Will The Nasdaq 100's Relief Rally Hold Or Is A Sharp Decline Inevitable?

Image Source: Pixabay

Watch the free-preview video below extracted from the WLGC session before the market opens on 23 Jul 2024 to find out the following:

- How might the rotation of funds into small-cap stocks and the Dow Jones affect the Nasdaq 100?

- How can we spot the exhaustion of the downward momentum and hidden demand?

- Why could more weakness be ahead in the Nasdaq 100 and what to expect next?

- And a lot more...

Video Length: 00:06:53

Market Environment

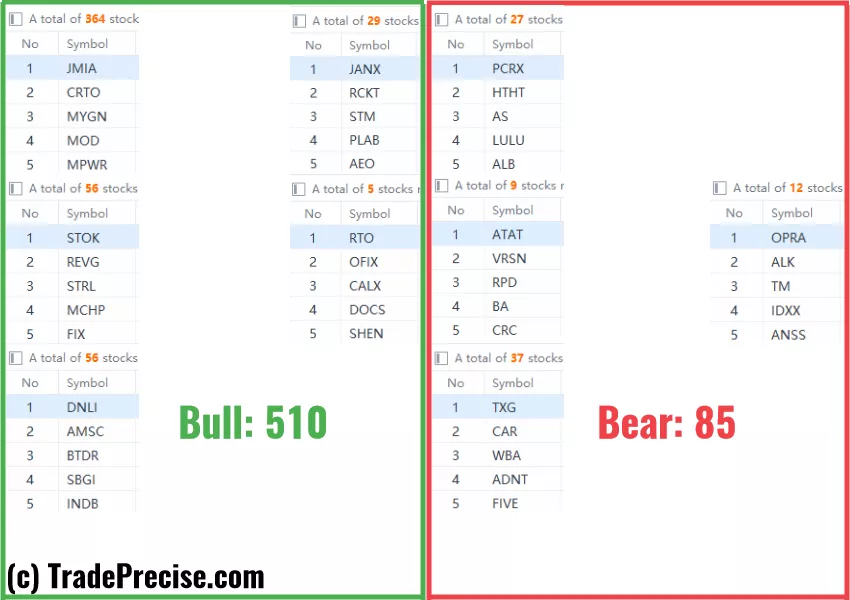

The bullish vs. bearish setup is 510 to 85 from the screenshot of my stock screener below.

The ongoing rotation from the Nasdaq 100 & S&P500 into the Russell 2000 as mentioned in last week’s email is further manifested in yesterday’s price action among the indices.

Despite the weakness reflected in the major indices, there is still no shortage of bullish setups (510 bullish setups vs. 85 bearish setups) thanks to the market rotation.

3 Stocks Ready To Soar

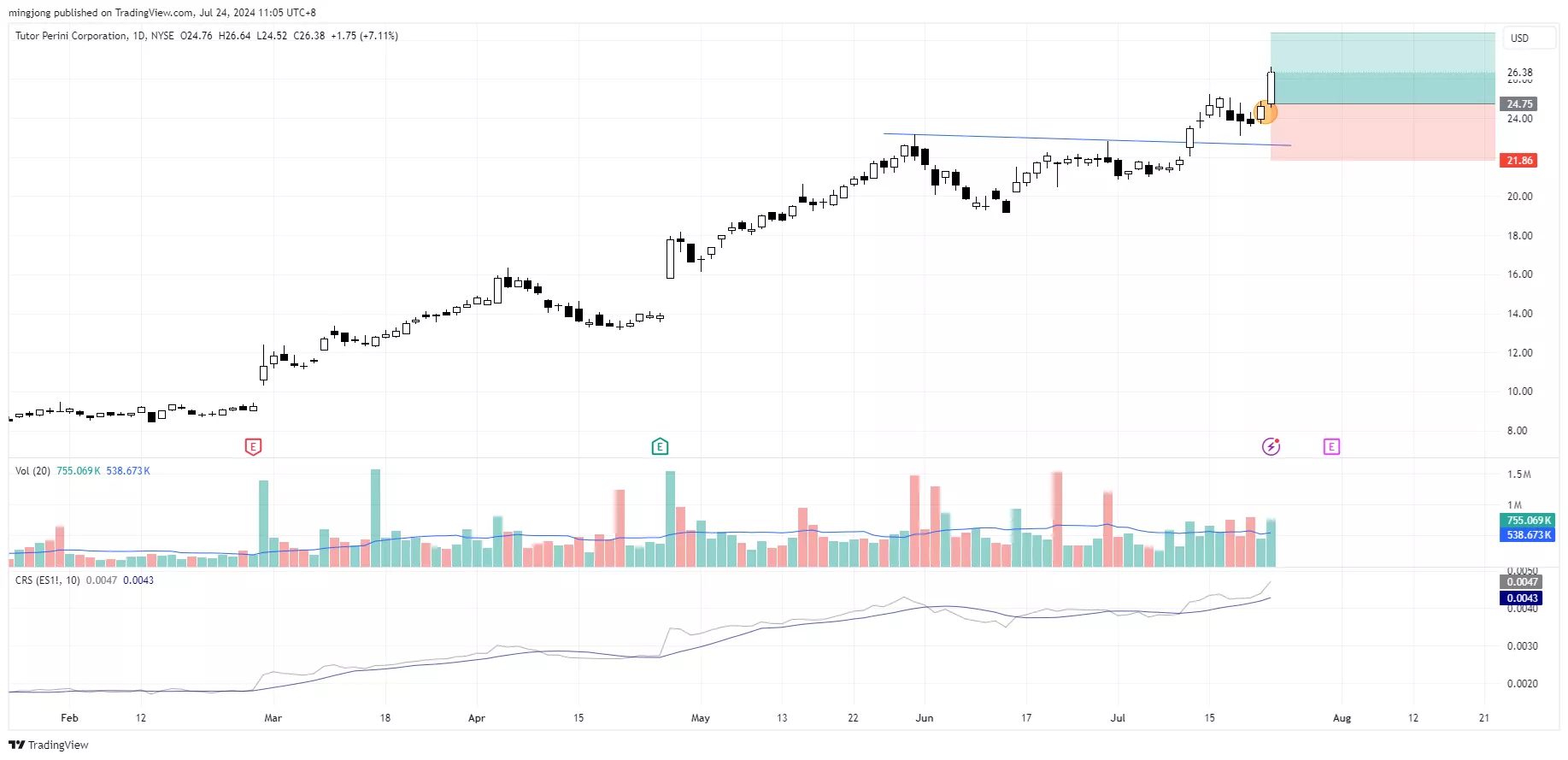

5 “low-hanging fruits” trade entries setups CLBT, TPC + 19 actionable setups CVNA were discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

How The Hidden Signs Of Selling Into Strength Could Shake The S&P 500

Low Volume Flag Breakout! What’s Next For S&P 500?

Could This Be The Turning Point? The S&P 500's Next Big Move Explained

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.