The US Stock Market; Correction Before A Serious Fall

Image Source: Unsplash

Two months ago, it was said about the imminent end of the growth of the S&P500 index and the beginning of a decline. The main question was: is this the end of the entire correction (2), or will it continue?

S&P500 (futures).

The main option involves the formation of an initial diagonal from 4634.5 (in DJ, the downward movement can be calculated with a stretch as a normal impulse). The initial diagonal is a very controversial model and often turns out to be a correction, so the reversal has not yet been confirmed.

(Click on image to enlarge)

The chart (daily) shows MA50 (blue) and Ma 200 (red). While we are between them, it is difficult to talk about something specific, but in general, when breaking through MA50 and fixing higher, we will test 4634.5, if we pass MA200 (an important medium-term level as seen from history), then we will move to the area of 3839.25 and further as shown on the chart.

From a technical point of view, it would be desirable to pass 4634.5, then many technical indicators would form divergences on the weekly chart, although this is not a prerequisite for a serious fall. A more detailed analysis of short-term movements will be in the closed section.

From a fundamental point of view, the situation strongly resembles the state of the end of 2019 and the beginning of 2020, when there were already prerequisites for the fall of the markets (not only COVID), but the situation remained "stable" and nothing seemed to happen, as it broke at the end of February - March.

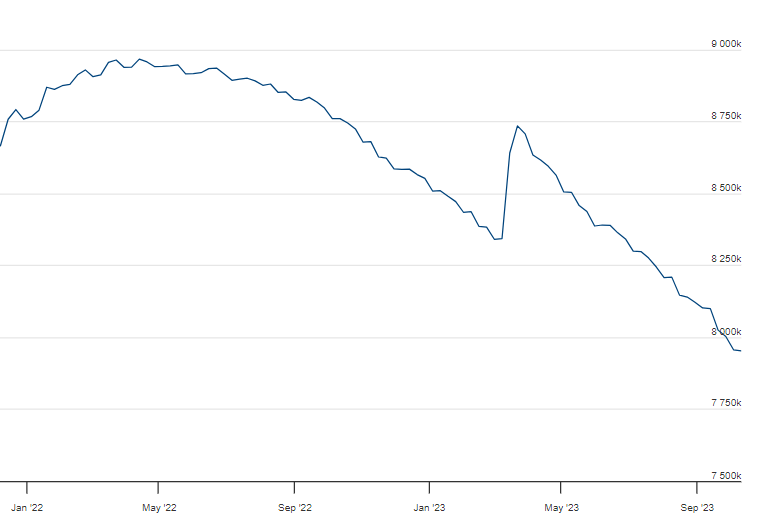

First of all, we need to pay attention to the reduction of the Fed's balance sheet. As you can see, the previous "cycle" from April 2022 a year later led to a local "bankfall" in the United States and panic in the markets, after which liquidity had to be injected. However, after the stabilization of the situation, the reduction continued.

