Zoom Is Now Worth More Than The World's 7 Biggest Airlines

Amid the COVID-19 pandemic, many people have transitioned to working - and socializing - from home. If these trends become the new normal, certain companies may be in for a big payoff.

Popular video conferencing company, Zoom Communications, is a prime example of an organization benefiting from this transition. However, other industries haven’t been so lucky.

The Zoom Boom, in Perspective

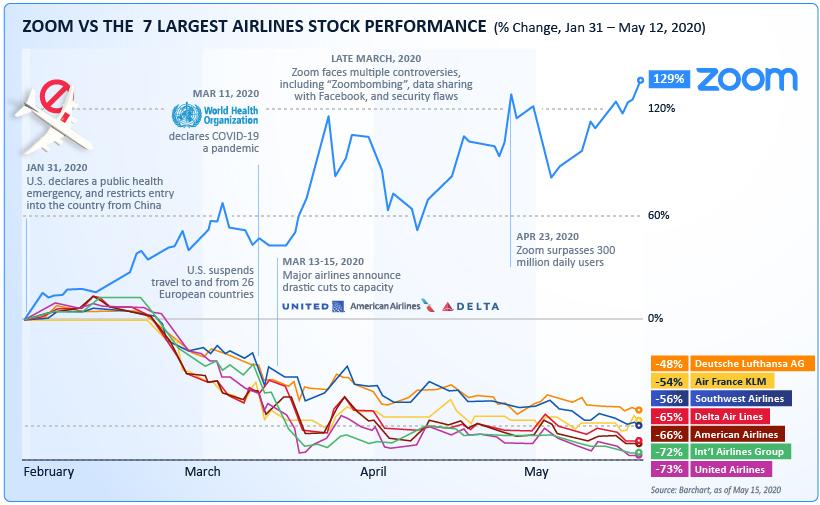

As of May 15, 2020, Zoom’s market capitalization has skyrocketed to $48.8 billion, despite posting revenues of only $623 million over the past year.

But, as Visual Capitalists' Imam Ghosh asks, what separates Zoom from its competition, and what’s led to the app’s massive surge in mainstream business culture?

Industry analysts say that business users have been drawn to the app because of its easy-to-use interface and user experience, as well as the ability to support up to 100 participants at a time. The app has also blown up among educators for use in online learning, after CEO Eric Yuan took extra steps to ensure K-12 schools could use the platform for free.

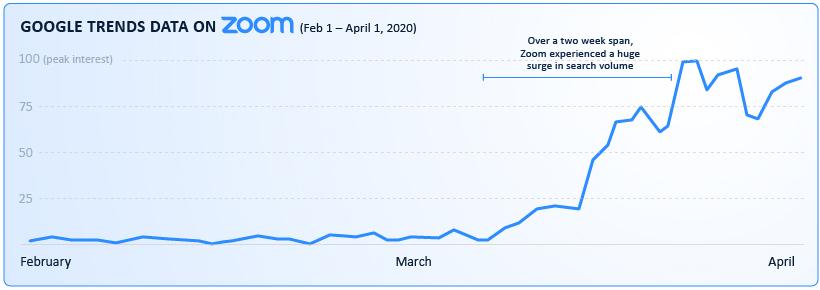

Zoom daily users have skyrocketed in past months, going from 10 million in December 2019 to a whopping 300 million as of April 2020.

The Airline Decline

The airline industry has been on the opposite end of fortune, suffering an unprecedented plummet in demand as international restrictions have shuttered airports:

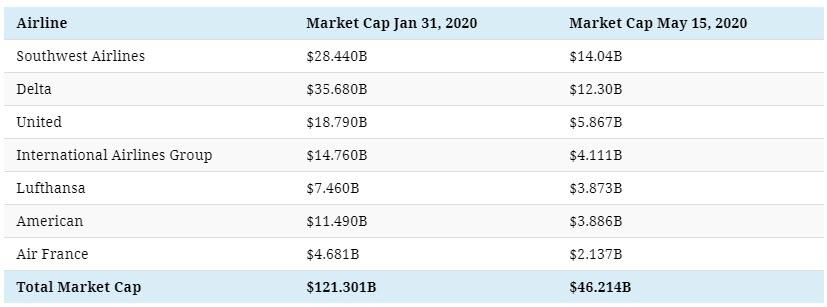

The world’s top airlines by revenue have fallen in total value by 62% since the end of January:

Source: YCharts. All market capitalizations listed as of May 15, 2020.

With countries scrambling to contain the spread of COVID-19, many airlines have cut travel capacity, laid off workers, and chopped executive pay to try and stay afloat.

If and when regular air travel will return remains a major question mark, and even patient investors such as Warren Buffett have pulled out from airline stocks.

Source: YCharts, as of May 15, 2020.

"The world has changed for the airlines. The future is much less clear to me about how the business will turn out."

- Warren Buffett

What Does the Future Hold?

Zoom’s recent success is a product of its circumstances, but will it last? That’s a question on the mind of many investors and pundits ahead of the company’s Q1 results to be released in June.

It hasn’t been all smooth-sailing for the company—a spate of “Zoom Bombing” incidents, where uninvited people hijacked meetings, brought the app’s security measures under scrutiny. However, the company remained resilient, swiftly providing support to combat the problem.

Meanwhile, as many parts of the world begin taking measures to restart economic activity, airlines could see a cautious return to the skies—although any such recovery will surely be a “slow, long ascent”.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

With both Facebook and Google announcing that they plan to take on Zoom, it's days are numbered. They will become like the Palm Pilot or Netscape. $ZM

Yawn, their tech is nothing spectacular and there is going to be increased competition by others who can offer the same thing without getting barred by the US government and most tech leaders who found them dencrypting messages in China and then re-encrypting them. The only thing that keeps people from shorting this back to the ground is that undoubtedly they will get a huge portion of the Chinese market and may be bought out by a US tech company someday. It is always easier to buy clients than it is to build them over time.

Yes, the tech giants have already set their eyes on Zoom. Their days are numbered and their lack of security features and constant "zoombombs" will continue to plague the company.

#Zoom is a $20 dollar stock masquerading as part of #FAANG. $ZM

#Zoom P/E is almost at 2000. Way over priced. That’s dangerous for investors.

The new age market doesn't care about valuations. It's crazy. Just look at shop. Already priced for future earnings 10 years out.

I know it’s crazy. It just shows people are not doing dd. I looked up #zoom to buy and was so surprised at the p/e number. The p/e should be at 13-30. 2000??? One bad or even neutral news this stock will fall off a cliff. $ZM

I know. It just shows people are not doing dd. I looked up zoom to buy and was so surprised at the p/e number. The p/e should be at 13-30. 2000??? One bad or even neutral news this stock will fall off a cliff.