What Happens In A Stock Market Recession And How To Survive

Rising interest rates, a more assertive Federal Reserve, challenges in addressing inflation, and geopolitical issues have all posed risks to the U.S. equity market, potentially impacting how users invest stocks in the U.S.

The market seemed resilient for most of the year, with stocks rallying despite these concerns. However, recent trends suggest a shift, with the stock market expiring symptoms of that during a recession.

The S&P 500 Index declined by 2.5% in the past week, marking a 10% drop from its July high. Similarly, the Nasdaq fell 2.6% last week, and it is now 12% down from July. (as of end of October, 2023)

With both indices experiencing a correction, it’s important to understand what a stock market recession is, and how investors can navigate through it.

So, let’s read the article and learn more about navigating recessions!

Stock Markets in a Recession

A market correction happens when there’s a decrease in the price of stocks in the overall market or a specific sector. Even investing in Amazon or Tesla stocks during the most recent recessions led to a serious drop in investment value. Specifically, it’s when prices drop by 10% to 20% from their most recent high.

This can happen to broad markets like the S&P 500, specific types of goods like commodities, or even single stocks from popular companies. This can be a significant concern for investing in stocks in the short term.

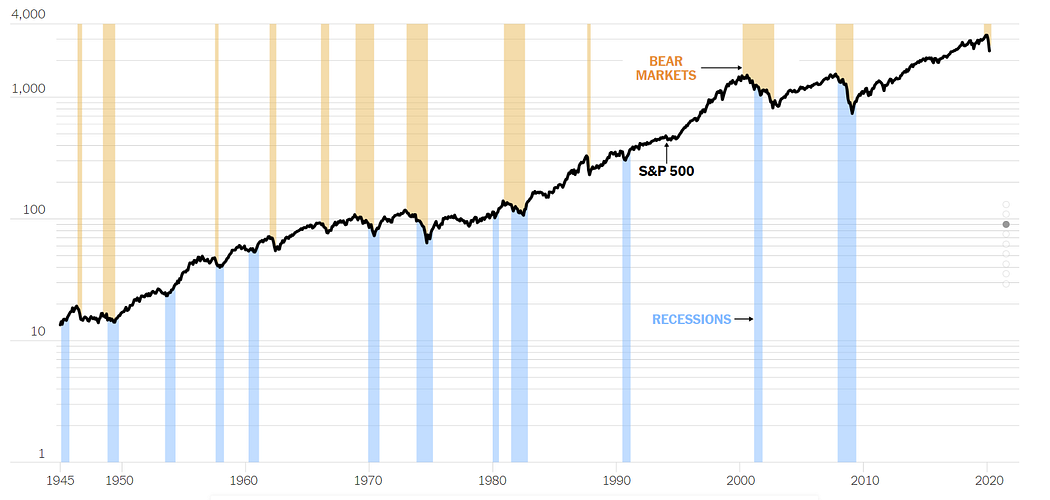

These drops often occur because of sudden economic changes or big events that make investors rethink their decisions. Since 1974, there have been 24 of these corrections. Notably, five of them went even deeper in 1980, 1987, 2000, 2007, and 2020, turning into bear markets where prices fell by more than 20%.

(Click on image to enlarge)

S&P500 and Stock Market Recessions. Source: NYTimes

So, essentially, the market tends to see a correction every couple of years, with a bigger drop about once a decade, potentially throwing a wrench in popular investing stock strategies.

What to Do During a Stock Market Recession?

Bull markets, characterized by rising stock prices, don’t last forever. They inevitably give way to bear markets or market corrections, which, though unnerving, are natural market rhythms every investor will encounter.

To navigate these periods, context is key. Historically, since 1966, even the harshest market correction has spanned only about 15 months, which is a brief spell compared to the longevity of bull markets.

These corrections can be swift and unpredictable, as evidenced by the 2020 pandemic-induced bear market, which lasted just 33 days. Contrast this with prolonged bull markets, like the one from 1986 to 2001, which spanned 4,494 days, or from 2009 to 2020, which neared 4,000 days.

