Gold And Silver. Will The Fall Continue ?

Photo by Jingming Pan on Unsplash

Two months ago , various options for further development were considered. Volatility at that time was low , but nevertheless a resumption of the fall was expected, which has been observed in recent weeks.

There are several options in the long-term calculation, which in turn affects the medium-term.

1. Red. The end of wave I was a historical peak, now we are correcting all this growth. In this case, a drop below 1618 is expected.

2. Black. We made only 1 in (5), now there is 2.

Important levels are also marked, first of all it is 1800, the trend line (in black) is about the same place.

(Click on image to enlarge)

Another interpretation is not fundamentally different from "red".

(Click on image to enlarge)

A more detailed schedule. This calculation assumes a movement below 1618. While there is a decline in the channel, its penetration will confirm the movement to 1714 and 1531. As you can see, the lower border runs around the 1800 level, which was mentioned above.

Cancellation of the fall scenario: breaking through the upper border of the channel and the marks of 1983 and 2010.85.

(Click on image to enlarge)

SILVER

From the beginning of 2021 to the end of 2022, an impulse passed, after which, until May 2023, there was a correction of 2.

(Click on image to enlarge)

We have broken through the trend line, a further decline towards these goals is expected in the medium term.

Detailed monitoring of short-term development was conducted in a closed section.

01.08

Passed 2000.65 , finally the main scenario was option 1-2 . There is also a goal of 2032 , for the resumption of the fall it is important to form a clear downward momentum and pass 1941.75.

(Click on image to enlarge)

30.08. Another 1-2 was recorded.

(Click on image to enlarge)

And 09.09

The downward movement continues, the trend line has been broken. The downward momentum has passed , a correction is underway ((2)), perhaps it has already ended. The main goal for III is 1824 . Stop -1980.05

(Click on image to enlarge)

The fundamental factors are the same . The impending crisis and the corresponding liquidity problems are already beginning to take their toll . The dollar index is strengthening fast enough and stock indexes are falling. The price of "paper" gold is falling, although there is an active demand for physical gold. At the moment, only digital is "holding on", although sooner or later it will follow the stock market, and very quickly.

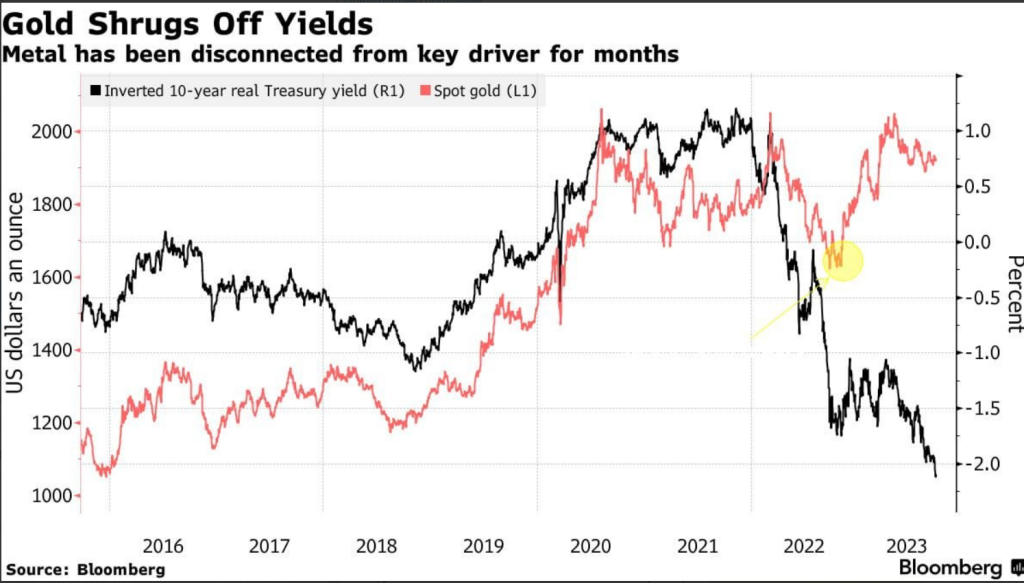

An interesting graph of the correlation of the price of gold with the real (minus inflation) yield of American 10-year-olds. So far, we have observed a " disconnect " because the yield has broken the lows of 2022, but gold has not. Here either it will go below 1618, or the yield will bounce sharply up. The first option is still a higher priority.

(Click on image to enlarge)

Conclusion : Gold is still expected to move to 1714 (most likely with corrections), silver also has further targets. The charts show important medium- and long-term cancellation and confirmation levels that are worth paying attention to.

More By This Author:

Elliott Wave Technical Analysis: Bitcoin Update

Elliott Wave Technical Analysis: The Dollar Index

Elliott Wave Technical Analysis: Bitcoin

Disclaimer: My opinion is provided as general market information and do not constitute investment advice