TalkMarkets Tuesday Talk: A Run Up To The Election Round-Up

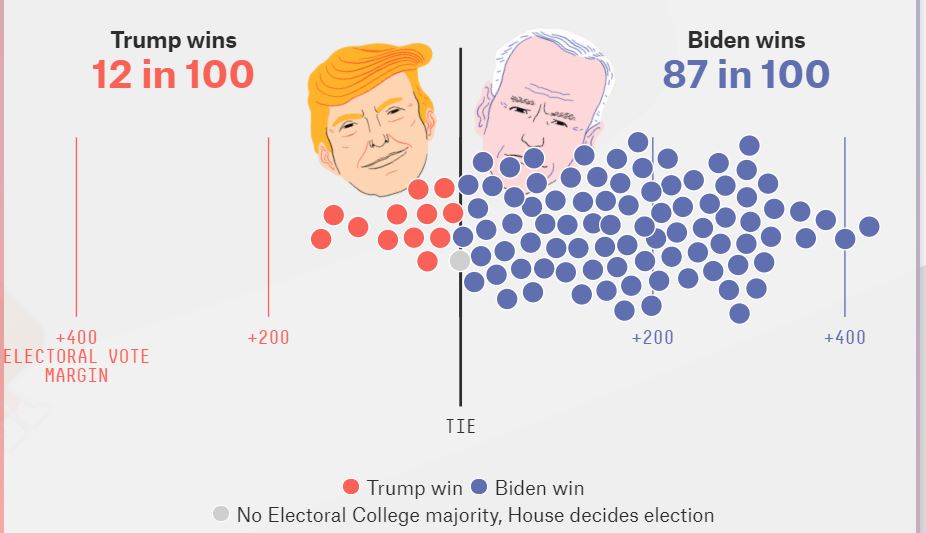

Today is Tuesday, October 27 and that means we are just shy of 7 days till the U.S. Elections. The latest sample of 100 possible outcomes conducted by Nate Silver of 538, gives Trump a 12 in 100 chance of winning, Biden an 87 in 100 chance, and a 1 in 100 chance of no Electoral College majority (House of Representatives decides the race).

The majority of other polls also give Biden the edge, but as the folks at 538 remind us:

So if the markets have already factored in a Biden win, and many companies reporting better than expected Q3 earnings what was the cause of the sharp bump downwards, yesterday? Realization that there will be no pre-Election stimulus package, COVID-19 worries, the one day, 21% drop in software maker SAP's (SAP) stock (yesterday the company said that the pandemic will delay the company's plans for cloud revenue and overall sales and profit goals by one to two years)? Jitters and more jitters. But a seesaw is a seesaw and U.S. Market futures are trading in the green this morning, albeit light green. To keep things in perspective see the 1 day, 1 month and 1 year performance metrics for the S&P 500 and the Nasdaq below:

1 Day - October 26

![]()

M-t-D September - October

![]()

Y-t-D 2019-2020

![]()

Source: The New York Times

In today's column we look at what is on the minds of our TalkMarkets' contributors other than (but not despite COVID-19) the election.

Jim Wiederhold in a TalkMarkets Editor's Choice article entitled A Supply Drop And Demand Pickup Pushed Soybeans To A Three-Year High, brings us up to date on what has been a recent rollercoaster ride for the commodity (SOYB) in terms of both supply (weather related) and demand (largely COVID-19 related).

"Only a few months ago, it seemed that global soybean supplies were more than ample, and in the case of the U.S., a semi-permanent soybean mountain had been built in the wake of damaged demand from its top customer, China. Fast forward to late October 2020, and the S&P GSCI Soybeans is up 29% since the low in March of this year, making a new high last week driven by abrupt supply cuts and the rapid return of export demand. Earlier this month, the USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report forecast a large, and somewhat unexpected, reduction in global soybean stocks. Exhibit 1 illustrates global soybean ending stocks in the 2020-2021 crop year dropping in October 2020 to the lowest level in four years."

Wiederhold makes the following observations worth noting:

- "Brazil and the U.S. make up approximately 85% of total soybean exports, and there have been supply issues in both countries."

- There is an increased possibility of South American supplies tightening in 2021, particularly if the current La Niña weather pattern leads to drier conditions in Brazil and Argentina. Similarly, in the U.S., dry conditions have negatively affected yields.

- On the demand side of the ledger, China imports roughly 60% of total global soybean exports. The recovery of China’s pork industry from the African swine fever has spurred imports in 2020.

- The 2018-2019 crop year coincided with the start of the China-U.S. trade war, which was the catalyst for U.S. soybean exports to plummet. Two years later, China’s commitment has rebounded substantially.

- According to the USDA, outstanding sales to China from the U.S. in mid-September 2020 totaled nearly 17.0 million metric tons, nearly equal to the record set in 2013."

Trade war or not Chinese pigs need to eat. It may be of further interest to note that China also, imported 1.68 million tons of pork in the first 5 months of 2020, 156% more than a year ago and of this amount the leading exporter was the United States with 333,445 tons.