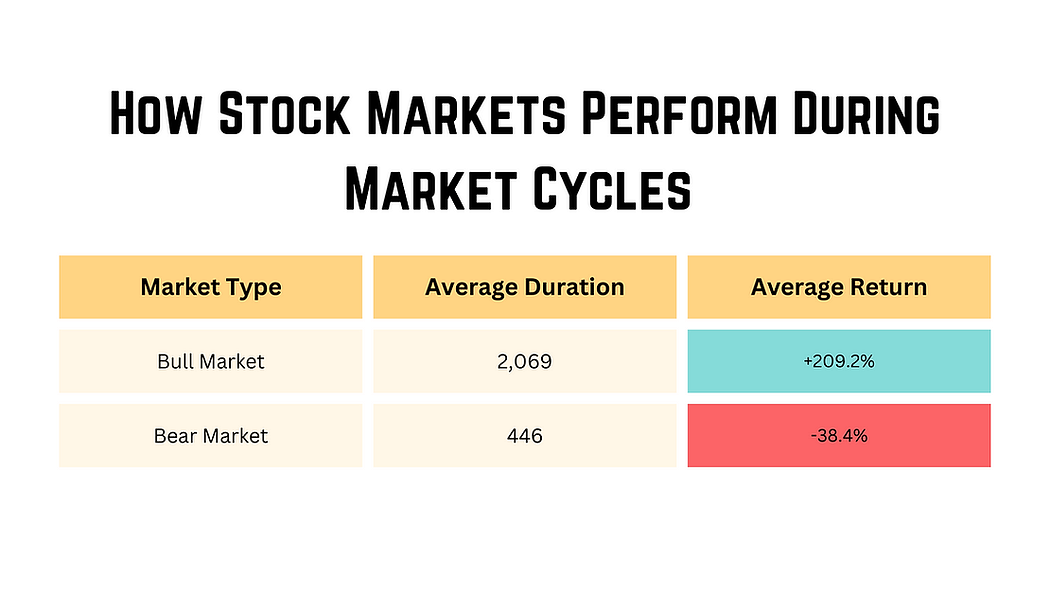

Stock Market During Market Cycles

Statistically, bull markets average over 2,000 days, while severe corrections hover around 446 days. Moreover, the rewards of staying invested during growth periods are substantial: an average gain of 209.2%.

Meanwhile, a typical correction might only reduce a portfolio’s value by 40%. So even if stock market returns after a recession are negative, the average investor is better off staying in the market over the longer term.

Even amidst uncertainty, continuing to invest often proves more beneficial in the long run, and is a great stock investing tip for beginners.

