What You Should Know About Dividend Paying Stocks

Image Source: Pixabay

It’s no secret that we all love to get paid. And when you think about it, dividend stock payments are essentially investors’ versions of paydays within the stock market.

Dividends provide a passive income stream, limit the impact of drawdowns in other positions, provide more than one way to profit from an investment, and provide the ability to reap maximum returns through dividend reinvestment.

There are several parameters investors can follow to aid them in constructing an income-generating portfolio. Let’s take a closer look at a few key aspects that investors shouldn’t ignore.

Higher Dividend Yields Are Not Always Better

Right off the bat, a stock’s annual dividend yield is obviously a focal point. It’s crucial to know that dividend yields are constantly fluctuating, calculated by dividing the annual dividend per share by the current stock price. If the stock price goes down, yields go up, and the opposite is also true.

However, as attractive as high-yielding investments may be, they’re not always the correct choice for investors who seek reliability. But why?

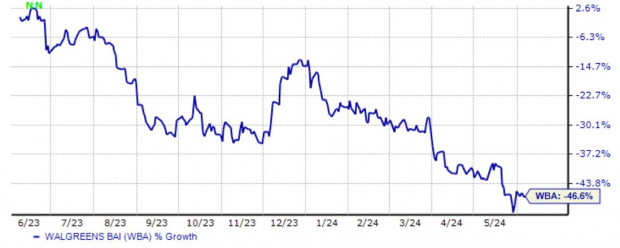

Some high-yield stocks can be ‘dividend traps’, where the high yield wows investors but the company’s fundamentals are weak under the hood. An interesting example of this has been Walgreens Boots Alliance (WBA - Free Report), whose shares currently yield a sizable 6.1% annually.

While the yield is attractive, WBA shares have lost 46% in value over the last year, leaving a significant dent in any initial investment.

Image Source: Zacks Investment Research

So, while high-yielding stocks are suitable for stacking a cash pile quickly, long-term reliability is not on the side of investors.

Keep an Eye on the Dividend Payout Ratio

The dividend payout ratio measures the proportion of a company's earnings paid out as dividends to shareholders, always expressed as a percentage.

For example, if a company reported a net income of $50 million and paid out $25 million in dividends, the payout ratio would be 50%. A high payout ratio indicates that the company distributes a more significant portion of its earnings to shareholders, which is attractive to income-focused investors.

However, a high payout ratio may not be sustainable if the company faces an adverse liquidity situation.

A dividend payout ratio of 30% to 60% is generally considered sustainable for mature companies with stable earnings and cash flows, although this does differ from industry to industry. Atmos Energy (ATO - Free Report), a current Zacks Rank #2 (Buy), has a payout ratio sitting at 48% of the company’s earnings.

Below is a graphic illustrating the company’s key dividend metrics.

Image Source: Zacks Investment Research

Dividend Reliability is King

And when looking for dividend reliability, look at the Dividend Aristocrats.

Dividend Aristocrats have shown an unparalleled commitment to shareholders through 25-plus years of increased dividend payouts. These companies are commonly regarded as some of the most dependable and financially stable in the market, as they’ve demonstrated their ability to maintain and grow dividends even during rough economic times.

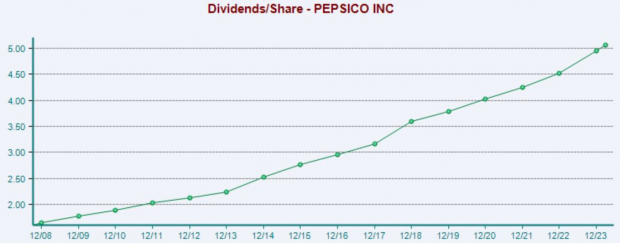

A famous example of a Dividend Aristocrat is consumer staples heavyweight PepsiCo (PEP - Free Report), which also currently sports a favorable Zacks Rank #2 (Buy). The company has years of increased dividend payouts under its belt, reflecting its commitment to rewarding shareholders in a big way.

Below is a chart illustrating the company’s dividend payouts on an annual basis. Please note that the last value is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Putting Everything Together

Dividends can provide a massive boost to any portfolio, helping to offset the losses in other positions and allowing the opportunity to maximize gains through dividend reinvestment.

When considering dividend-paying stocks, three areas of focus for investors include the current annual yield, the payout ratio, and the overall reliability of the dividend.

More By This Author:

Insiders Are Buying These 3 StocksBear Of The Day: Skyworks Solutions

2 Dividend Stocks To Buy For AI Exposure: VRT And DLR