Insiders Are Buying These 3 Stocks

Image Source: Pexels

Investors closely monitor insider buys, as they can deliver a positive message to shareholders, reflecting overall business confidence.

Of course, many strict rules apply to insiders.

Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.

In addition, insiders have a longer holding period than most, a critical aspect that investors should be aware of.

Three companies – Cummins (CMI - Free Report), Packaging Corp. of America (PKG - Free Report), and Public Storage (PSA - Free Report) – have all seen recent insider activity. For those interested in trading like the insiders, let’s take a closer look at each.

Cummins Insider Buys $80k in Shares

Cummins is a leading global designer, manufacturer, and distributor of diesel and natural gas engines and powertrain-related component products. The VP recently made a small purchase, scooping up roughly 280 shares at a total cost of just above $80k.

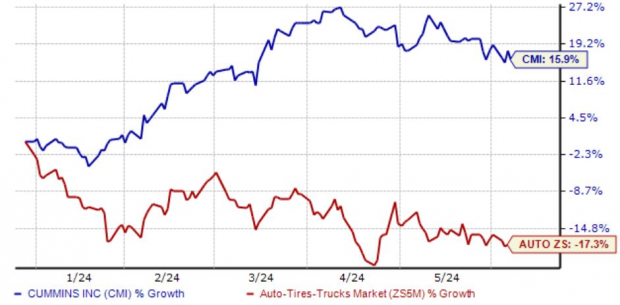

Shares have been strong year-to-date, gaining 16% and widely outperforming relative to the respective Zacks Auto sector. The relative strength has been aided by quarterly results, with shares seeing post-earnings positivity in 2024.

Image Source: Zacks Investment Research

Public Storage Insider Buys 2.1k Shares

Public Storage's principal business activities include the ownership and operation of self-storage facilities and other related operations, including tenant reinsurance and third-party self-storage management.

A director recently made a decent-sized purchase, acquiring roughly 2100 shares at a total transaction value of just under $600k. Given its status as a REIT, income investors could be interested, with shares currently yielding 4.3% annually.

REITs must distribute at least 90% of their net earnings to shareholders as dividends. As shown below, the current yield crushes the Zacks Finance sector average. Bumpy price action YTD has boosted the yield, with PSA shares down 8% in 2024.

Image Source: Zacks Investment Research

Packaging Corp. of America Insider Dives in

Packaging Corporation of America is the third largest producer of containerboard products and a leading producer of uncoated freesheet paper in North America. A director recently stepped in and purchased 300 shares at a total cost of roughly $54k.

The company’s latest set of quarterly results came in above expectations, with shares moving higher since the release. Concerning headline figures, the company posted a 5% beat relative to the Zacks Consensus EPS estimate and posted sales 3.6% ahead of expectations.

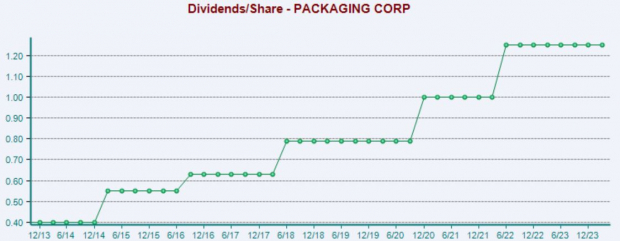

Lower expenses paired with higher volumes in its Packaging and Paper segments aided the company, with EPS also exceeding prior guidance. The company’s shareholder-friendly nature can’t be overlooked, currently sporting a 13% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, as they can provide a high level of confidence and conviction.

And recently, all three companies above – Cummins, Packaging Corp. of America, and Public Storage – have seen recent insider activity.

More By This Author:

Bear Of The Day: Skyworks Solutions2 Dividend Stocks To Buy For AI Exposure: VRT And DLR

3 Tech Stocks To Buy For Income