (PZZA) and Walmart (WMT).

In other news ZeroHedge's Tyler Durden reports in World's Largest Producer Of Small Gasoline Engines Files For Bankruptcy, that Briggs and Stratton (BGG) has filed for Chapter 11.

“Todd Teske, Briggs & Stratton's CEO, stated the Company faced "challenges" during the virus pandemic that made reorganization "necessary and appropriate" for the survivability of the Company…Briggs & Stratton is the world's top engine designer and manufacturer for outdoor power equipment, with 85% of the small engines produced in the U.S. The pandemic and resulting virus-induced recession have been brutal for the Company, with declining engine sales, resulting in a reduction in the US workforce. “

I hope the company emerges stronger from Chapter 11, the name for me is synonymous with summer and lawn mowing. I had a lawnmower with a Briggs and Stratton engine when I was a kid and mowing lawns was one of the ways I learned to “earn money the old-fashioned way”. Have a good week.

Good article, thanks.

Glad you liked it.

This is a good and important read

Thanks.

Quite an interesting article indeed. With a lot of valid conclusions. I too hope that the economy recovers, and that the financial sector gets more regulation, and that creating "derivatives" becomes a punishable crime. And we would all be better off, long-term, if "leveraging" were regulated more than it is.

Sadly, the financial sector needs tremendous reform, regulation and oversite. But as long as they keep donating billions to the politicians, they'll never get more than a slap on the wrist.

Unfortunately, you are correct. Certainly money does talk, and just as certainly some folks listen and act as requested.

You sound like you have some kind of axe to grind William? Why do you feel so strongly about it?

My motivation? My ax to grind? Simply look at the damage done by those causing the "crunch" back in 2008. Consider the damage that was done to many folks.

Was just curious if you were personally ever impacted by this. I know many who were. Seems like the little guy always gets the raw end of the stick here. There is a different rule of law for the rich and powerful (aka Wall Street).

OK, short answer is YES, I was impacted in the form of financial loss. I am very far from "the rich and powerful", not even part of the "Fairly wealthy and somewhat powerful" group. The impact was not a Disaster, but certainly an inconvenience.

I hear you buddy. I was very into the Occupy Wall Street movement back when I thought it would bring about some real change. But money talks and the politicians always listen. It's a messed up system.