5 Steps to Take During a Market Correction

Picture by gettyimages on Canva

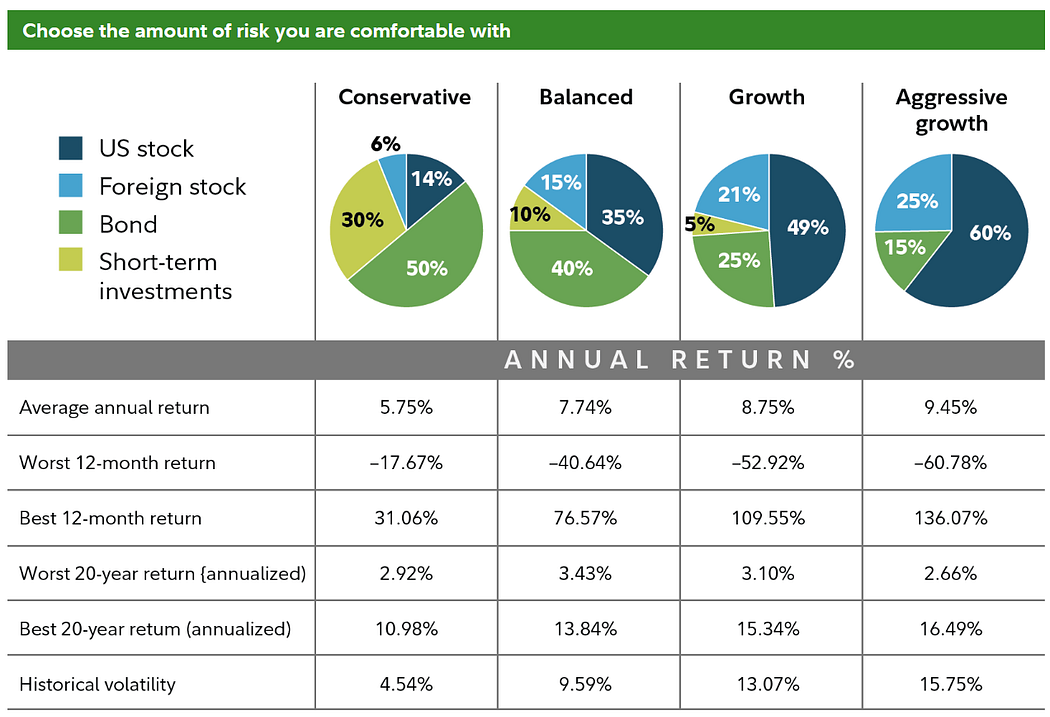

Navigating market downturns can be challenging. While booming markets often involve risk-taking, corrections serve as reminders to re-evaluate asset allocations, helping invest long-term in stocks.

1. Assess Risk Tolerance

Gauge both your emotional and financial resilience to potential losses. Using an investing stocks calculator to gauge potential losses can be helpful.

2. Seek Guidance

Taking surveys from financial institutions like Vanguard or Charles Schwab can pinpoint your investor profile, helping match you with a suitable asset allocation.

3. Rebalance

Over time, the market can tilt your portfolio’s balance. Regularly readjust by selling overweight positions and buying into underweight ones.

4. Factor in Life Stage

Younger investors with long-term goals can typically withstand market dips. In contrast, those nearing or in retirement should lean towards a more conservative risk profile, emphasizing regular rebalancing and diversification.

5. Post-Retirement Precautions

Recent retirees, especially in the withdrawal phase, should note that early poor returns can strain portfolios. Consider curtailing withdrawals or delaying large expenditures in downturns to avoid selling assets at lower values.

Every investor’s journey is unique, but being proactive during market corrections can safeguard and optimize one’s financial future.

Diversifying to Prepare for a Stock Market Recession

Diversification is often hailed as a bedrock principle, especially when investing long-term in stocks. Having a portfolio that spans a variety of asset classes, such as stocks, bonds, and cash, is akin to not putting all your eggs in one basket.

This diverse spread ensures that as some assets might wane, others could wax, creating a balance.

How you apportion each asset should reflect your personal investment goals, your willingness to shoulder risks, and the time you have before you need to tap into these funds.

But as the market ebbs and flows, even a meticulously crafted portfolio can veer off course.

Example of Diversification Strategies. Source: Fidelity

This is where diversification of investment enters the fray. Diversification is essentially a periodic health check for your investments. You might find yourself selling some of the assets that have gone beyond their intended share and buying those that have dwindled.

For instance, diversification examples include allocating assets in a certain mix: for instance, 50% in Apple Stock, 20% in Tesla, and 15% each in AMD and Intel stocks, and eventually buying or selling based on price movements.

Now, let’s talk strategy during those bear market phases. They might be challenging, but they’re not devoid of opportunities. Enter tax-loss harvesting. By strategically selling off assets that have lost value, you can offset your capital gains, offering a silver lining in the form of a reduced tax bill.

But a word of caution here: the wash-sale rule dictates a brief moratorium on buying a similar asset right after a sale, so tread carefully to avoid missing out on potential rebounds.

Speaking of safety during tumultuous market phases, there’s merit in considering risk-averse assets. T-Bills, or Treasury bills, are akin to short-term IOUs from the U.S. government, while Certificates of Deposit (CDs) are a bank’s promise to pay back your money with interest after a set period.