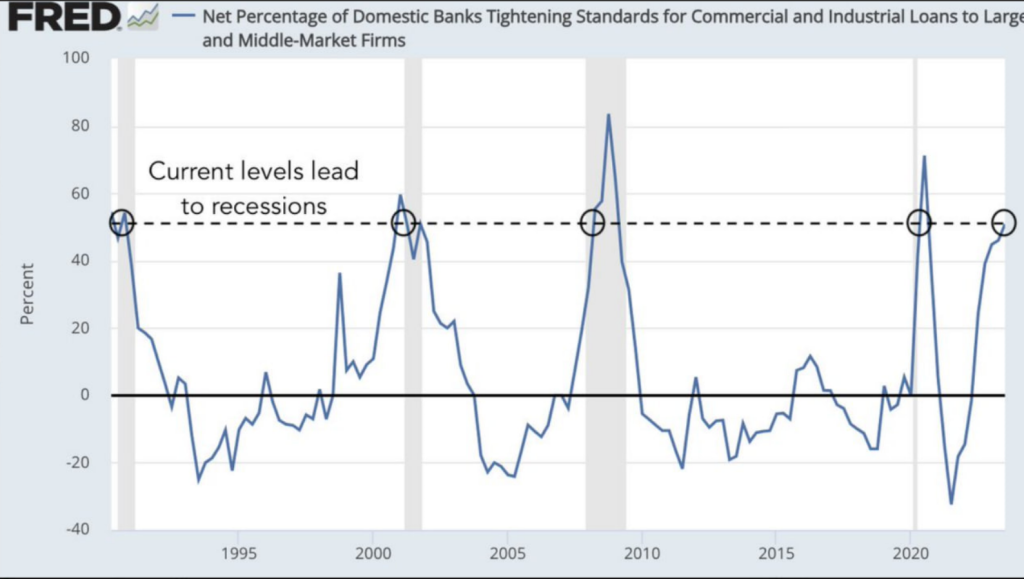

Tightening of the financial conditions. This has always led to problems in the economy, and problems with debt servicing are accumulating accordingly.

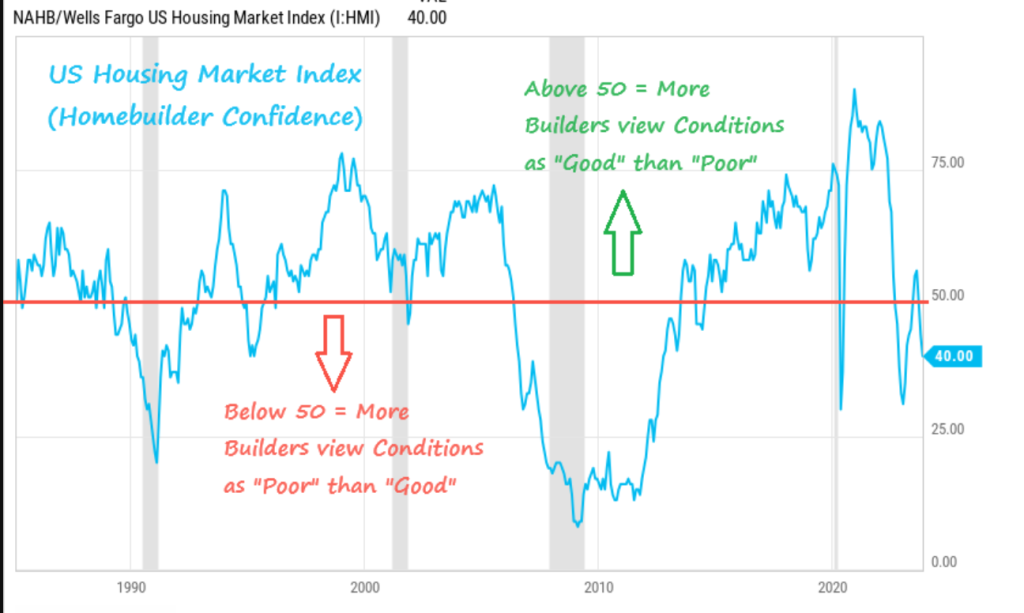

One of the main indicators of the economic state is the situation in the real estate market. The huge "unrealized losses" of many banks were mentioned back in April, and then the situation was normalized, but the problems remained.

There is a lot of data showing serious problems. Below is the US housing Market Index (confidence of developers). There is a conditional line 50, the penetration of which led to recessions.