The Staff at Upfina seem a bit more upbeat than last week, writing in This Global Wave Could Last Years? that "The global economy is in a cyclical upswing in spite of the spike in COVID-19 cases. The high frequency economic data isn’t as bad as you’d expect. There actually is high retail card spending growth in a few midwestern cities even though they are dealing with the worst of the virus."

They cite research and include graphs prepared by Bank of America (BAC) which details the how and why. Interesting reading which includes a splash or two of cold water, lest any readers get over enthused.

But the most newsworthy piece in the article comes at the beginning with Upfina reporting that the Swiss National Bank which owns over $100 million in U.S. equities may soon be forced to divest itself of its' defense related holdings. An upcoming national referendum in Switzerland on November 29, will pose just that question to it citizens.

"The proposal to force the SNB to sell shares in firms that derive more than 5% of their sales from arms is supported by 54% of Swiss citizens and opposed by just over 40%. The SNB will need to sell its shares in 300 firms which together are worth 11% of its portfolio of global stocks.

This is another slippery slope because morality might not stop there...Normally, many investors would say to try to maximize profits, but in this case, it’s the central bank owning the shares. There doesn’t seem like much downside for voters to support selling defense stocks. We don’t know when the sales will occur, but we do know when the vote happens, it should impact prices immediately."

Another thing for investors to keep in mind.

Quickly we go to Todd Campbell in a TalkMarkets exclusive, for a look at Best & Worst ADRs - Monday, Oct. 26. Currently the top rated sector is services and the top rated ADRs by country are Luxembourg, Bermuda and Canada. Campbell as usual provides a list of the best and worst in chart form:

As we struggle to grapple with macro and microeconomic upheaval on both societal and personal levels during this pandemic year, Econintersect economist Steven Hansen in September 2020 CFNAI Super Index Moving Average Index Continues To Suggest A Marginal Slowing Of The Economic Rate Of Growth draws our attention to the Chicago Fed's National Activity index, 3 month moving average, as an indicator worth watching. Hansen gives a very thorough and detailed explanation of the index in the article but some of his most interesting notes and observations are as follows:

-

This index is likely the best coincident indicator of the U.S. economy. A coincident indicator shows the current state of the economy. This month, there was a general slowing across the board for the economy - but the economy remains above the historical trend rate of growth. The economy has slowed from its rate of growth in 2018 but now has moved above territory associated with recessions.

- This index is a rearview mirror of the economy.

- A value of zero for the index would indicate that the national economy is expanding at its historical trend rate of growth and that a level below -0.7 would be indicating a recession was likely underway. Econintersect uses the three-month trend because the index is very noisy (volatile).

- Econintersect considers the CFNAI one of the better single metrics to gauge the real economic activity for the U.S. - and puts the entire month's economic releases into their proper perspective, although it is almost a month after the fact. It correlates well and historically has lead GDP.

So no recession for now. Certainly a lot better picture than the one in April.

Sounds like a good time to invest? Alex Kagin who likes Tech, in The 4 Best Tech Stocks In 2021 Are Pioneers Of The New Economy suggests where. Kagin picks four big trends for 2021 and suggests a stock for each trend.

"Big Data - The amount of data we produce every day is astronomical. So much that 90% of the world's data was created in the last two years alone. This means that making sense of this data has become a huge opportunity. And one company is making this all possible. Elastic NV (ESTC) was founded in 2012 as a search company that builds self-managed and SaaS offerings for search, logging, security, and analytics use cases. The company develops the open source Elastic Stack, which includes Elasticsearch, Kibana, Beats, and Logstash."

"Cloud Computing - Everyone knows the name Microsoft Corp. (MSFT), and chances are you use its products every day, from Windows to Word. But over the last few years, it has transformed itself into a cloud-first behemoth. Last quarter, its cloud computing services platform, Azure, grew revenue 47%, and while they don't break out its revenue, its commercial cloud revenue topped $50 billion for the fiscal year. That makes it larger than Amazon and Google."

"Drug Technology - As the world continues to wait for a COVID-19 vaccine from one of the dozens of companies developing a cure, we have realized one thing: Faster drug development could save millions of lives. Schrodinger Inc. (SDGR) has created one of the most advanced drug discovery platforms on the market. It's used by the world's largest pharmaceutical companies, which are also using it to develop drugs in house. In light of the pandemic, Schrodinger has grown its software revenue by 35% in the first half of 2020 vs. 2019 and has continued to move forward with the 12 programs that are in late-stage discovery.

"FinTech - The dramatic shift away from cash has created a huge opportunity for companies like Visa, PayPal, and Square that power our contactless society. But an even bigger opportunity comes from the ARK Fintech Innovations ETF (ARKF). Up 75% this year, there is still plenty of room to run given some of its high-growth tech holdings looking to capture large addressable markets.

Check out the article for more details. As always, caveat emptor.

That's a wrap for today. If you are in need of a reminder of why it is important to vote, here's one from Abraham Lincoln.

“Elections belong to the people. It's their decision. If they decide to turn their back on the fire and burn their behinds, then they will just have to sit on their blisters.”