Notably, the latter stands firm even when interest rates play hopscotch, offering a reassuring stability. Another step to consider for portfolio diversification for those who have already balanced their portfolio is dollar-cost averaging.

It’s the discipline of regularly investing a predetermined sum, come rain or shine. While it doesn’t promise the highs of timing the market right, it offers a shield against its caprices, especially given the unpredictability of bear markets and their deceptive rallies.

Stock market recessions might be daunting, but with the right strategies and a sprinkle of discipline, they can be navigated with finesse, turning potential roadblocks into avenues for growth.

Bottom Line on Surviving During a Stock Market Recession

Understanding and adeptly maneuvering through market corrections is pivotal. While the unpredictability of bear markets can test an investor’s mettle, a strategic blend of diversification, rebalancing, and savvy tactics like tax-loss harvesting can turn the tide.

Opting for risk-averse assets offers a cushion, and the disciplined approach of dollar-cost averaging serves as a steady compass. Remember, investing is a marathon, not a sprint. Embracing a long-term perspective and informed decisions can transform challenges into opportunities.

As the tapestry of market cycles unfolds, equipped with the right strategies, investors can weather the storms and thrive in them.

Frequently Asked Questions (FAQs)

How Long Recession Will Last?

The duration of a recession can vary widely depending on various factors, including the economic downturn's severity, government policies' effectiveness, and global economic conditions. On average, recessions tend to last for about 11 months, but this is a generalization and not a strict rule.

Some recessions are relatively short-lived, lasting only a few months, while others can be more prolonged, extending for several years. The depth and breadth of the economic contraction and the effectiveness of policy responses play crucial roles in determining the duration of a recession.

How Many Recessions Has the US Had?

The United States has experienced multiple recessions. The specific number can depend on how one defines and categorizes recessions. However, major recessions in U.S. history include:

- The Panic of 1819

- The Long Depression (1873–1879)

- The Panic of 1893

- The Panic of 1907

- The Great Depression (1929–1933)

- The Recession of 1937–1938

- The Post-World War II Recession (1945–1946)

- The Recession of 1953

- The Recession of 1958

- The Recession of 1960–1961

- The Recession of 1969–1970

- The 1973–1975 Recession

- The Early 1980s Recession

- The Early 1990s Recession

- The Dot-Com Bubble Burst (early 2000s)

- The Great Recession (2007–2009)

Remember that these are major economic downturns, and there were periods of economic slowdowns that might not meet the technical definition of a recession. The National Bureau of Economic Research (NBER) is the official organization that determines the dates of U.S. recessions.

Why Recession is Bad?

Recessions are considered bad for several reasons:

- Unemployment: Businesses cut jobs, leading to higher unemployment.

- Income Decline: Households face wage cuts and income loss.

- Reduced Consumer Spending: People cut back on spending, affecting businesses.

- Decline in Business Investment: Companies delay or cancel investments.

- Financial Market Volatility: Markets become more unpredictable, impacting investors.

- Housing Market Downturn: Home values may drop, causing financial stress.

- Government Budget Challenges: Lower tax revenues and increased social service demands create budget deficits.

- Global Impact: One country's recession can affect others through global economic connections.

More By This Author:

Step-By-Step Guide For Valuating A Non-Profitable Stock

Is NIO Stock Revving Up For Future Growth?

Beyond The Average Income: Financial Strategies And Calculating For Retirement

Disclaimer:The information provided is for general educational and informational purposes only and should not be construed as financial advice. Any investment or financial decisions you make based on ...

more

Fine article.

Thank you!

In my arcticle I have tried to explain the same https://elliotwave.org/2023/10/18/fondovyj-rynok-ssha-korrekciya-pered-sereznym-padeniem/

https://talkmarkets.com/content/stocks--equities/the-us-stock-market-correction-before-a-serious-fall?post=416019

Thanks for sharing! It is a nice article!