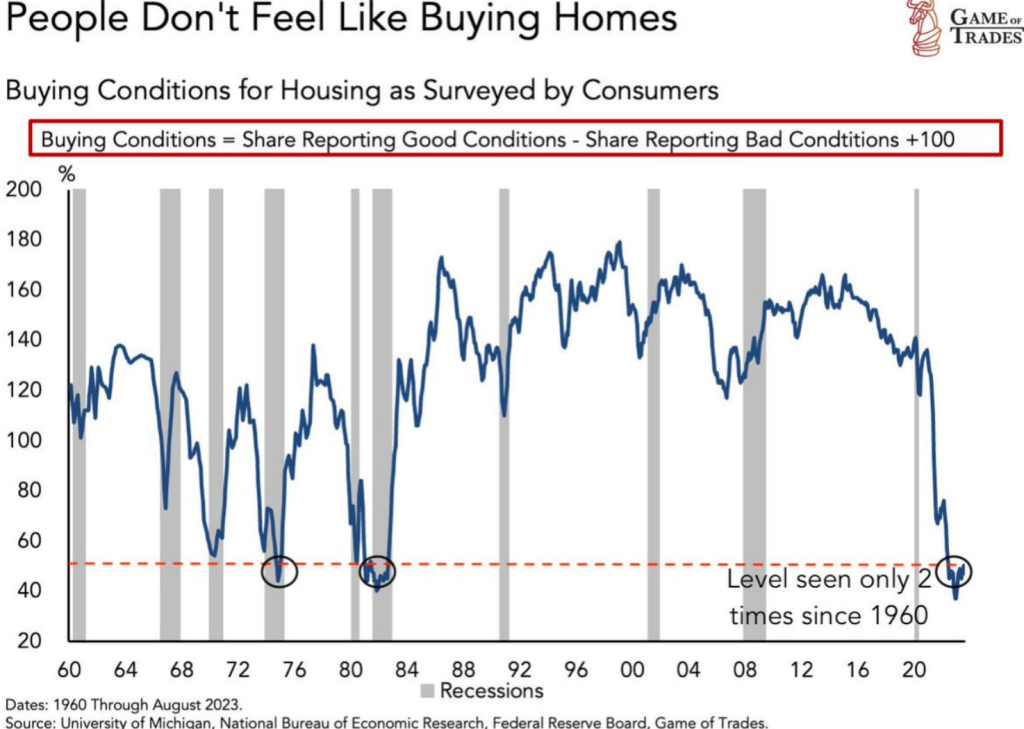

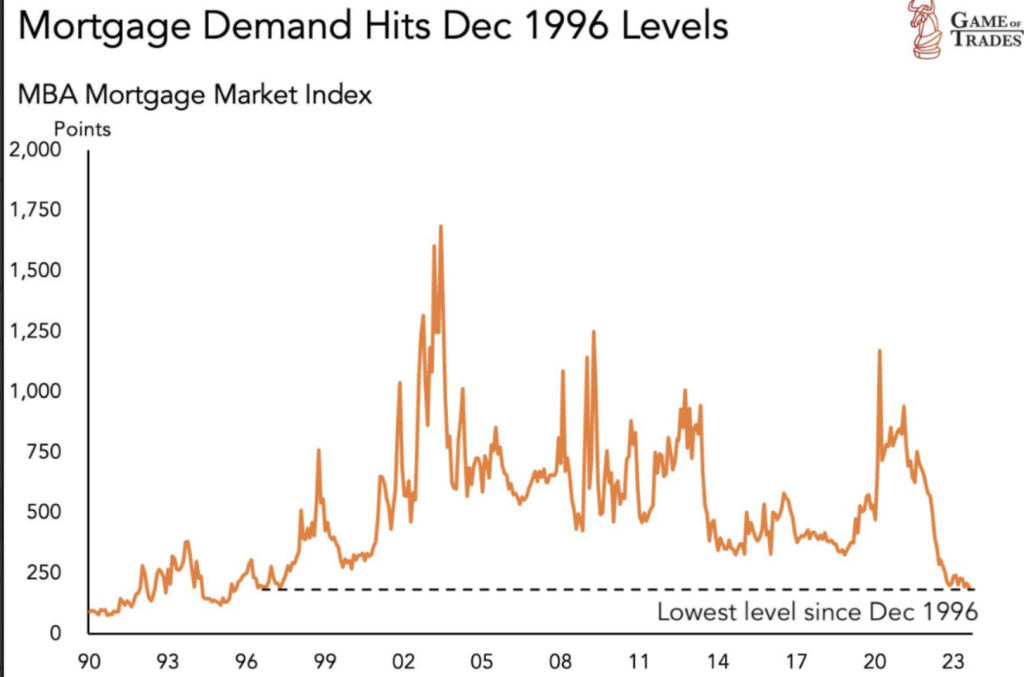

The situation looks even worse among buyers

Mortgage demand is falling

Another important market is the US government debt market. Recently there have been massive sales (long end), yields have risen sharply. An extremely negative sentiment suggests that a reversal is somewhere close, and perhaps has already occurred.

Below is a graph that says that the 10-year yields have equaled in stocks. The situation is extremely unusual because the treasury is a less risky asset compared to stocks. Consequently, the outflow of funds from stocks to bonds should begin in the near future due to the lack of a risk premium.

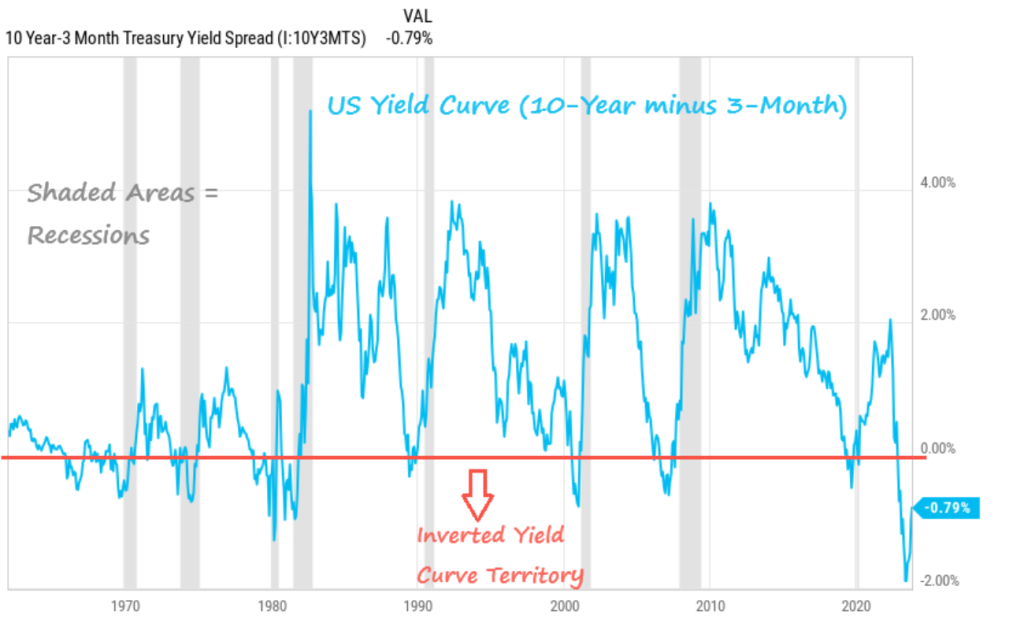

Gradually, the yield curve begins to return to normal. The chart shows the spread of 10-year — 3-month bonds. Such a move has always meant a recession. The depth of the inversion indicates the scale of future events.

Some people look at the ratio of 10-year-olds to 2-year-olds, but the situation there is similar.

Conclusion: As mentioned above: the development of the movement strongly resembles the end of 2019 - the beginning of 2020. Technically, we still have options, the situation is likely to clear up in the coming weeks, while we focus on the levels indicated on the charts.

More By This Author:

Gold And Silver. Will The Fall Continue ?

Elliott Wave Technical Analysis: Bitcoin Update

Elliott Wave Technical Analysis: The Dollar Index

Disclaimer: My opinion is provided as general market information and do not constitute investment advice