Bear Of The Day: Skyworks Solutions

Skyworks Solutions Inc. (SWKS) designs, manufactures, and markets a broad range of high-performance analog and mixed-signal semiconductors that enable wireless connectivity. The company's products include power amplifiers (PAs), front-end modules (FEMs), radio frequency (RF) sub-systems, and cellular systems.

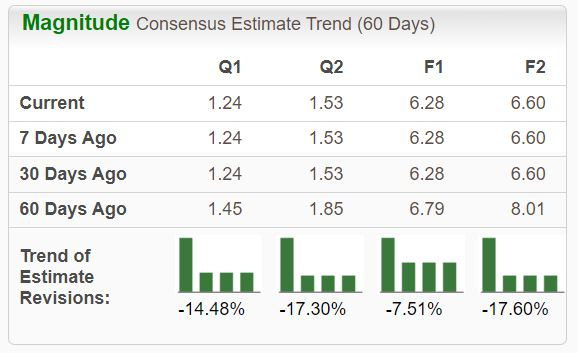

Analysts have taken a bearish stance on the company’s outlook, pushing it into a Zacks Rank #5 (Strong Sell).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Let’s take a closer look at the current state of the company.

Skyworks Solutions Shares Fall Post-Earnings

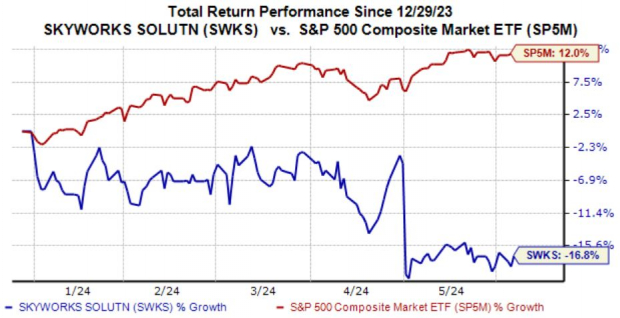

SWKS shares have struggled to find their footing year-to-date, down 16% compared to the S&P 500’s impressive 12% gain. The company’s latest set of quarterly results caused post-earnings selling pressure, with analysts also taking expectations lower following the release.

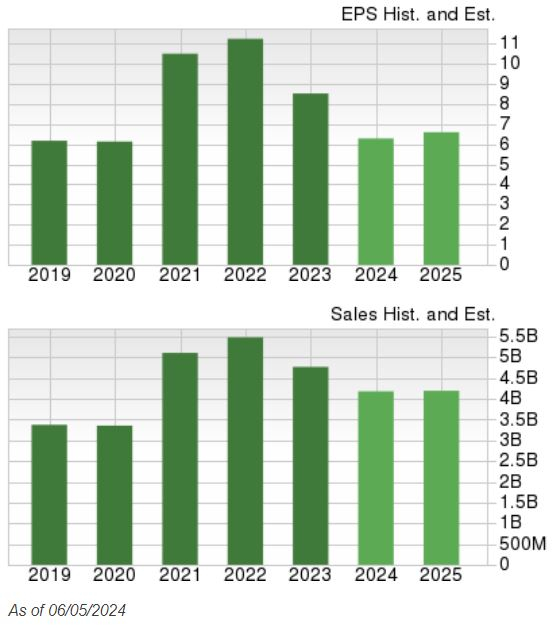

Earnings fell 26% year-over-year, whereas sales pulled back roughly 9%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

CEO Liam Griffin spoke on the results: "During the March quarter, in our mobile business, we saw below normal seasonal trends, with lower-than-expected end market demand. Over the long-term, we intend to leverage our connectivity technology across edge-connected IoT devices, automotive electrification and advanced safety systems, and AI infrastructure.”

So, while the company remains positive from a long-term standpoint, the near-term outlook remains cloudy, reflected by the downward earnings estimate revisions. The company is in the midst of a growth cooldown, with consensus expectations for its current fiscal year suggesting a 26% pullback in earnings on 12% lower sales.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts paint a challenging picture for the company’s shares in the near term.

Skyworks Solutions Inc. is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

2 Dividend Stocks To Buy For AI Exposure: VRT And DLR

3 Tech Stocks To Buy For Income

These 3 Companies Boast Bright Outlooks