These 3 Companies Boast Bright Outlooks

Image Source: Pixabay

Favorable earnings estimate revisions are key for a stock to move higher, precisely where the Zacks Rank comes into play.

The Zacks Rank uses four factors related to earnings estimates to classify stocks into five groups, ranging from ‘Strong Buy’ to ‘Strong Sell.’ Importantly, it allows individual investors to take advantage of trends in earnings estimate revisions and benefit from the power of institutional investors.

Let’s examine a few highly ranked stocks, including Stride (LRN - Free Report), Interactive Brokers (IBKR - Free Report), and Haemonetics (HAE - Free Report).

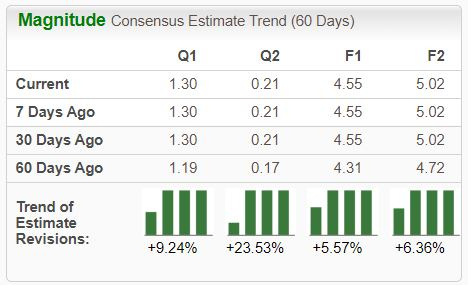

Stride Enjoys Profitability Boost

Stride is a premier provider of K-12 education for students, schools, and districts, including career learning services through middle and high school curricula. The stock sports a Zacks Rank #1 (Strong Buy), with earnings expectations higher across the board.

Image Source: Zacks Investment Research

Strong quarterly results have aided share performance year-to-date, with LRN shares adding 16% in value in 2024 relative to the S&P 500’s 12% gain. In fact, the company has exceeded the Zacks Consensus EPS estimate by an average of 42% across its last four releases.

Operational efficiencies have allowed the company to enjoy notable margin expansion, improving profitability considerably. Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

And the company’s growth is expected to remain robust, with consensus expectations for its current fiscal year suggesting 53% EPS growth on 10% higher sales.

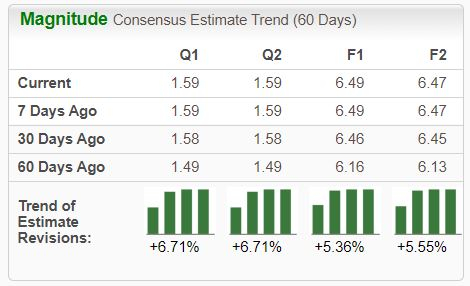

Interactive Brokers Shares Up +50% YTD

IBKR shares have been notably strong year-to-date, gaining +50% compared to the S&P 500’s impressive +12% gain. The company’s latest set of quarterly results brought post-earnings positivity, with it exceeding both earnings and revenue expectations.

Analysts have raised their earnings expectations across the board, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

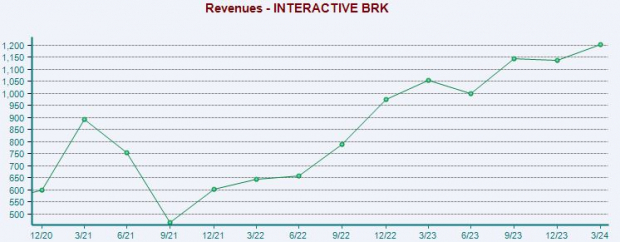

The results snapped a streak of mixed earnings results, with earnings and revenue growing by 21% and 25%, respectively. IBKR’s revenue growth has remained strong, with the company posting double-digit percentage year-over-year sales growth rates in each of its last seven periods.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

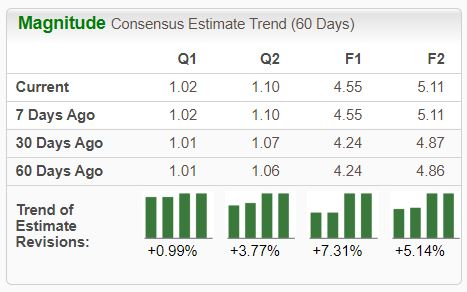

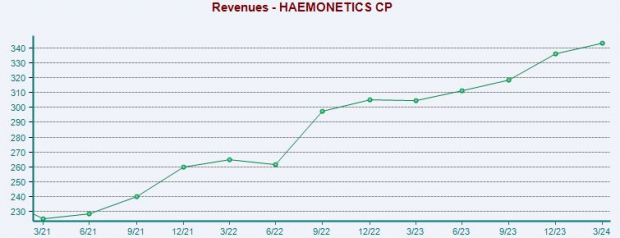

Haemonetics’ Sales Continue to Grow

Haemonetics provides blood management solutions to customers encompassing blood and plasma collectors, hospitals, and health care providers globally. Analysts have raised their expectations higher, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Like IKBR, the company has been enjoying notable revenue growth, posting double-digit percentage year-over-year sales growth in nine of its last ten periods. And growth is expected to remain solid, with consensus expectations for its current fiscal year suggesting 15% earnings growth on 7% higher sales.

Image Source: Zacks Investment Research

Bottom Line

Listening to the Zacks Rank can consistently result in market-beating gains, as positive earnings estimate revisions provide the fuel needed for shares to move higher.

All three stocks above – Stride, Interactive Brokers, and Haemonetics – presently sport a Zacks Rank #1 (Strong Buy), reflecting upward trending earnings estimate revisions.

More By This Author:

4 Factors That Drive Share OutperformanceThese 3 Tech Companies Recently Broke Quarterly Records

3 Stocks To Buy For Big Growth